Beyond the impact of the business cycle on the economy and financial markets, with the cycle itself being better understood through the lenses of energy efficiency of an economy, which can be proxied by the relative performance of the country's stock market against the price of oil in its domestic currency and the quality of a currency as a store of value, measured by the relative performance of gold in the local currency compared to the domestic bond market, liquidity is what drives markets. Just as blood is essential for the human body to stay alive and alert, liquidity plays a key role in sustaining the life and performance of the economy and financial markets throughout the 4 quadrants of the business cycle.

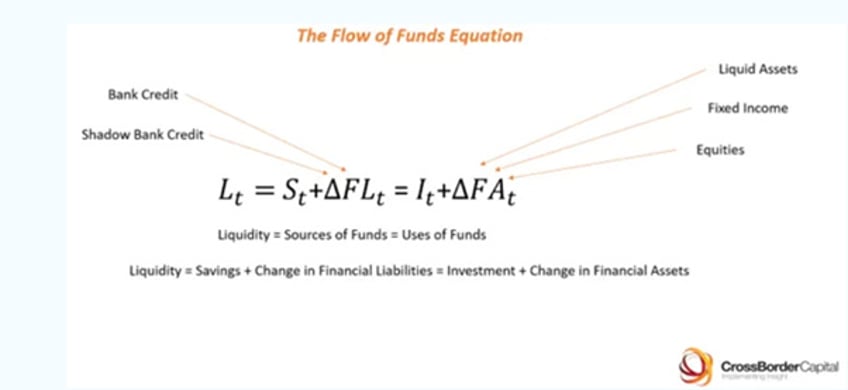

Liquidity is undeniably important to navigate the business cycle. Global liquidity must be monitored because, for the most part (outside of crises), national sources of liquidity are fungible, meaning they flow across borders. Global liquidity represents roughly a $170 trillion funding pool, which can be measured by assessing sources of funds from the assets side of the private sector balance sheet. This includes the short-term liabilities of credit providers, such as banks and shadow banks, as well as the cash flows of households and corporations. Since the focus is on flows through asset markets, the funding-based definition of liquidity emphasizes the financial sector. It extends beyond traditional money supply measures like M1. The cash flow equation illustrates the math behind the definition of liquidity. Unlike most economic statistics, which reflect net flows, liquidity is a gross balance sheet concept that measures the capacity of capital. The equation shows that sources of funds, or liquidity, namely savings (S) and changes in financial liabilities (ΔFL), must, by definition, equal the uses of funds, such as new capital investment (I) and changes in the value of asset holdings (ΔFA). It follows that the overall private sector balance sheet can expand (i.e., both FA and FL increase) while net savings (S - I) remain unchanged. In this case, liquidity expands independently of savings. Sources of funds (S + ΔFL) typically drive the uses of funds (I + ΔFA), but rising collateral values (ΔFA) can also trigger second-round effects that further expand lending and, in turn, boost liquidity.

This elasticity in the liquidity-creation mechanism is crucial. It surpasses conventional explanations of excess liquidity, such as the widely quoted 'savings glut' theory, which became a popular explanation for the 2008/09 Global Financial Crisis. This theory, associated with former Federal Reserve Chair Ben Bernanke, argued that abundant Asian savings flows inflated the US asset bubble. However, this seems unlikely in terms of scale. Instead, Asian savings flows (S) may have initially triggered an increase in liquidity that was later amplified by aggressive lending from banks and shadow banks (ΔFL → ΔFA → ΔFL), creating a massive wave of liquidity.

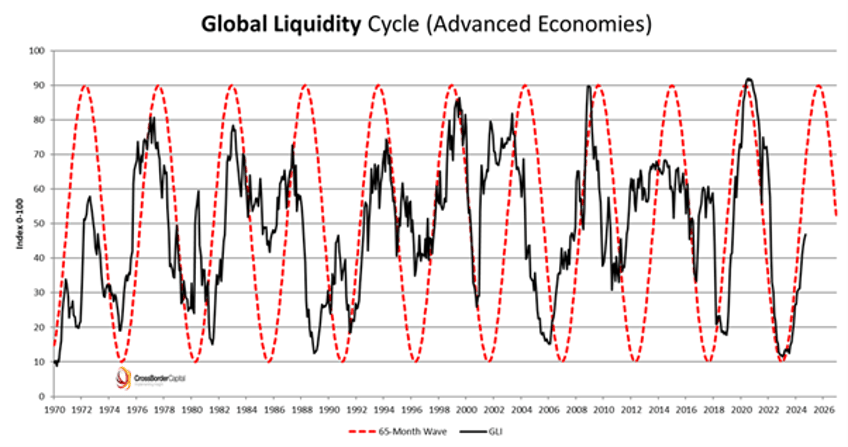

The elasticity of the liquidity mechanism plays a dominant role in the liquidity cycle, with some referring to it more accurately as a 'banking glut' rather than a 'savings glut.' Liquidity, like the economy, is cyclical. Global Liquidity can be measured as a normalized index (GLI) ranging from 0 to 100, with a mean of 50, to track its momentum over time and across countries. A chart plotting the GLI against a repeating 65-month cycle (estimated using Fourier analysis from 1965-2000 and extrapolated since), shows that the Global Liquidity Cycle is expected to peak around September 2025, following the trough in December 2022.

The 65-month cycle (between 5 and 6 years) can be explained by the fact that this frequency represents the turnover of debt, making it the debt refinancing cycle. The average maturity of debt in the world economy is about that length of time. As debt is rolled over, it creates cyclical movements, which is what we are seeing now. The cycle bottomed in October 2022 and is expected to peak in late 2025.

