Looking at the English dictionary, ‘Trumped’ means to be surpassed or outdone by something stronger or more significant. The term comes from card games like bridge, where a winning card ‘trumps’ others. In broader use, it describes one argument, event, or action overriding another. A ‘trumped trade’ refers to a transaction that is decisively outperformed by a better alternative. In finance, this could mean an investment strategy that is overshadowed by a more profitable opportunity, such as a stock position losing appeal due to a sudden market shift. This definition is based on linguistic roots rather than an established financial term.

It has been 60 days and counting since the ‘Disruptor In Chief’ has been sworn in as the 47th U.S. president, and unless investors have been living in a deep hole in the middle of the Gobi Desert, the word that has predominated in financial media is the supposedly most beautiful word in the English dictionary, i.e. tariffs.

Mentions of Tariffs.

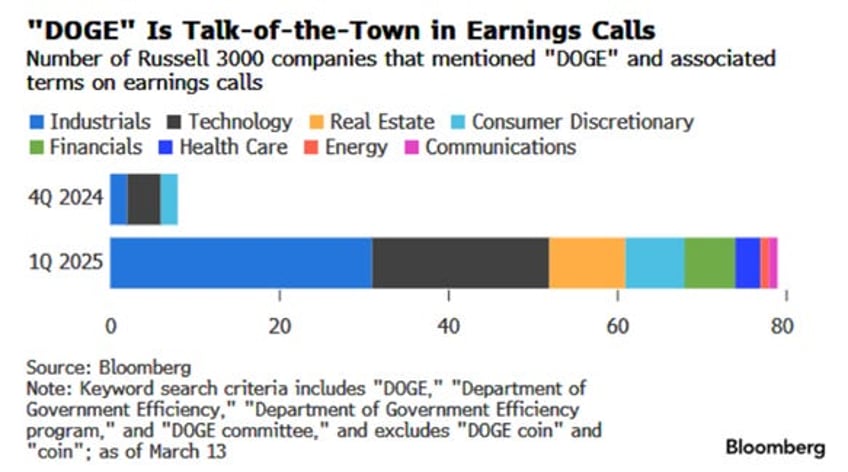

Outside of tariffs, the other hot topic among American CEOs in recent months has been the implementation of government spending by the now-famous Department of Government Efficiency (DOGE), led by the world's richest man and Tesla CEO, Elon Musk.

Tariffs are government-imposed taxes on imports or exports, mainly used to raise revenue, protect domestic industries, or influence trade balances. For example, a 10% tariff on imported steel raises costs, encouraging local alternatives. While tariffs can shield domestic producers, they also spark trade disputes and impact consumer prices. Historically, tariffs have shaped economies for centuries. Ancient empires used them as tolls, medieval states for revenue and protectionism, and mercantilist powers to control trade. The 19th century saw fierce debates between free trade and protectionism, with the U.S. imposing high tariffs like the 1828 "Tariff of Abominations." In the 20th century, the Smoot-Hawley Act worsened the Great Depression, leading to post-WWII tariff reductions under GATT.

The first impact of tariffs is increased trade policy uncertainty, as they can change at any time at the discretion of the ‘Disruptor-in-chief’ in the Oval Office. Since the November 5th election results, this uncertainty alone is expected to reduce world trade by 1.5% and global industrial production by 1.0% by year-end, compared to a scenario with stable trade policy.

US Economic Policy Uncertainty Index.

