What Powell Should Do Beyond Today's FOMC

Authored by GoldFix ZH Edit

We assert this is how Powell should be, better be, and is likely thinking given the recent rise in Long Term rates. If he is not, then heaven help us, because Yellen and Biden certainly are not capable of thinking like this.

Contents:

- FOMC Prep

- Goldman Thinks They Are Done

- JPM Thinks Maybe One More and Done

- Bonds: Spending Money is Inflationary Dummy

- Cure Inflation "By Forcing Long Term Rates Higher"- Zoltan Pozsar

- The IRA Guaranteed Inflation, Powell’s Nightmare

- POWELL’S DECISION MATRIX

FOMC Prep

Fed will almost certainly keep rates unchanged in the 5.0-5.25% range if you believe the market's expectations

Fed statement will be either the same as it was last month (which was hawkish), or change more dovishly.

If the statement remains unchanged, the Press conference should be more dovish in that Powell acknowledges the rising long bond rates are tightening financial conditions for him.

Goldman Thinks They Are Done

Goldman thinks The Fed is done hiking altogether due to the bond market rout.

The Fed "coalesced around the view that the recent tightening in financial conditions led by higher long-term interest rates has made another hike unnecessary." (more below)

JPM Thinks Maybe One More and Done

The September Dot plot showed the Fed expected one more rate hike by end of year. JPM notes that in their statement describing what they expect today.

If asked whether the September dots pointing to another hike this year are still relevant, we expect the Chair will hedge that signal and fall back on data dependency. (more below)

Bonds: Spending Money is Inflationary Dummy

The Bond market has collectively been casting its vote on the Inflation Reduction Act (IRA) these past few months by ratcheting up rates incessantly as we alerted readers to this past year several times, most auspiciously in “The Broken Bond Ladder”. We also noted something Zoltan Pozsar said back then telling us what would happen. Absolutely noone in the MSM cared to pay attention. The headline was all that need be read. Here it is again:

Cure Inflation "By Forcing Long Term Rates Higher"- Zoltan Pozsar

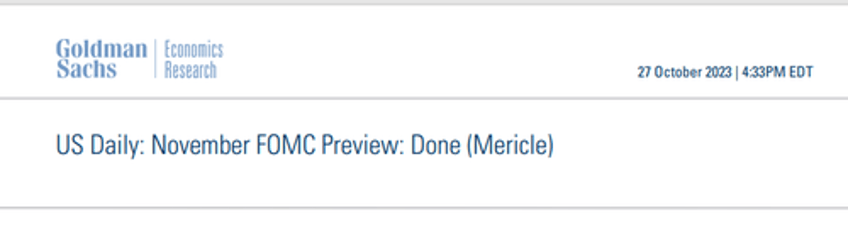

With long term yields this low, the prospects of raising short term rates to stop inflation will not give us much ability to reduce long term rates further. We need long term rates to go up, then come down. We need the fear of true baked in inflation to rise. We need a controlled free market-clearing event. In conjunction with this rise in long term rates, the Fed can continue raising the short end without causing recession. One possible outcome is to massage the curve flat at a higher level.

That chapter, predicted in April 2022 is now over. What is next? YCC is next. When? We don't know, but we are pretty sure under what circumstances it will be implemented. That is below. First The IRA Effect and how it will contribute to Powell's process after the bond market’s demolition

The IRA Guaranteed Inflation, Powell’s Nightmare

The vote is in. The IRA is inflationary. The bond market is telling you rates must go up to absorb this Federal fiscal largess and the new bond issuance accompanying it for financing that.

Long rates will remain high until one of 3 things ( absent a crash) happens now:

Fiscal spending stops

Signs of fiscal spending increasing productivity show up in the market

The Fed implements YCC/QE to stop or slow it down

Number 1 will not happen any time soon. If it does the stock market will take it as very deflationary and we get the crash we deserve. Number 2 is the actual goal of all this, and is a byproduct of successful completion. We are nowhere near that yet. Number 3 happens if Powell and Co. get concerned the back end rates are rising too high too fast.

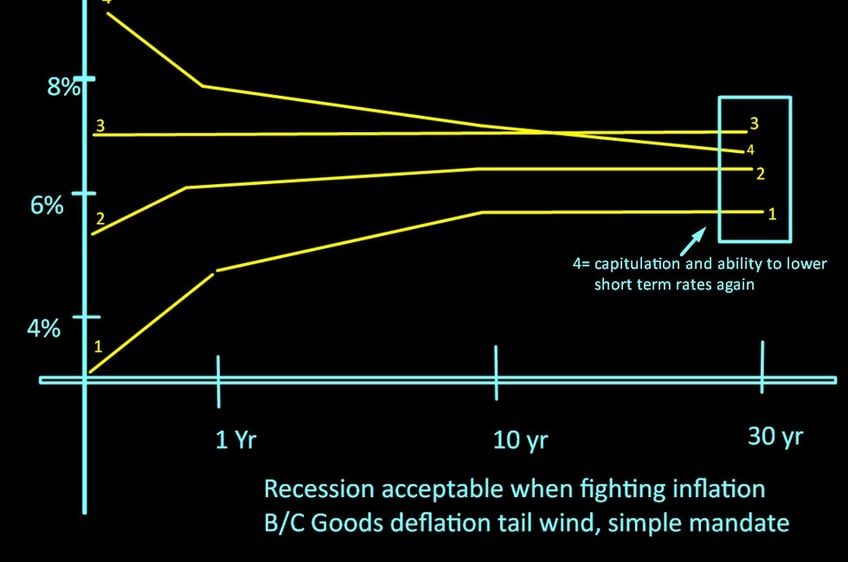

POWELL’S DECISION MATRIX

Ideally Powell wants the back end to stabilize, then ratchet slightly lower, which will give him clearance to ease sooner. Until that happens he should do nothing unless stocks crash.It is likely the FOMC were fine up until now with rates rising in the back end up to a flat yield curve once again at 5%. However, if the curve normalizes with the back end above Fed Funds rate, say at 6%, they will not be happy. We feel strongly that any steeping of the yield curve above Fed funds rate (similar in speed of ascent to what we just had) will be met with YCC/QE.

We are in the corridor headed to YCC now. Until that happens, assume the Fed does nothing as the Treasury does their job ( really the Treasury is forcing the Bond Vigilantes to do it) for them. Above Fed Funds rate, and things get scary for them.

We bet Powell’s Decision Matrix looks like this:

- “Back end rates climbing are signaling the market needs higher for longer back there to discount the inflationary effects of the fiscal spending.

- But if the curve steepens beyond flat, ...

Continues here ...

Free Posts To Your Mailbox