To understand how the world has been flooded with liquidity over the past years, investors can first look at a rough proxy for the global money supply by summing up the M2 of major economies such as the United States, the Eurozone, China, Japan, South Korea, Canada, Taiwan, Brazil, Switzerland, Australia, Mexico, and the UK. You don't need a PhD in macroeconomics or work for a central bank to see that over the past 20 years, this proxy for liquidity across major economies has more than tripled, from roughly $30 trillion in 2002 to about $105.5 trillion as of October 19th, 2024. At the same time the 65 months rate of change peaked in 2009; 2011; 2014 and mid-2021, period which coincided with financial crisis around the world.

Global Money Supply Proxy (blue line); 65-months Rate of Change (red histogram).

Aside from the liquidity created by central banks, there is also liquidity generated by governments, which reflects their fiscal policies. This can be proxied by the government debt issued by the three largest economies in the world: the US, China, and Japan. Over the past 20 years, the debt issued by these three governments has more than quadrupled, rising from less than $8 trillion in late 2004 to more than $45 trillion as of the end of October 2024. Here as well, looking at the 65-months rate of change it peaked in early 2013 before troughing in late 2019 and since then rising to a gargantuan 69%.

US + China + Japan Government debt (blue line); 65-months Rate of Change (red histogram).

Focusing on the US alone, since it has held the imperialist privilege of being the reserve currency since the end of World War II, the money supply in the US, proxied by M2, and US government debt have both increased exponentially over the start of this decade. On a longer time horizon, the US money supply rose from less than $500 billion at the end of 1964 to more than $21 trillion (almost 42 times) in around 60 years, while US public debt more than doubled over the past 12 years to exceed $35 trillion.

US Money Supply (blue line) & YoY Rate of Change (green histogram); US Government debt (red line) & 65-months Rate of Change (purple histogram).

An anecdotal observation illustrating how public debt has been used for political purposes is that US government debt rose by more than half a trillion dollars ($500 billion) since the end of August. This demonstrates that no amount of public money is ever enough to lure more voters into the false illusion that government spending will lead to prosperity under the next president whoever he or she is.

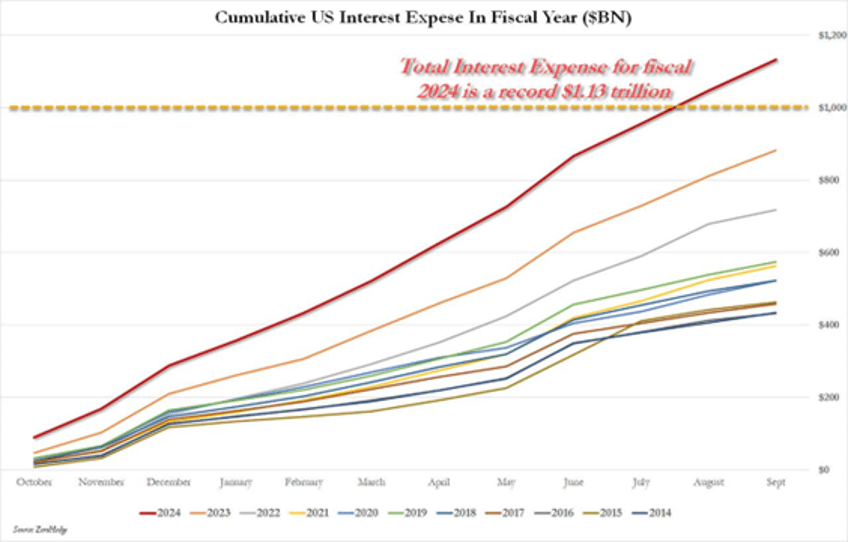

With $35.8 trillion in debt, US government debt is increasing by $1.0 trillion every 100 days. Based on the latest budget statement, the government now spends more than $80 billion on gross interest each month. For fiscal year 2024, which ended on September 30, US interest spending hit an all-time high of $1.133 trillion. This is the first time in history that annual interest on U.S. debt has surpassed $1.0 trillion. To put this in perspective, gross interest on the debt has grown by 30% year-over-year and now exceeds defense spending, as well as income security, health, veterans' benefits, and Medicare. It has become the second-largest US government outlay, trailing only Social Security, which costs approximately $1.5 trillion annually.

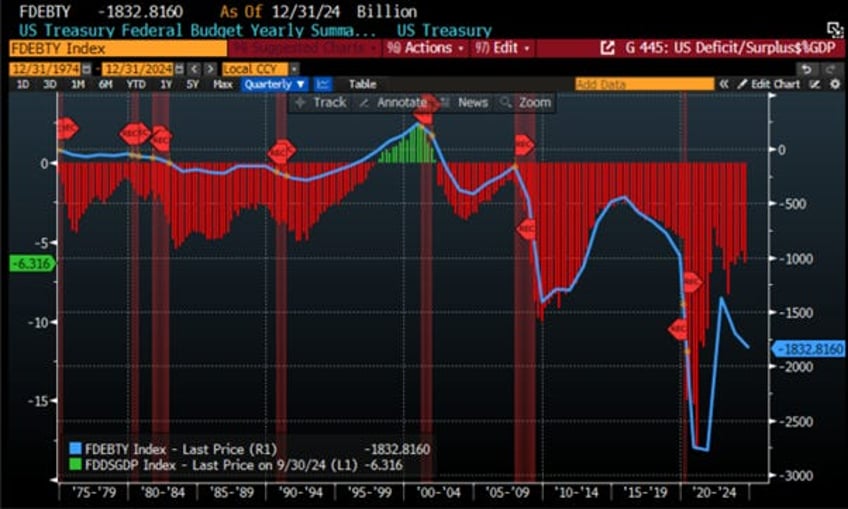

For the fiscal year 2024, ending September 30, the US Treasury reported a $1.833 trillion budget deficit, the third highest on record, primarily driven by government spending. This deficit increased by 8%, or $138 billion, from the $1.695 trillion reported in 2023. The largest deficit occurred in 2020 during the COVID-19 pandemic, followed by $2.772 trillion in 2021 as cleanup efforts took place. The spending included a reversal of the decision to forgive $330 billion in student loans after the Supreme Court deemed the action unconstitutional. Democrats are now blaming Republicans for ‘tax cuts that led to low revenue levels and increased debt.’ While the reality is higher spending and tighter regulations which are burdening taxpayers. At 6.3% of nominal GDP, the deficit remains lower than during the COVID crisis. However, with slower economic growth and rising inflation and war driven misery in the quarters to come, everybody should expect the deficit to continue increasing in dollar or percentage of GDP terms in the coming quarters.

