Time to reiterate our 3 MAJOR THEMES IN 2025

Underestimated AI Impact and Infrastructure Spending: AI's economic impact is underestimated and will fundamentally reshape the economy, requiring massive infrastructure investment comparable to the Industrial Revolution.

Rethinking Traditional Investment Approach: Traditional 60/40 portfolios are outdated. Markets now demand thematic factor investing and company-specific focus, especially in U.S. markets and AI-related opportunities.

Higher Interest Rates, USD and Inflation: Expect sustained higher interest rates and inflation, driven by deregulation and tech innovation.

This week:

We want to revisit a few calls we made back in Q3 and Q4.

What to watch: Meta, Tencent, China, AST Spacemobile, Tesla, AMD, Bitcoin & Johnson Controls.

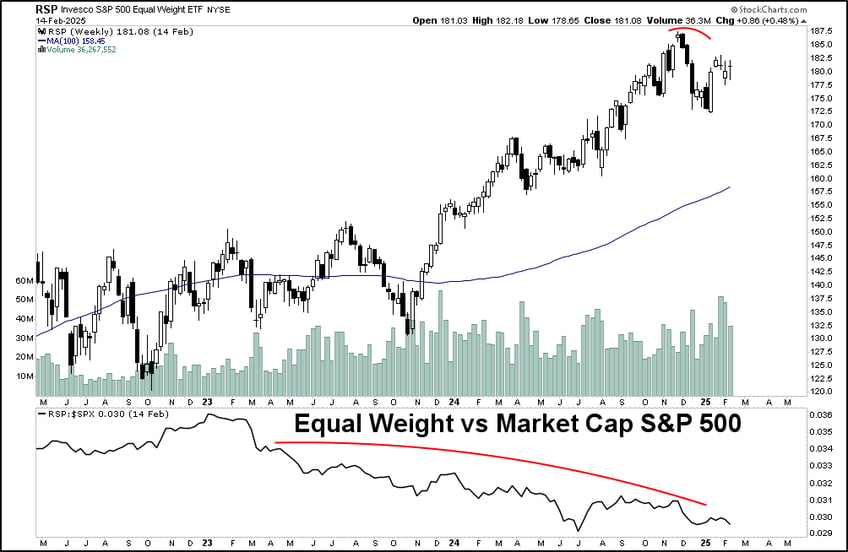

What to avoid: Equal weight S&P, India, Nike, Apple, Financials & Airlines.

**Something is going on with the storage of Gold in New York and London. Huge vol risk here. We will keep you posted.

During the DeepSeek freakout we were pounding the table on META being the winner out of this. It has been up 20 days straight since.

Japanese rates are a concern for us.

Equal weighted S&P will continue to underperform Mag 7

ASTS: AT&T revealed a 2.7% equity stake. Keep an eye on this one.

We want to shine some light on a few calls we made back in Q3 and Q4.

Sept 30th: “Opera Browser is catching our eye.”

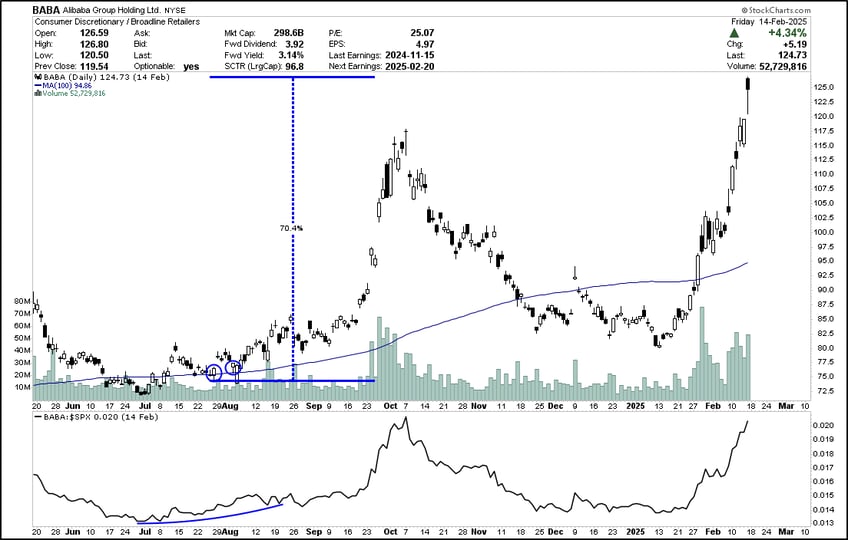

July 29th: “Don’t look now, but Alibaba is starting to show signs of life.”

April 29th: “Tencent: A distinct China breakout. Pay attention to this.”

Sept 23rd: “Johnson Controls (JCI) will lead the liquid cooling space. Room to grow.”

Long China / Short India

India was such a bull trap.

Coupang!

Nike posted its lowest weekly close since Covid.

Remember, most “investors” in this industry have no clue what they are talking about and regurgitate the news like a bird.