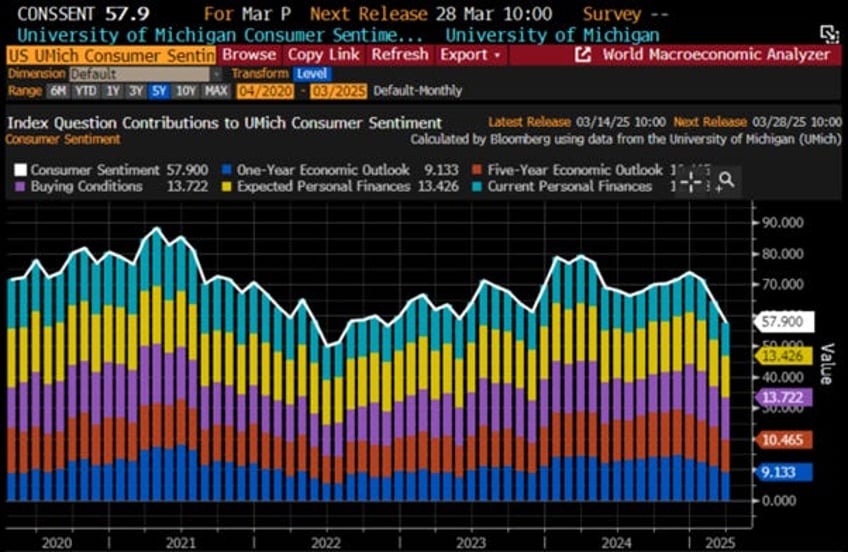

As tariffs are on, tariffs are off, tariffs are delayed, US consumer confidence has taken a sharp hit, as reflected by the University of Michigan sentiment survey, which dropped to its lowest level since the inflation peaks of 2022. This decline in confidence has led to a noticeable shift in spending patterns. The combination of unclear policy direction and rising living costs is creating a toxic mix for the average American. The US economy is inevitably heading into a period of stagflation, where the prices of goods and services rise while real buying power diminishes, leaving consumers spending more for less. Many are mistakenly equating rising prices with inflation, failing to recognize that stagflation, not deflation, is the real issue, as disposable income stagnates. The lack of confidence in both the economy and government policy has become a self-fulfilling prophecy, with businesses and consumers hesitant to invest, reinforcing a cycle of slow growth and rising costs. Ultimately, it all boils down to a crisis of CONFIDENCE.

University of Michigan Consumer Sentiment.

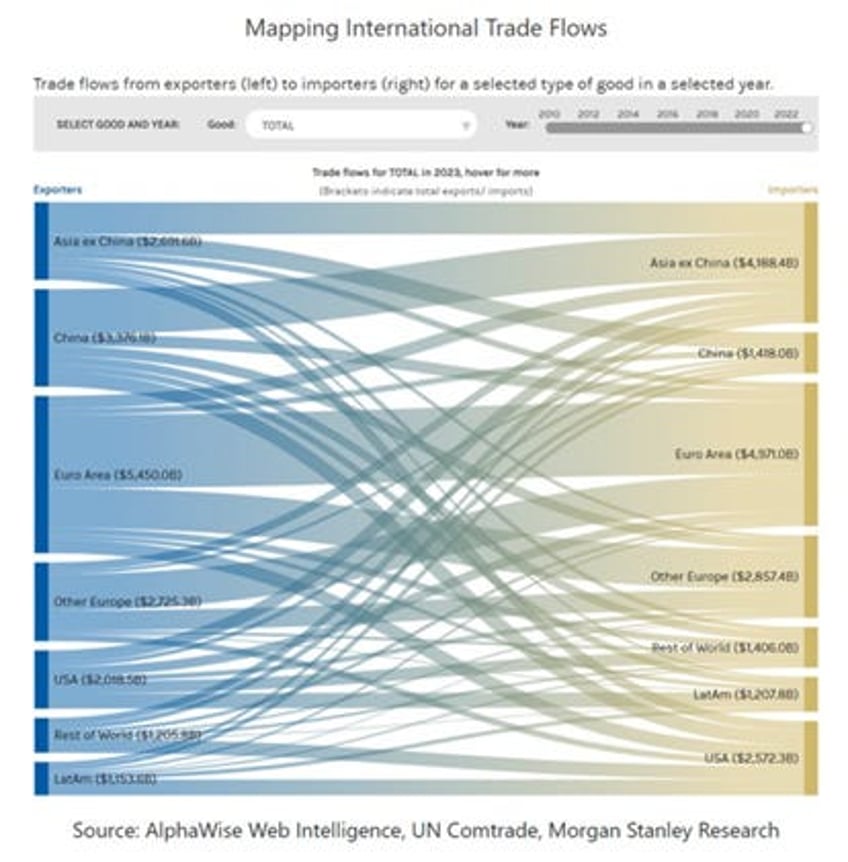

Tariffs are just one of many policy tools designed to raise trade barriers and realign supply chains in the name of national and economic security. While implementation has accelerated under the 47th U.S. president, the overall direction has remained consistent across three administrations.