US Treasury Federal Budget Deficit/Surplus (blue line); US Treasury Federal Budget Deficit as % of US GDP (histogram) & US Recessions.

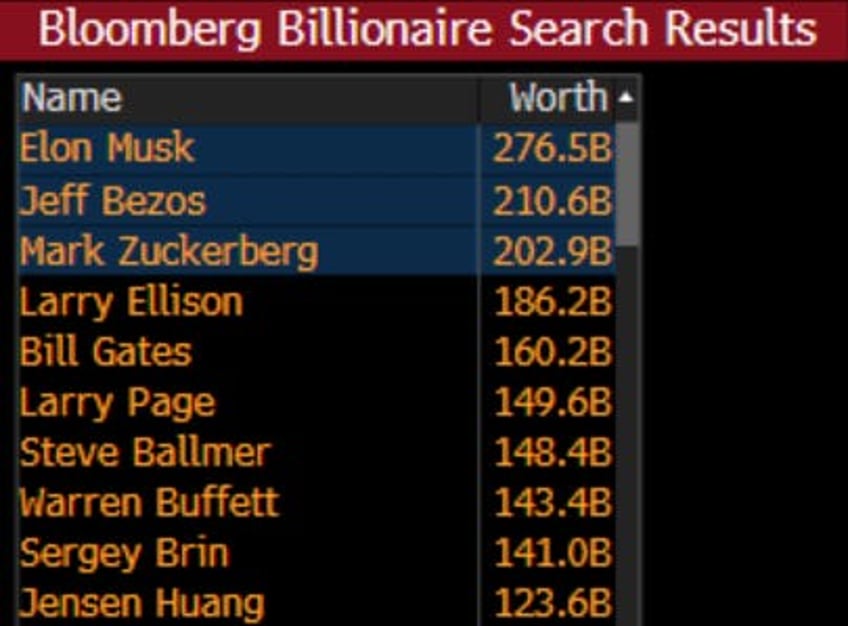

For those who believe taxing the ‘rich’ through measures like taxing unrealized gains will solve fiscal issues, they should think twice. The combined wealth of the 10 richest Americans, around $1.7 trillion, would only cover roughly 1.5 years of U.S. government interest expenses or barely the last yearly US budget deficit.

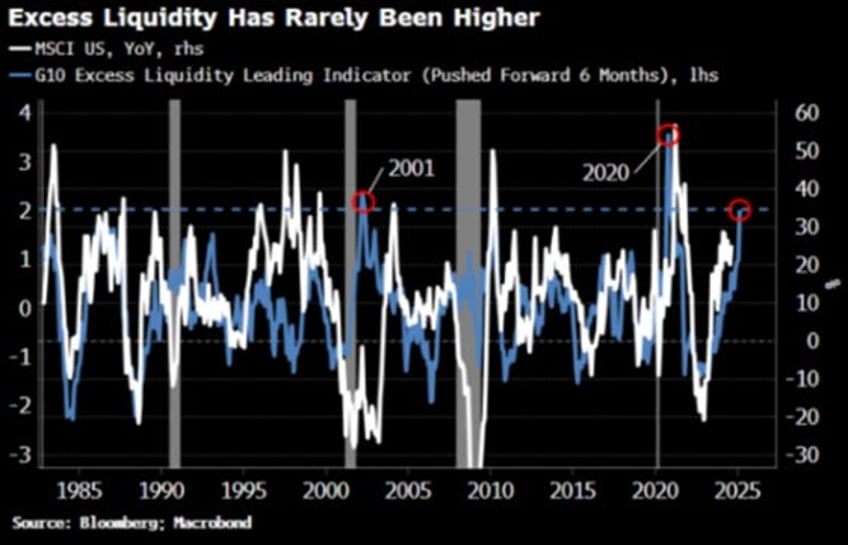

In this context it is fair to acknowledge that in the short-term, liquidity conditions in the US and globally are strengthening, with G10 excess liquidity reaching levels seen only twice in the past 50 years. Stimulus in China and easing in the US will enhance the positive backdrop for risk assets in the short-term. However, excessive liquidity will inevitably lead to frothy markets. Indeed, as everyone knows the post-pandemic cycle has been volatile, and it may become even more so, as excess liquidity, measured by real money growth outpacing economic growth, has hit a recent high, surpassed only in 2001 and 2020.

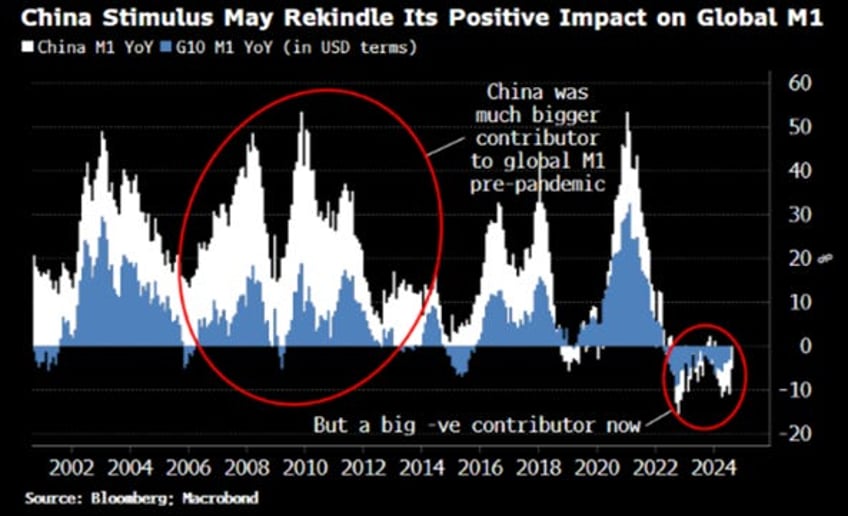

Outside the US, the stimulus in China which still needs to be quantified and implemented could be a game-changer for the global liquidity landscape. While China doesn't directly contribute to G10 excess liquidity, its money supply is likely to grow from depressed levels, further enhancing the positive liquidity backdrop. Historically, China has been a major driver of liquidity, contributing up to 70% of global money growth during the Global Financial Crisis. However, in the past two years, it has significantly hindered global money growth.

