"Here’s the kicker.. Empirically speaking: Oil prices were *not* why we had such persistent stagflation in the 1970s.."

Authored by GoldFix ZH Edit

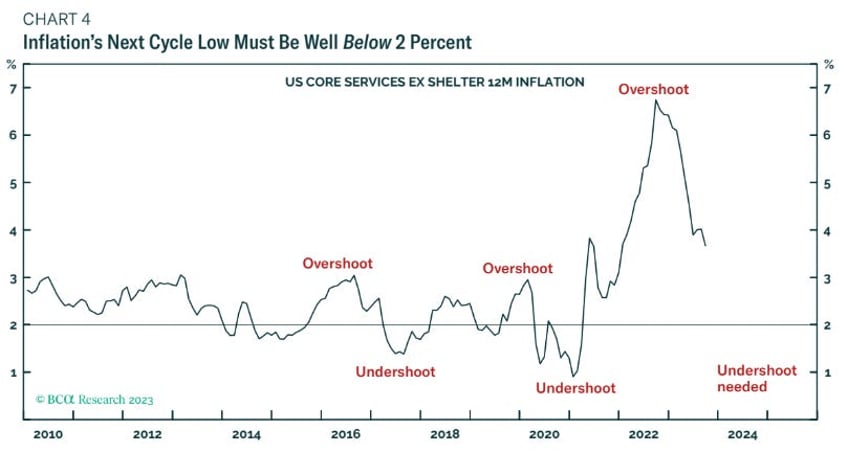

One thing mentioned often enough here is the opinion inflation will remain sticky over the next few years. That begs the question why.. Here are a couple possible reasons culled from research being done into answering that question. One reason is Perception. The other is the math that supports much higher inflation tolerances or much higher unemployment now. First Perception.

Fighting inflation is like rolling up a ball of string in your hand. One slip and gravity sets you back years re-rolling.it.

That’s a comment on inflation expectations/perceptions getting ruined, as opposed to actual data seen.A whole generation just sh*t themselves not even knowing inflation was a thing. Now there’s a new monster under their bed to worry about.A monster they won’t they won’t soon forget no matter how hard the media tries to make them.

Every time something is bought, millennials are reminded of inflation now by the legacy change in prices that shocked them. It’s baked in because those prices won’t come back down. They may stop going up, but they’re remaining elevated is a constant reminder of the risk of re ignition. They are now sensitized to it.

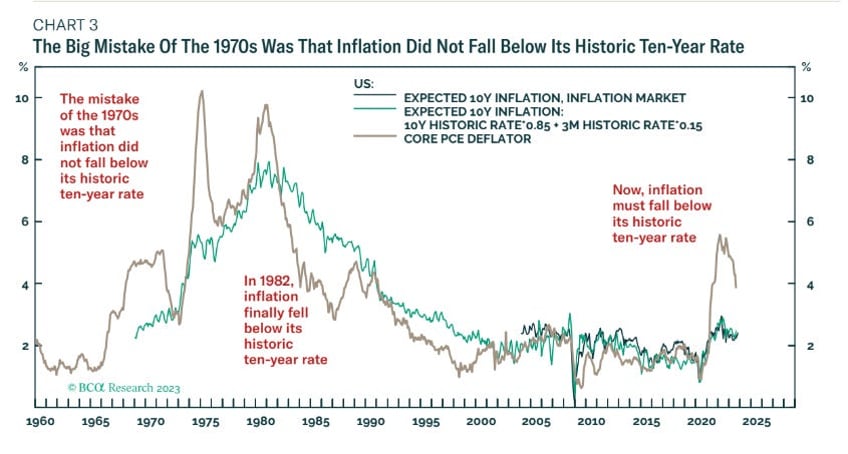

It took a decade to get inflation under control last time. Why?

Those newly born inflationary perceptions are 50% of the battle in actually fighting inflation… The Fed tries to cure you of that opinion despite the prices you see daily. Failing to do that, they try to get you to accept lower standards of living. They are already trying that. Watch it ramp up this winter.

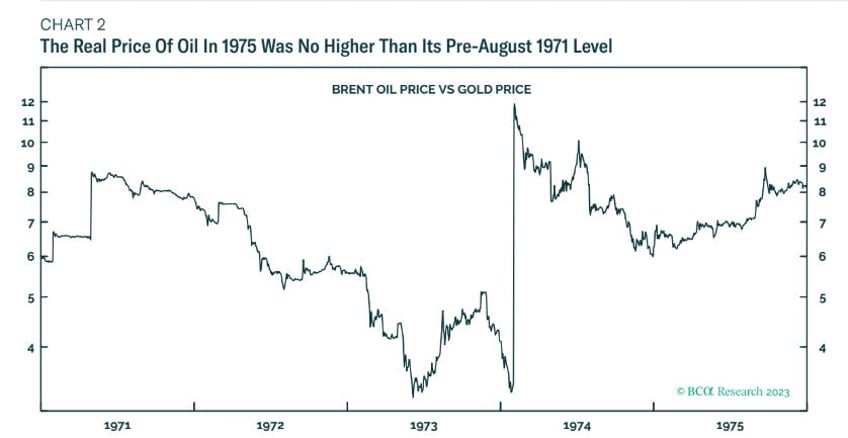

The kicker?.. Empirically speaking: Oil prices were NOT why we had such persistent stagflation in the 1970s.. Decoupling from Gold was.

Here is a related post from Sept 2022 on the math of it all.

Continues here ...

Free Posts To Your Mailbox