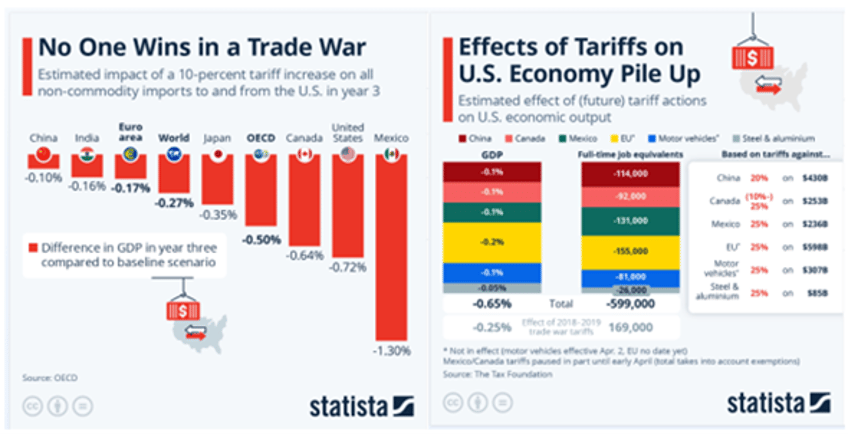

In a nutshell, no one wins in a trade war. According to OECD estimates, rising trade barriers, political uncertainty, and a 10% tariff hike on U.S. imports, met with retaliation, could shrink global GDP by 0.3%, hitting North America hardest: U.S. (-0.7%), Canada (-0.6%), and Mexico (-1.3%). Inflation would rise by 0.4 percentage points globally and 0.7 in the U.S. over three years. The OECD warns that escalating trade wars will hurt all economies, with the U.S. among the biggest losers.

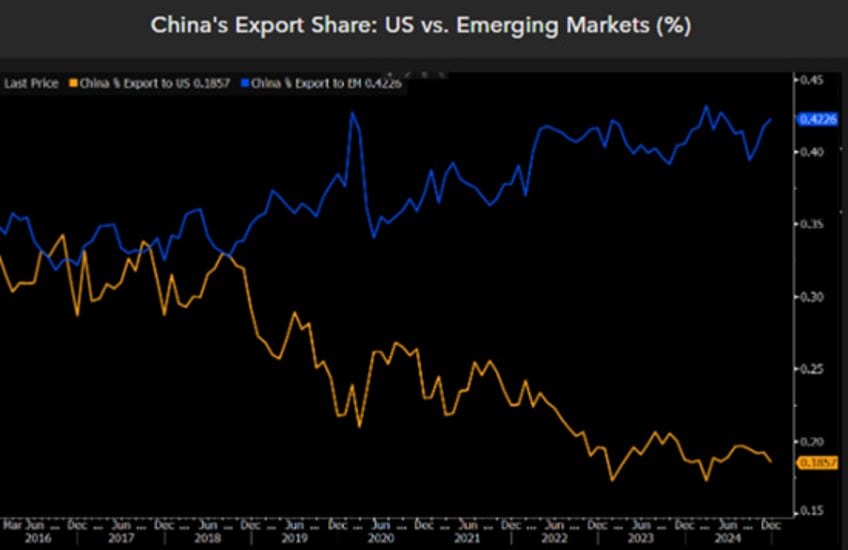

Tariffs may cut China’s U.S. export share, but they accelerate its shift to emerging markets. From 2017 to 2024, China’s exports to EMs nearly doubled to $1.49 trillion, raising their share from 32.5% to 42.3%, while the U.S. share fell from 28.8% to 18.6%. Key growth markets include Mexico ($90B, doubled) and ASEAN ($587B, now China’s top export destination). While new U.S. tariffs will push China’s effective rate to 30%, exports to the U.S. account for just 2.5% of China’s GDP. Even a 30% drop in U.S.-bound exports wouldn’t be a major shock to growth.