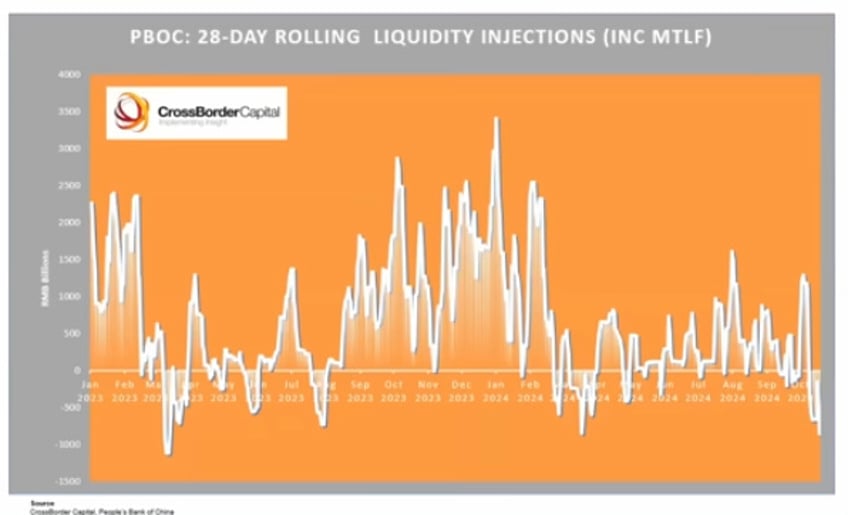

Looking deeper at the China's economic model, it is in the process of shifting towards consumption, but recent government stimulus measures appear inadequate and unsufficient to accelerate this process which is part of the Make China Great Again agenda. While a proposed trillion Yuan in fiscal stimulus sounds significant, it is minor compared to the US.'s $2-3 trillion spent during the 2008 financial crisis. What China requires is a massive monetary and fiscal stimulus to bring the economy out of its inflationary bust by improving its energy efficiency and restoring the Yuan as a good store of value compared to gold. Despite the common belief in the western world that China aims to develop the Yuan as the next reserve currency in a de-dollarizing world, Chinese elites understand the cost of managing a global reserve currency. Instead, China is working to establish a decentralized monetary system within the multipolar mercantilist Global South, where each member can trade in their own currency, avoiding the imposition of a new centralized ‘operating system’ like the USD-centric world built around SWIFT after World War II. In this scenario, China will seek to position the Yuan as a credible store of value against other currencies from the Global South, with the USD reference losing relevance once China's economy is fully de-dollarized, likely post-2028. As the Chinese government has always been hesitant to issue money out of thin air, as its fiscal spending relies on existing savings rather than new money creation, the timing to exit the current inflationary bust could still require investors to have a taoist patience which is far behind any time horizon of all investors, especially in the western world. Investors will remember that historically, similar situations have precipitated economic crises, as seen in Northeast Asia in the 1990s. Similarly, in early 2008, China tightened monetary conditions before the Olympics, inadvertently pushing borrowers into the eurodollar markets, which contributed to the global financial crisis. A similar scenario is on the cards if China continues to tighten credit while increasing fiscal spending. Recent data indicates that, despite claims of injecting liquidity, they are actually withdrawing funds from money markets, suggesting a tightening of conditions rather than economic stimulation.

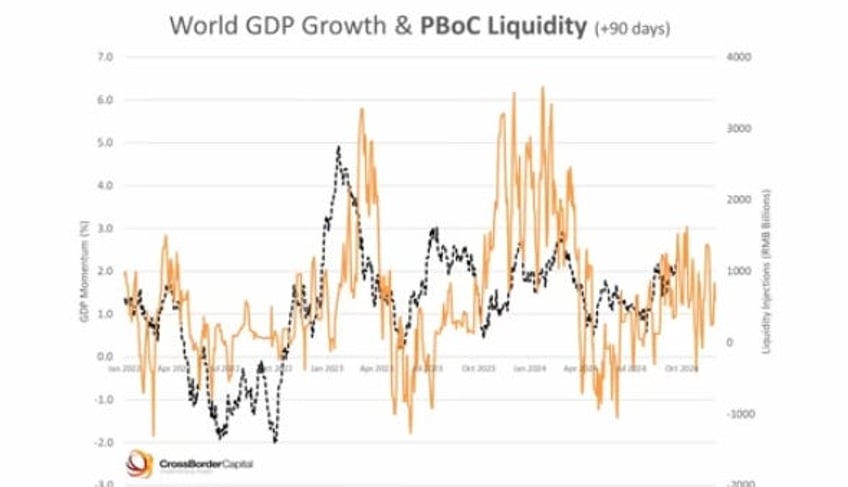

A quick look at PBOC liquidity injections alongside a nowcast of world GDP shows that while the Federal Reserve's actions significantly impact financial markets, China's policies affect the global economy and commodity prices. Recently, liquidity injections have started to decline, indicating potential slowdowns in the world economy and increased pressure on financial markets. This comes at a time when China is struggling to implement effective policies to address its substantial economic imbalances. As a dollarized economy, Chinese banks hold significant dollar positions in both assets and liabilities, with much of their trade conducted in dollars. This situation is critical, as China can influence global dollar demand by pulling liquidity from the system at inopportune times for the rest of the world.

