Why Goldman’s $3100 target is Low.

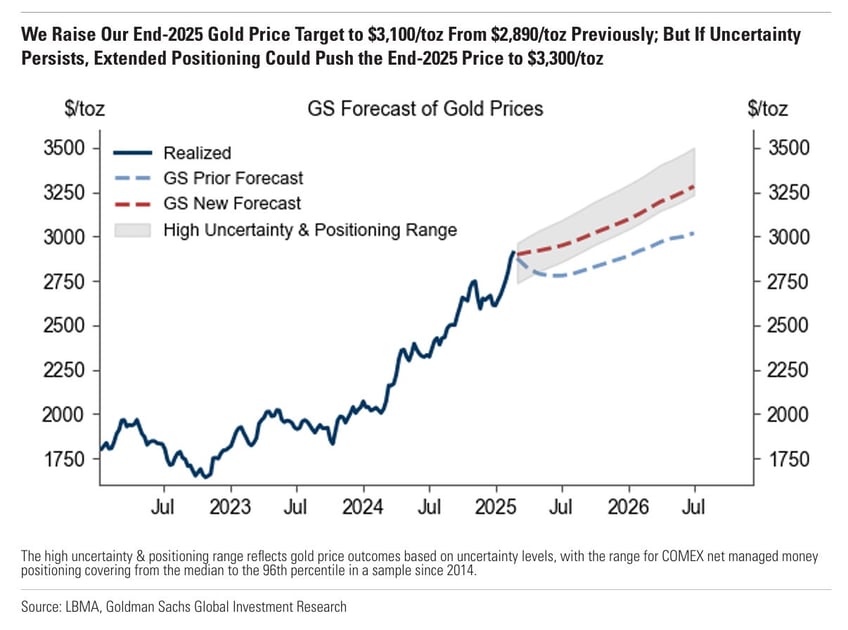

Goldman Sachs raised its gold price forecast for the end of 2025 to $3,100 per ounce, up from its previous estimate of $2,890. The adjustment reflects the bank’s expectation of sustained central bank physical demand driving the market higher.

Before drilling down into this report, some context is in order, namely a bigger picture overview of the London Gold drainage situation, a signpost of why we feel Goldman’s target is conservative

1- Context: China and the US Drain London Stockpiles

In this report by Goldman, we see China is not yet finished with its own purchases while the US has begun calling its own Gold home. In effect, the basket of (unencumbered) balls that was the London Bullion Market Association is fast emptying. Goldman’s $3100 target is likely low given this and the China insurance news recently announced.

2- Central Bank Demand Rises Again

Goldman estimates that a "structural rise in central bank demand would add 9% to gold prices by the end of 2025." The bank increased its central bank demand assumption to 50 tonnes per month, up from 41 tonnes. Should monthly purchases average 70 tonnes, Goldman sees gold reaching $3,300 per ounce by year-end 2025.

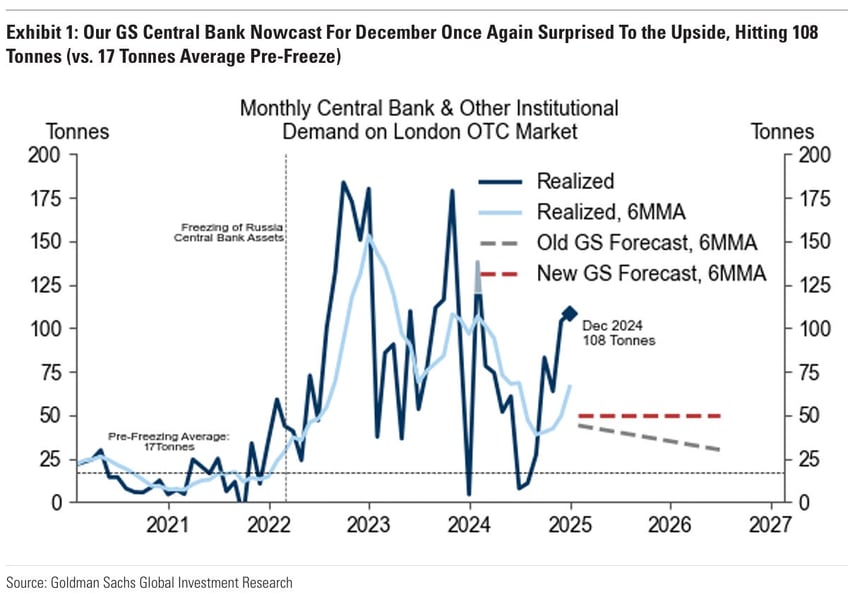

“The December reading of our GS nowcast of central bank and other institutional gold demand on the London OTC market came in strong at 108 tonnes… China was again the largest buyer, adding 45 tonnes.” – Goldman Sachs.

As a result, Goldman raised its baseline assumption for central bank buying to 50 tonnes per month (from 41 tonnes). This sustained demand is expected to add 9% to gold prices by the end of 2025.

We would add, the change from 41 to 50 tonnes is even more significant when you consider the bank changed a 6 month moving average after 2 months of data— not a one month data point— by over 20%.

From: The Path to $3,500 Goes Through China Insurers

Bank of America expects that [China’s insurance] companies will purchase gold actively and use their allowance within a year. Putting concrete numbers behind this, the purchases could generate around 300 tonnes of gold purchases.

If you are old enough to remember, this is very similar to what Ronald Reagan did in the 1980s when he deregulated insurance companies enabling them to invest in and offer more stock-based insurance products. This was one harbinger of the great 1980s bull market.

Taken together, the probability of Goldman’s $3300 target, and even BOA’s $3,500 target are not insignificant. Goldman also notes significant upside risks not yet in their price calculus. We make it clear that one of them, the Tariff risk, is already manifesting and will not stop.

3- More Upside Surprise Risks

Goldman outlined multiple scenarios for gold's trajectory:

- If the Fed does not cut for the rest of 2025, even with no further increases in China buying, gold is forecasted to hit $3,060 per ounce.- green line

- If ETF inflows pick up alongside rate cuts as forecast, gold could reach $3,100.- red line

Continues here

Free Posts To Your Mailbox