Nearly one-in-ten U.S. homes are now worth at least $1 million.

Analysis from Redfin has found that 8.2% of homes in America were million-dollar homes as of June 2023, nearing the June 2022 peak of 8.6%.

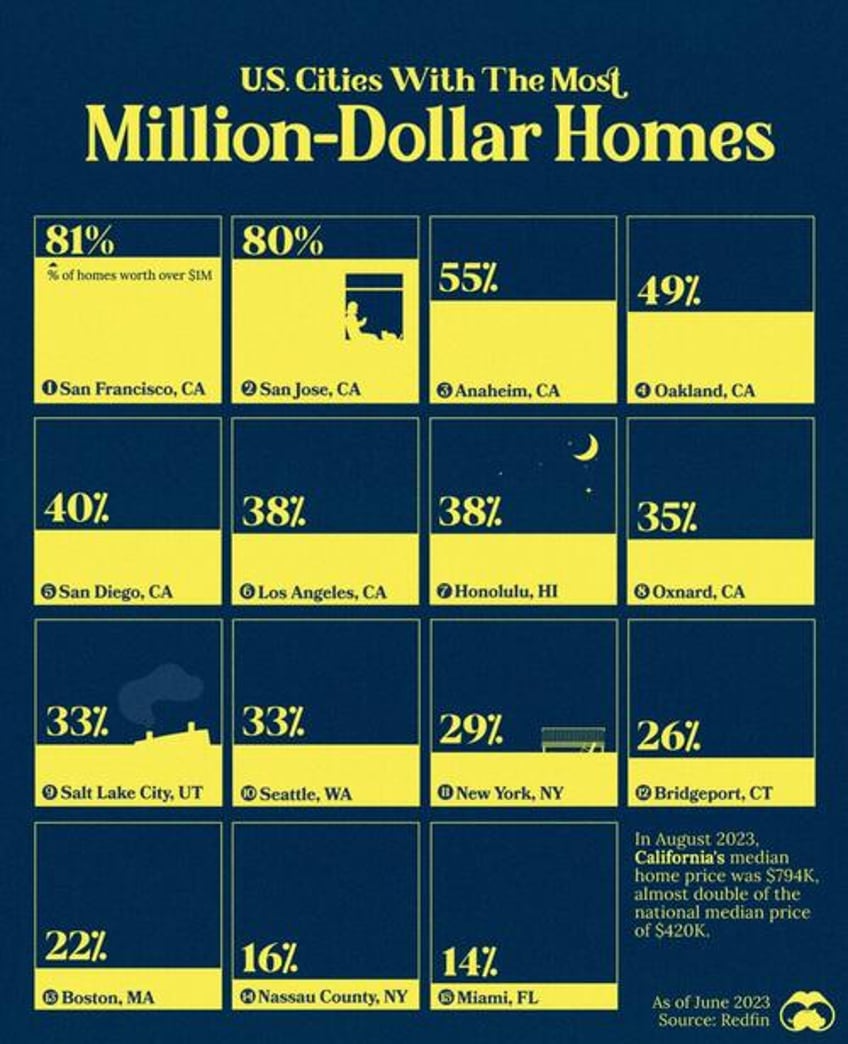

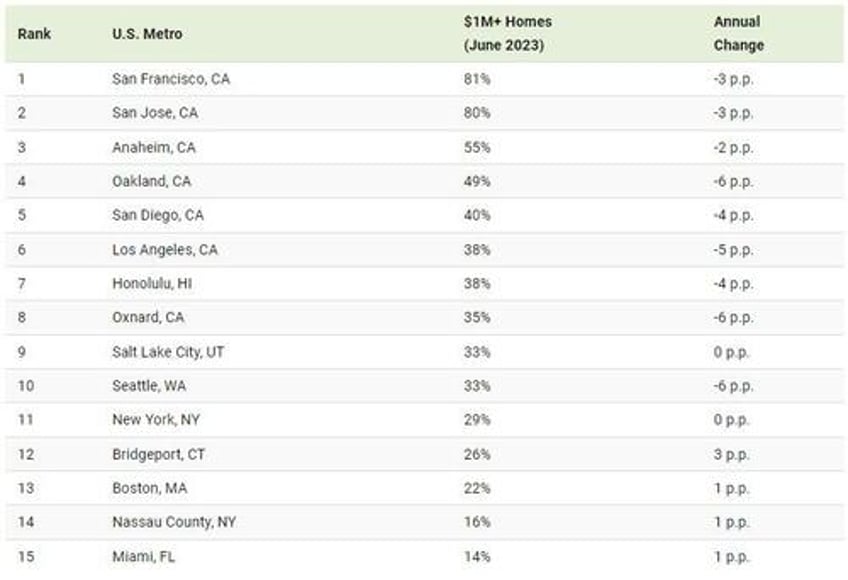

In the graphic above, Visual Capitalist's Marcus Lu uses Redfin and MLS data to highlight the top 15 U.S. cities by their percentage of million-dollar homes, based on June 2023 home values in metropolitan statistical areas (MSA).

Top 15 U.S. Metros by Share of Million-Dollar Residences

California has seen an exodus of residents over the last few years due to many factors, but the state still has the highest share of million-dollar homes in the country by far.

Cities in California claimed the top six spots by share of million-dollar homes in June 2023. Here are the top 15, along with the change since June 2022 in percentage points (p.p.).

First is San Francisco, where 81% of homes were worth at least $1 million. This is actually lower than the year previous, which saw 84.2% of homes cost more than one million dollars.

Neighboring San Jose, home of Silicon Valley, was second place with million-dollar homes accounting for 80% of residences. The entire San Francisco Bay Area is the most expensive real estate market in America, with Oakland also having 49% of homes costing $1 million or more.

Southern California also featured prominently, with Anaheim (55%) actually outranking San Diego (40%) and Los Angeles (38%). The first non-California metro to make the rankings was Hawaii’s Honolulu at 38%.

Other regions to feature at the top of the rankings were the Western U.S. (Seattle and Salt Lake City) and the Northeast (New York City, Bridgeport, and Boston). Miami was the sole entry from the South, with far lower shares of million-dollar homes in major metros like Dallas-Fort Worth, Atlanta, and Phoenix.

Share of Million-Dollar Homes Doubled Since 2019

One reason for the increase in housing prices is intense competition for those trying to enter the housing market.

Many existing homeowners are opting to stay put in their current residences to retain their relatively low mortgage rates, with the U.S. 30-year fixed-rate mortgage reaching its highest level since 2002.

Subsequently, the high cost of financing has also caused development to slow down. But high demand from new potential homeowners has propelled prices to new heights. According to Redfin, the share of homes worth seven figures has doubled since before the pandemic.