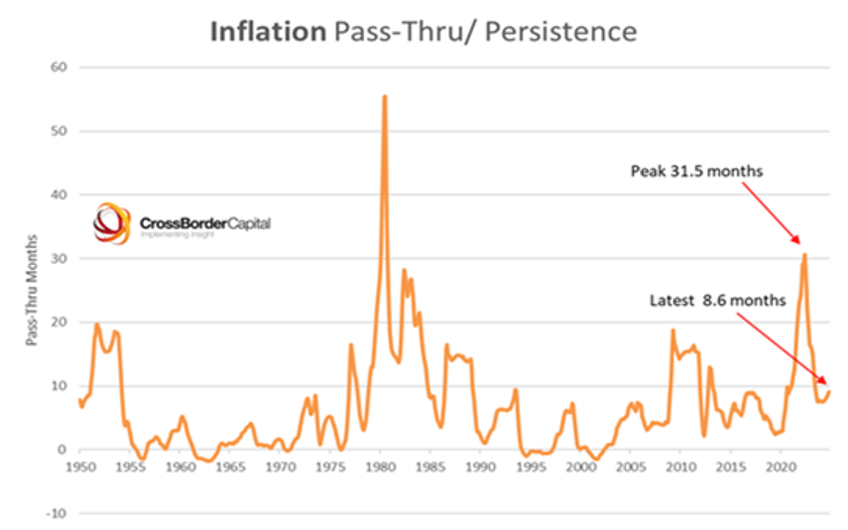

In this context, it’s evident that the FED and other central banks are laying the groundwork for the next credit disaster. US monetary policymakers may feel relieved after completing a vigorous hiking cycle without crashing credit markets, but the swift easing already in motion is distorting debt valuations and flooding markets with liquidity. The Federal Reserve could adopt ‘mission accomplished’ as its slogan after stifling inflation without derailing the economy or shutting down debt markets. While defaults and bankruptcies have increased slightly, the damage has been less severe than feared, despite funding costs doubling for weaker borrowers. If anyone still has doubts about the stickiness of inflation, a simple computation of autocorrelation and estimates of the number of months that shocks persist or echo through the pricing structure show that this indicator, which averaged 5 to 6 months over the past 74 years and peaked in 1980 at 56 months, has once again increased to a worrying level of 8.6 months. This indicates, for those willing to listen, that the fight against inflation is far from being a ‘mission accomplished,’ as propagandistically claimed by the Fed chairman over the summer.

Over the past few years, the FED has become known for spreading the forward illusion by injecting shadow liquidity behind the scenes. This has been highlighted in financial media as ‘stealth easing’ or ‘Not QE, QE.’. To understand what is happening in terms of debt monetization within the US system, let's examine the FED's actions, The blue line represents the absolute size of the FED's balance sheet. The FED discusses its quantitative tightening (QT) policy in the context of this total balance sheet, stating that if the blue line is decreasing, they are effectively undertaking QT. However, this perspective is insufficient because not all parts of the balance sheet create liquidity and liquidity can be injected into financial markets by using other means that the balance sheet such as the Treasury General Account and the Reverse Repo Program or like during the 2023 bank walk the use of the Bank Term Funding Program (BTFP). The red histogram which is a rough proxy of the FED’s liquidity and calculated by adding the liquidity available from the Treasury General Account and the Reverse Repo Program shows that ‘real liquidity’ the evolution of the FED balance sheet can diverge significantly. Indeed these 2 trends have deviated significantly from those projections. Two key events have altered the Fed's approach:

The British Gilt Crisis (September 2022): The UK sovereign debt market experienced a sharp sell-off after a poorly executed budget announcement, leading the Bank of England to pivot from QT to QE. This event served as a wake-up call for policymakers, highlighting the vulnerability of sovereign debt markets to missteps. Ultimately, the primary goal for the FED and the Treasury is to maintain the integrity of the U.S. Treasury market, with inflation and employment mandates taking a back seat.

The SVB Crisis (March 2023): Following this crisis, liquidity increased significantly, marking a clear inflection point. The shadow liquidity rose sharply over that period with even the FED balance expanding as shadow liquidity injection were required to save the financial system from the disastrous effect of the ‘bank walk’.

Overall, these developments illustrate how the FED’s liquidity measures have evolved in response to crises, impacting the broader financial landscape and cannot be only summarized as the evolution of the FED balance sheet.

FED Balance Sheet (blue line); USD Liquidity proxy Index (red histogram).

What the mass media refers to as ‘Not QE QE’ suggests that while the FED claims not to be engaging in quantitative easing, they effectively are. The outlook for the next three months appears positive, primarily due to the impending reimposition of the US debt ceiling on January 2, 2025, which will require the Treasury's general account at the FED to be reduced from its current level of about $850 billion to the historical norm of around $250 billion. This could inject approximately $500 billion back into financial markets, enhancing liquidity as year ends.

Additionally, authorities have recently relaxed the rules governing stress tests for US banks, allowing them to incorporate access to the discount window, loans from federal home loan banks, and the standing repo facility into their assessments. This means banks may not need to hold as many reserves at the FED. A decline in bank reserves at the FED will allow them to utilize these funds in other areas, such as the Treasury market and therefore is also enhancing liquidity in financial markets. In essence, shadow liquidity is increasing under the guise of ‘Not QE QE.’ as besides the partisan and politically driven interest rate cuts, the FED has been actively injecting liquidity behind the curtain. On the other hand, uncertainty around the outcome of the presidential election and the expected chaotic change of power coming by January 21st, 2025, will inevitably create social unrests which in financial markets would translate into much higher volatility and in the economy in much higher inflation, driven by shortages.

NY FED Reverse Repo Data (blue line); US Treasury General Account (red line); FED Balance Sheet (green line).

