Is This The Bounce?

That was the question raised by The Market Ear after Friday's close ("Shaky Market Confidence"). They noted that major indexes have fallen below their 50-day averages and are flirting with the 100-day averages.

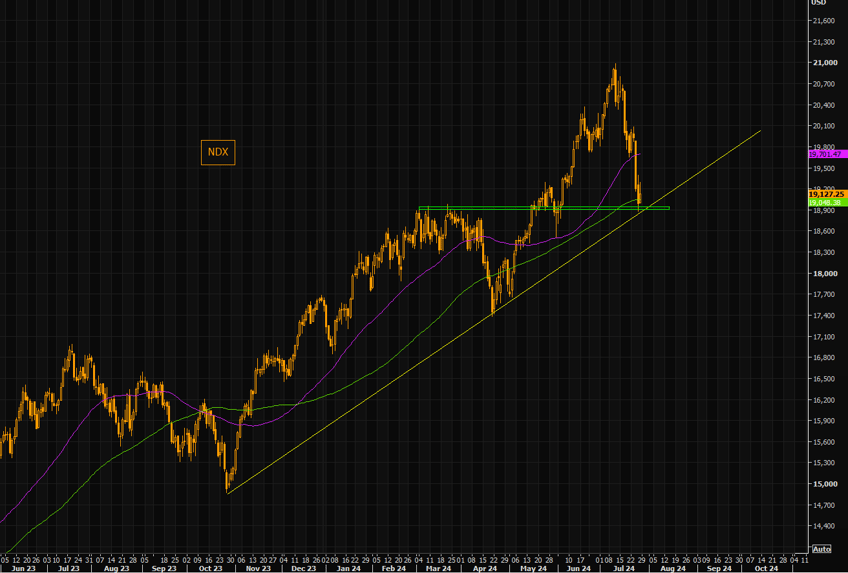

NDX is trading right on the 100 day (well below the 50 day). Note the big trend line coming in here. These levels have been important earlier this year.

Source: Refinitiv

Let's consider two scenarios, in the context of the Magnificent Seven stocks.

If The Market Bounces From Here

In a post last week ("When To Buy Nvidia"),

When To Buy Nvidia

— Portfolio Armor (@PortfolioArmor) July 18, 2024

We looked at when to sell Nvidia earlier this month. Now let's consider when to buy it back. $NVDAhttps://t.co/eaOZVLtrEu

I recapped my trading of that Magnificent Seven stock before the recent market rotation,

Trading Nvidia Shares

I bought Nvidia as part of my trading Substack's core strategy, which is to buy equal dollar amounts of Portfolio Armor's top ten names, put trailing stops of 15% to 20% on them, and then replace each one with a new top ten name after we get stopped out. Using this approach, I bought Nvidia in February of 2023 and exited last April, for a gain of 259% over about 13 months (Nvidia has appeared in our top ten on multiple occasions over the last 8 years).

Nvidia (NVDA 0.00%↑). Bought at $230 on 2/24/2023; stopped out at $825.06 on 4/18/2024. Profit: 259%.

Trading Nvidia Options

One difference between stocks and options is that options expire, so there's no place for diamond hands: if you don't sell or exercise before expiration, your options will expire worthless. Most of the options trades we do in my trading Substack are spreads, where the maximum possible gain and loss are pre-defined, What I do in those cases is open a GTC order to exit at about 95% of the spread, and lower that price, if necessary, as the expiration date approaches. Here are a couple of examples of me doing this trading Nvidia options.

Call spread on Nvidia (NVDA 6.15%↑). Entered at a net debit of $2.10 on 2/20/2024; exited at a net credit of $4.74 on 2/22/2024. Profit: 126%.

Call spread on Nvidia (NVDA 0.00%↑). Entered at a net debit of $3 on 5/21/2024; exited at a net credit of $9.45 on 5/23/2024. Profit: 215%.

Those were both earnings trades. The spread between the strike prices on the first one was $5, and on the second one, $10. I placed the second trade after I started my current practice of aiming for ~200% gains on options spreads.