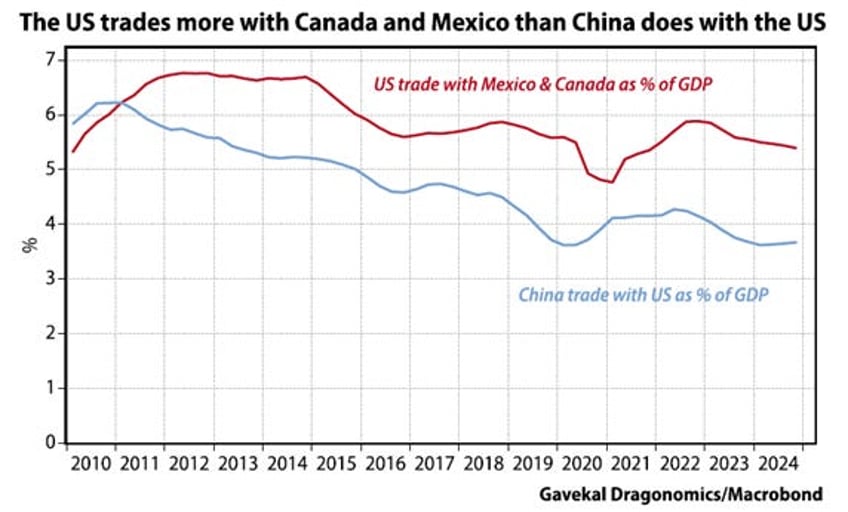

By contrast, a full-scale trade war within the tightly integrated North American economies, once unimaginable but now highly likely, would significantly impact all three countries' economic activity. Sustained U.S. tariffs on Canada and Mexico would almost certainly trigger retaliatory duties. U.S. trade with Mexico and Canada accounts for 5.4% of its GDP, a much larger share than China’s trade with the U.S., which represents only 3.7% of its economy.

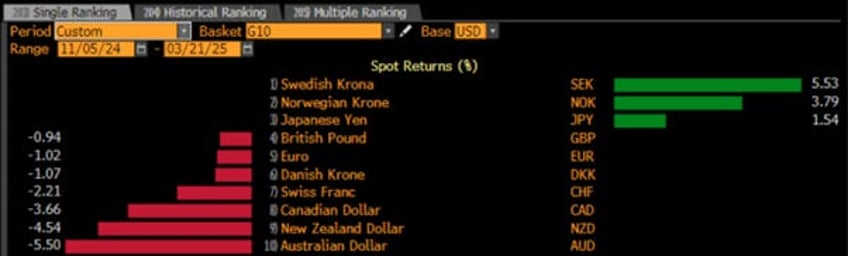

As the mercantilist Global South moves to de-dollarize trade, fewer USD will be generated globally, while USD-denominated debt remains unchanged. Combined with factors like geopolitics and looming debt crises in Europe and Japan, tariffs will further strengthen the USD against other fiat currencies.

Performance of G10 Currencies against USD since November 5th, 2024.

The binary nature of the tariff narrative, highlighted by Mexico-Canada tensions in early February, makes strong FX directional views difficult. Tariff uncertainty is driving higher FX volatility, with the JPM G-10 one-month volatility index rising to above 8.0 from a 2024 average of 7.71.

Tariffs are adding to the growing list of catalysts for further de-dollarization and FX regionalization. Not only are tariffs stagflationary, but they also contribute to an even more uncertain economic and geopolitical environment, as they are part of the tools used to weaponize USD assets. Ultimately, tariffs will drive the increase in gold reserves held by central banks, which has been the major catalyst for the gold bull trend. Indeed, spot gold has risen 76% since its late-2022 low just above $1,600 per ounce, coinciding with gold's share of central bank FX reserves rising from 13.5% to nearly 21%.

Gold Price in USD (blue line); % of Global FX Central Bank Reserve in Gold (red line).