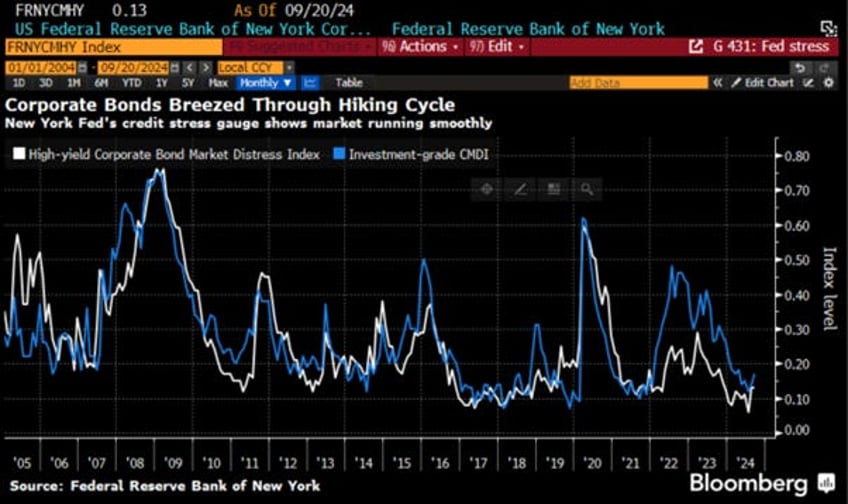

For the time being, markets are pricing in sustained rate cuts, offering vulnerable companies’ relief from elevated interest payments, but a credit market reckoning has only been postponed. The surprising 50-basis-point rate cut from the FED in September triggered a rally in junk corporate bonds, with buyers eager to seize the highest yields in decades, compressing spreads on CCC-rated bonds to their tightest since April 2022.

Even before easing began, debt market stress, as measured by the New York FED, was near historic lows, with credit spreads highly compressed due to demand outstripping supply, even as companies issued record volumes of debt. Corporate debt clearly didn't need additional stimulus; however, substantial easing and optimistic economic forecasts have created excess speculation. This environment encourages buyers and makes it easier for risky companies to take on more debt.

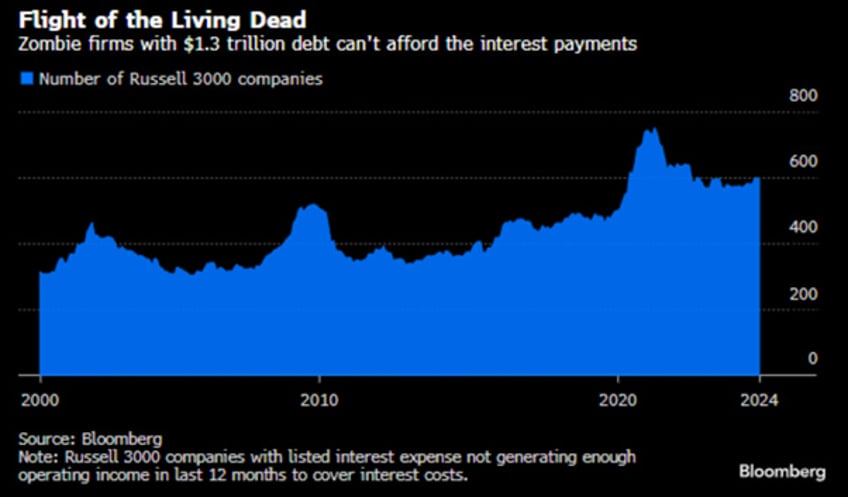

While two years of high rates eliminated many unsustainable companies, many others have managed to delay their reckoning. This year's rally in junk debt markets, fuelled by dovish rate expectations, has provided lifelines to numerous firms. Some have turned to private credit as a last resort, leaving hidden risks in the market. Currently, one-third of Russell 3000 companies with listed interest expenses failed to generate sufficient operating income to cover their interest costs in the past year, marking them as ‘zombie borrowers.’ This group holds a combined $1.26 trillion in debt, with 471 firms neither profitable nor cash-flow positive over the same period.

If bull markets thrive on a ‘wall of worry,’ financial crises often crash against a ‘wall of debt.’ On this matter, no one needs to be a PHD working for a central bank to understand that the world is approaching another crisis, driven not just by rising interest bills but by the looming challenge of rolling over the world's massive debt, estimated at $350 trillion. With the liquidity cycle peaking, the years 2025 and 2026 will be particularly difficult for investors, as they must contend with not only increasing concerns about future growth and inflation but also a significant maturity wall of corporate debt refinancings from years of low interest rates. This pattern has historically triggered financial meltdowns, as seen in the 1997-98 Asian Crisis and the 2008-09 Global Financial Crisis.

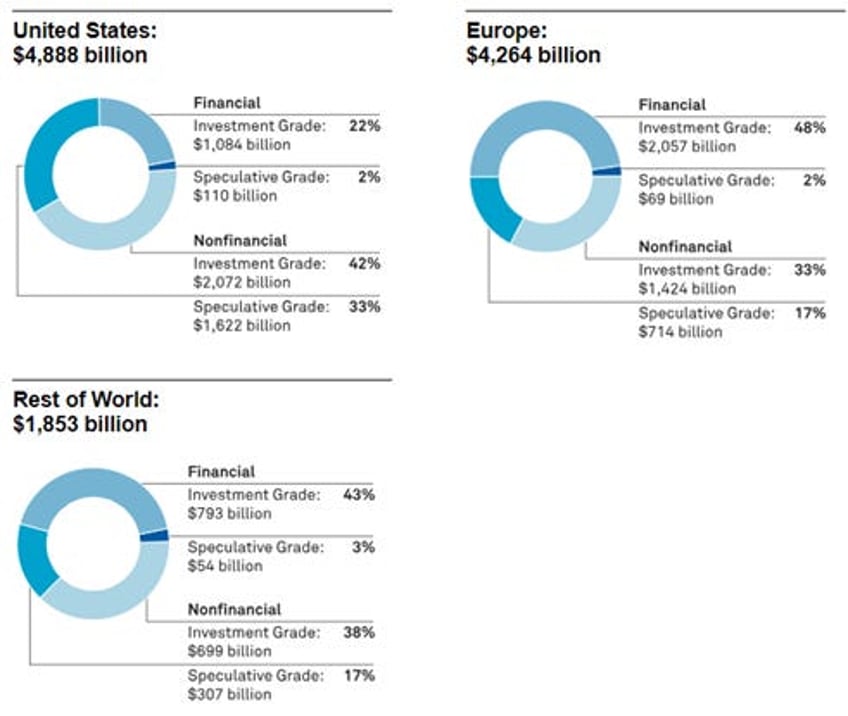

According to the latest estimates from S&P Global Ratings, approximately $11 trillion of non-financial S&P-rated debt is expected to mature in 2025 and 2026, with $4.888 trillion in the US, $4.264 trillion in Europe, and $1.853 trillion in the rest of the world.

