Subscribe on our website www.gmgresearch.com

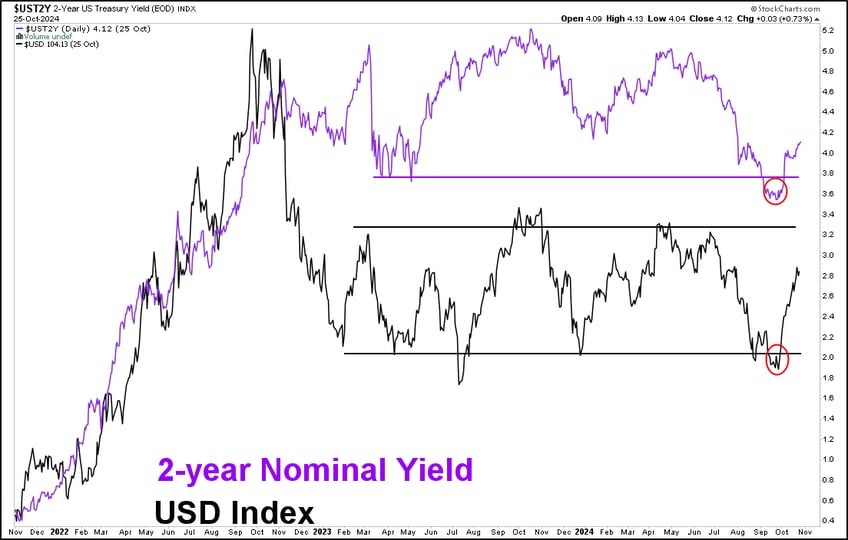

Macro: Rates are heading higher, oil weaker, gold/silver and Bitcoin are strong….. Inflation is around the election corner. Markets are still trading a Trump victory.

Bitcoin: Higher. At $69,000 now.

Tether: US might sanction tether the stablecoin. That could cause serious problems.

Energy: Continues to be weak

Goldman on Palladium move: “We are watching the 1-year highs at $1225 where dealers are short some gamma.”

Nvidia: Do not under estimate AI and what it will do. It is not the dot.com era.

Huge earning releases this week.

Rates and the US Dollar still have some room to rally.

USD continues to be strong

Bitcoin: Microsoft has a shareholder vote in Dec to invest in Bitcoin. Bullish since 2013.

The euphoria during the Ethereum ETF launch was unmatched. We always kept our distance. Solona is a better alternative.

A week ago we wrote: “Last time Chinese stimulus happened, Palladium passed $2,800.” 4 days later up 10% since US asked G7 to sanction Russian Palladium.

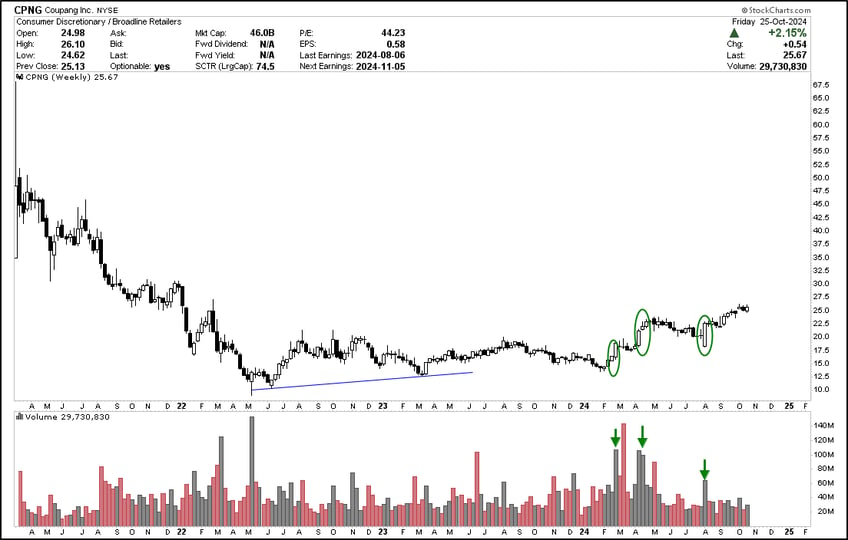

Good accumulation volume on Coupang!

In the spring we wrote to stay away from CSX. Look at that underperformance.

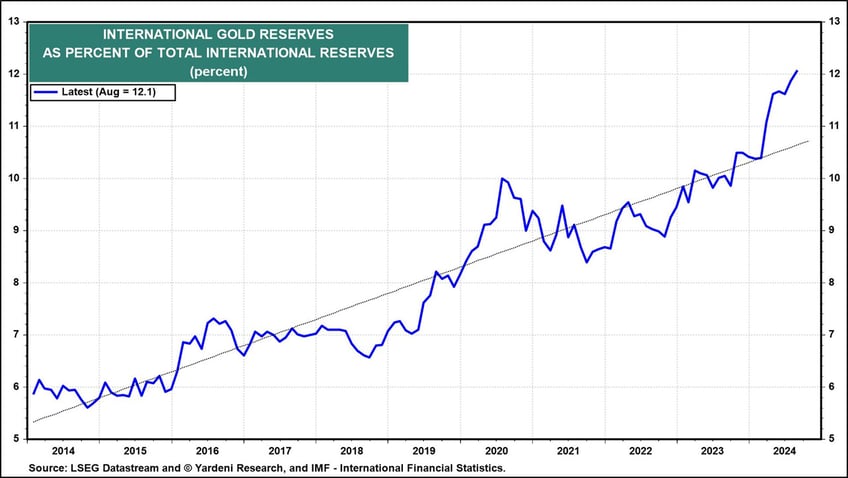

International gold reserves are growing FAST.

Zoom out and gold is started to tick higher.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.