One aspect of Trump’s tariffs that he and his advisers fail to understand is clearly related to his concepts of how the world economy functions, which were seriously forged in the Middle Ages. Trump's tariffs reflect a view of the economy, rooted in outdated concepts of backing, fiat, and gold. The dollar's reserve status has nothing to do with gold or the old ideas of currency value; all currency is fiat, decreed by governments. Historically, even gold and silver coins were fiat, with governments controlling their weight and value. The true backing of a currency lies in the productivity and freedom of its people, as seen in the rise of Japan and Germany post-WWII, and in America's innovation during the Cold War, exemplified by Nixon's Kitchen Debate with Khrushchev. The dollar became the reserve currency not because of gold, but because of American ingenuity and productivity. This truth traces back to ancient Rome, where currency's value was shaped by the people's capacity to produce, not by the metal content, as noted by Sir Thomas Gresham. The $5 U.S. gold coin, weighing 8.359 grams at 90% purity, was overvalued in the Latin Monetary Union, prompting the creation of a $4 Stella coin pattern, though it was never issued, and the LMU ultimately collapsed.

Trump’s anti-BRICS stance overlooks the real reason BRICS emerged: the Neocons’ desire to undermine Russia's economy for geopolitical gains. Removing Russia from SWIFT raised global alarms, prompting China to create its CIPS system as an alternative. BRICS now represents over 50% of the world’s population, with neutral politics as its core appeal, in contrast to the U.S.’s military-focused approach. The dollar’s reserve status is tied to America's dominance in global trade, much like ancient Rome’s economic power. Trump’s tariffs, aiming to bring manufacturing back to the U.S., would harm global trade and undermine the dollar’s role. Historically, American companies have been more competitive and innovative, which helped maintain the dollar's status, but tax policies forcing businesses to go global in the progressive era pushed many out of the U.S., ultimately weakening its global trade advantage. The threat of US financial sanctions was little discussed by financial media, but one of Donald Trump’s first acts as the 47th US president was to threaten the Colombian government with financial sanctions, not just tariffs, should President Gustavo Petro refuse to allow deportation flights from the US carrying Colombian illegal immigrants to land in the country. Such threats have raised and will continue to raise the risk premium of US assets for foreigners from countries not keen to accept ‘Trumperialism,’ increasing the risk of further weaponization of USD assets in general.

Trump's economic strategies, including his support for cryptocurrencies and imposing drastic tariffs, are grounded in outdated theories that no longer apply. His advisers believe these actions will revive the U.S. economy, but they are misguided. Instead, these policies will likely shrink the U.S. economy and trigger a global recession. The U.S. is headed for an economic downturn and sharp rise in the unemployment rate through 2026 and beyond, as forecasted by the ratios which are driving the businss cycle such as the S&P to Oil ratio and the Gold to Bond ratio. The recent performance of gold, surpassing the S&P 500, and the break of the S&P 500 to gold ratio below its 7-year moving average on January 20th, 2025, the day the 47th president took office, indicates the beginning of a larger economic shift.

S&P to Gold Ratio (blue line); 84-month Moving average of the S&P 500 to Gold Ratio (red line); US Unemployment Rate (axis inverted; green line).

Treasury Secretary Scott Bessent's recent downplaying of tariffs’ inflationary impact is a significant mistake. He claimed tariffs would be a "one-time price adjustment," but this is far from the reality. Tariffs will have widespread, long-term effects that ripple through the global economy. His comments, likening tariffs to the past "transitory" inflation narrative, overlook the substantial economic consequences. Bessent's optimism about inflation being unaffected by tariffs reflects a misunderstanding of the broader economic impacts.