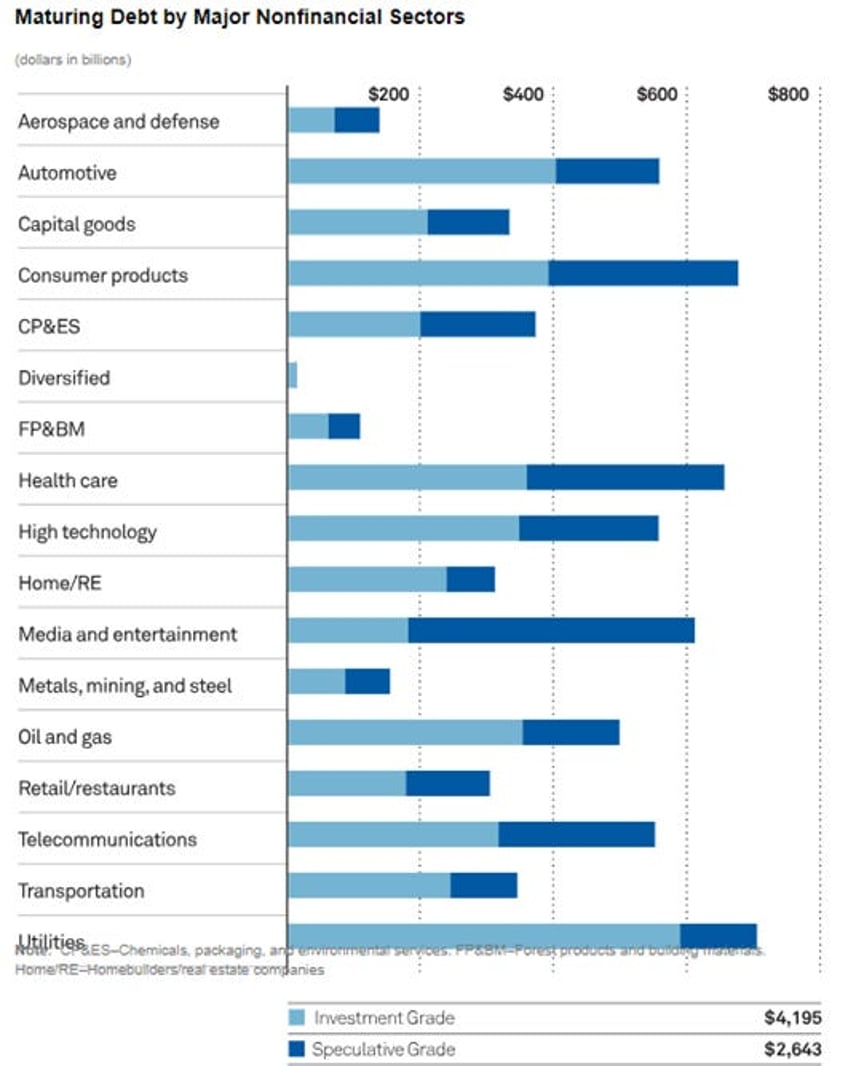

Looking at the details by sectors, debt is mostly concentrated in consumer products, healthcare, media and entertainment, and utilities, with the majority being investment-grade.

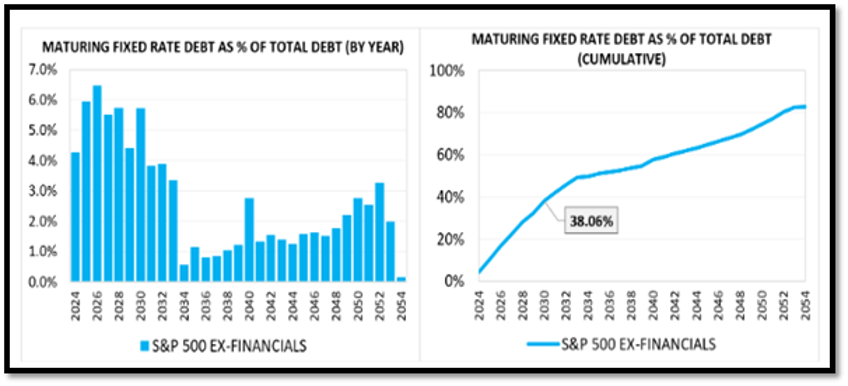

While the corporate sector remains relatively insulated from the immediate impact of rising interest rates, having issued substantial medium- and long-term debt during the low-rate environment of the last decade, the ‘maturity wall’ highlights the share of fixed-rate S&P 500 debt maturing each year as a percentage of total existing debt (both variable and fixed-rate). In plain terms, about 4% of S&P 500 debt matured in 2024, 6% will mature in 2025, and 6.5% in 2026. By 2030, roughly 38% of the total existing stock of S&P 500 debt will have matured.

A look at the net debt-to-sales ratio of the S&P 500 (excluding financials) shows that while it's below the peak of nearly 40% at the start of this decade, it remains at 32.5%, similar to mid-2019 levels and well above the 15% seen in 2008. However, with the U.S. 10-year yield rising from around 2.5% to over 4.2% by October 2024, any debt refinanced in the near future will face significantly higher coupon rates compared to the past 15 years.