And then I mentioned a screen I'd use as a guide to when to buy Nvidia again:

When I'd Place A Bullish Options Trade On Nvidia Again

I'd like to see a slightly better valuation on Nvidia with the stock still showing strong technicals. Let's quantify that. Currently, according to Chartmill data, here's what Nvidia looks like on three specific metrics (all of these are on range from 0 to 10, with 10 being the best):

- Technical Rating: 9

- Set-up Rating: 2

- Valuation Rating: 5

The technical and valuation ratings are self-explanatory; the set-up rating measures the short-term consolidation of share prices. Here's what I'd like to see before I place my next bullish options trade on Nvidia:

- Technical Rating: 6 or greater.

- Set-up Rating: 6 or greater.

- Valuation Rating: 6 or greater.

I set up an alert to notify me when Nvidia meets all three of those criteria. At that point, I'll investigate it further, and if it looks promising, I'll place another bullish bet on it.

That Approach Should Work If There's A Bounce

To be more precise, that approach should work for most of the Magnificent Seven names if there's a bounce. As we saw in my previous post ("Time For A Contrarian Bet On China"),

Time For A Contrarian Bet On China 🇨🇳

— Portfolio Armor (@PortfolioArmor) July 26, 2024

Chinese stocks are having their worst week since February. $BABA $AAPL https://t.co/TMe0nd6SWw

Apple currently has a Valuation Rating of 2,

If you're curious how a Magnificent Seven stock compares on those metrics, let's look at Apple (AAPL):

- Overall Fundamental Rating: 6

- Profitability: 9

- Health: 8

- Growth: 4

- Valuation: 2

So you might be waiting a while for Apple to hit the buy zone with our 666 screen. But Nvidia currently has a valuation rating of 5, so maybe if it crushes earnings next quarter, it could tick over to a 6. I don't think this screen is going to help us if the Nasdaq breaks through the 100-day though.

What If This Isn't A Bounce?

The first thing to note is we don't know if this is the beginning of a bounce or not, so if you're long equities here, you may want to consider hedging. As a reminder you can use our iPhone app to help you find optimal hedges. You can download the app here, or by aiming your iPhone camera at the QR code below.

The second thing to note is that we're unlikely to see any of the Magnificent Seven come up on our 666 screen in that case, because their charts will have broken down, and that's going to knock their overall Technical Ratings below 6.

So here's a new screen I've added for the Mag Seven stocks in case we crash here, I've labeled it as "Cheap and Stable":

- PEG (5 year) < 1

- PEG (Next Year) < 1

- Set-up Rating >=6

Let's break that down. PEG is the Price/Earnings ratio divided by the stock's growth rate. It's a way to compare apples to apples when evaluating stocks with different growth rates: with a high enough growth rate, a stock with a 30 P/E can be cheaper than a stock with a 15 P/E. The 5 year PEG compares the stock's current P/E to its growth rate over the last 5 years, and the Next Year PEG compares its P/E to its estimated growth rate next year.

The Set-up Rating is a technical measure of the stock price's consolidation. Note there's nothing in this screen about the stock's overall Technical Rating. I'm expecting the longer term chart to look ugly after a crash; I'm going to look at the Set-up Rating to see if the stock might have bottomed out.

How Nvidia Looks Now On These Metrics

Here's where Nvidia is now on those metrics:

- PEG (5 year): 1.23

- PEG (Next Year): 0.56

- Set-up Rating: 2

What Now?

A simple game plan if you're long:

- Hedge in case the market keeps dropping.

- Plan ahead which high-quality names you want to buy and what triggers you will use to buy them.

In my case, that "Strong and Stable" screen will by my trigger. I'll also do a qualitative assessment before placing any trades, just to make sure there isn't some other factor the screen has missed.

As always, when I place a trade, I'll post a trade alert on my trading Substack/occasional email list. If you want a heads up when I do, feel free to subscribe to it below.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).