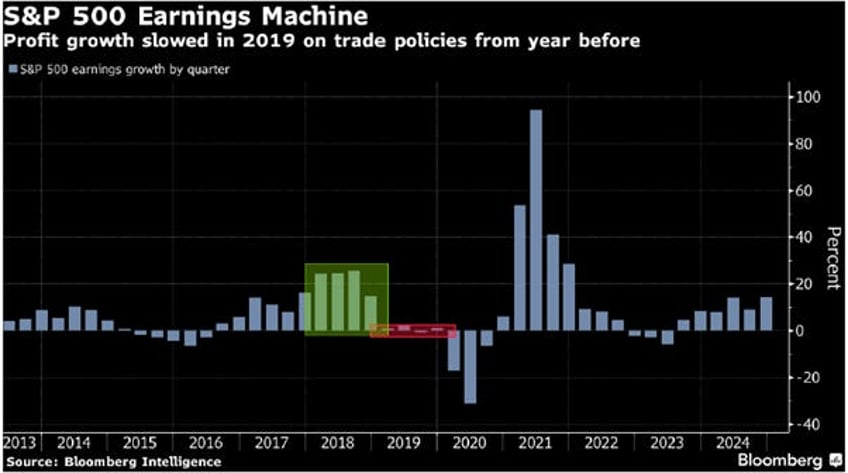

https://www.foxbusiness.com/video/6369692167112

Anyone with a modicum of economics knowledge knows tariffs have to be paid by someone, consumers, producers, or intermediaries. If companies bear the cost, operating margins will suffer, potentially weakening equity prices, as seen in 2018 when Trump's tariffs triggered margin declines and a double-digit drop in global stocks. This time, broader and more extreme tariffs could hit fundamentals even harder. From the first 2018 tariffs on washing machines and solar panels to the removal of some on Canadian and Mexican metals, 12-month forward operating margin estimates fell 70 bps for the S&P 500 index ex energy.

S&P 500 ex Energy Index Operating Margin.

While Bessent and others who support tariff myths argue that tariffs lead to a one-time price adjustment, the reality is more damaging. Tariffs raise costs across the supply chain, starting with direct goods and cascading through industries that rely on those goods, like cars and construction materials. These cost increases continue as businesses pass them down to consumers, creating a wage-price spiral as workers demand higher wages to cope with rising costs. In this context, it should not be a surprise that Wall Street’s confidence in corporate profits is waning. Analysts have downgraded profit forecasts for S&P 500 companies for 22 of the last 23 weeks, marking the longest stretch since early 2023. As a result, concerns about the economic impact of Trump’s tariffs are weighing on stock prices, with the S&P 500 down ..% since its all-time high. This erosion of earnings expectations could further depress sentiment, as analysts lower their outlooks.

As the first-quarter earnings season begins on April 11 with reports from JPMorgan Chase & Co. and other banks, some US companies are already signaling trouble. Following Delta Air Lines Inc.'s drastic cut to its profit outlook due to weakening air travel demand, retailers like Kohl’s Corp., Abercrombie & Fitch Co., and Walmart Inc. have also raised concerns. While analysts project a 10% advance in S&P 500 earnings for 2025, down from 13% in early January, there may be further downside..

Despite resilient corporate results in recent years amid inflation and high interest rates, investors hope Trump will either soften or remove tariffs before they impact profits. It may take months for analysts and companies to adjust forecasts lower, as seen during Trump’s first term, when the trade war with China hurt profits about a year later. The economy had a tailwind from corporate tax cuts then, and pressure is mounting on Trump to push through a tax bill in his second term.

The only U.S. president who truly understood that free trade and mercantilism, combined with access to cheap and abundant energy, are the foundations of long-term prosperity was Ronald Reagan. In a 1987 radio address, he stated: ‘The way to prosperity for all nations is rejecting protectionist legislation and promoting fair and free competition. Now, there are sound historical reasons for this, but for those of us who lived through the Great Depression, the memory of the suffering it caused is deep and searing.’ As Reagan rightly pointed out, tariffs may seem patriotic at first, protecting American jobs and industries. But over time, domestic companies grow complacent, relying on protection instead of innovation. Worse, tariffs trigger retaliation, escalating into trade wars with rising costs and shrinking markets. Eventually, inefficiency and high prices drive consumers away, leading to business failures and job losses.

Read more and discover how to trade it here: https://themacrobutler.substack.com/p/when-trump-trades-meet-trump-tari…

If this research has inspired you to invest in gold and silver, consider GoldSilver.com to buy your physical gold:

https://goldsilver.com/?aff=TMB

Disclaimer

The content provided in this newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice.

Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions.

Always perform your own due diligence.