Net debt to sales for S&P 500 ex financial index (blue line); US 10-Year Yield (red line).

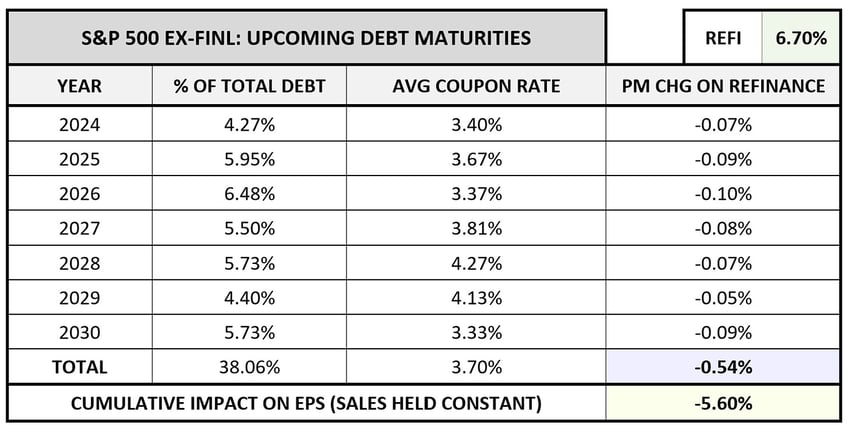

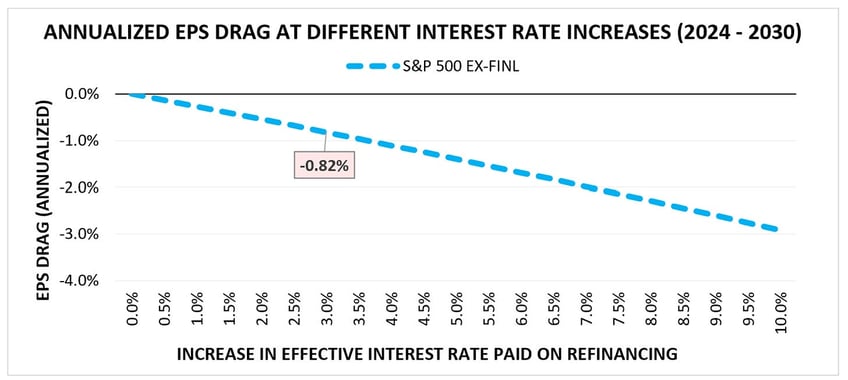

To estimate the earnings impact of upcoming debt maturities, we can approximate the cumulative effect on EPS by multiplying the percentage of debt maturing each year by the total debt as a percentage of sales, assuming sales remain constant.

Over the next seven years (2024–2030), the cumulative decline in profit margins is estimated at 0.54%, leading to a 5.6% drop in earnings and EPS, assuming all other factors like sales and share counts remain constant. While those variables will likely change as the S&P 500 grows, this 5.6% decline reflects the impact of higher interest rates alone. This decline is not an annual loss but a cumulative one, translating to an average annual drag of about 0.82%, enough to reduce the index’s returns below historical averages but not drastically alter overall performance. The calculation is based on a 6.7% nominal refinancing rate, 3% higher than the current 3.7% average coupon rate. If long-term rates rise further, the EPS reduction could be even greater.

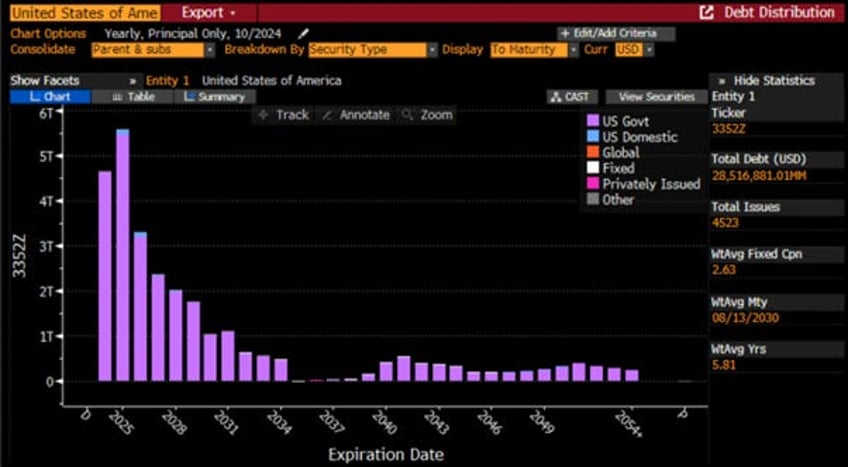

It is not only US corporations that will have to refinance debt. Indeed, the US government alone has more than $5.5 trillion and $3.3 trillion of debt to refinance in 2025 and 2026, respectively. This does not take into account the new debt that will be issued by the new tenant of the White House to finance the ‘forever bankers wars’ and the rising government spending that will inevitably be required to support the economy, even if it can miraculously avoid further economic slowdown.

Read more and discover how to position your portfolio here: https://themacrobutler.substack.com/p/when-the-liquidity-tsunami-meets

If this report has inspired you to invest in gold and silver, consider Hard Assets Alliance to buy your physical gold:

https://hardassetsalliance.com/?aff=TMB

At The Macro Butler, our mission is to leverage our macro views to provide actionable and investable recommendations to all types of investors. In this regard, we offer two types of portfolios to our paid clients.

The Macro Butler Long/Short Portfolio is a dynamic and trading portfolio designed to invest in individual securities, aligning with our strategic and tactical investment recommendations.

The Macro Butler Strategic Portfolio consists of 20 ETFs (long only) and serves as the foundation for a multi-asset portfolio that reflects our long-term macro views.

Investors interested in obtaining more information about the Macro Butler Long/Short and Strategic portfolios can contact us at

Unlock Your Financial Success with the Macro Butler!

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.