Submitted by QTR's Fringe Finance

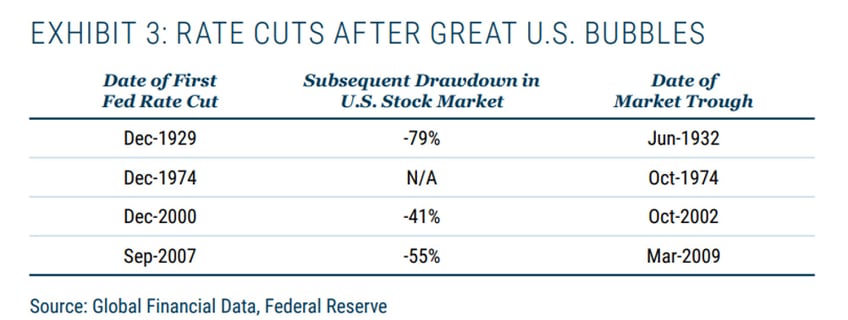

Rate cuts don't mean the market is going to rip higher. In fact, if history is any guide, they mean just the opposite.

So while the market is anticipating rate cuts and the economic data that could portend a Fed pause or cuts as positives, they really could instead be the alarm that indicates the market could be setting up for a marked move lower.

As you can see in the charts above and below, market bottoms generally follow Fed rate cuts. Cuts usually come just after hikes have made their way through the economy and are set to manifest in the economy (this usually takes 18 months to 24 months, something I wish I had been clearer about when I took my bearish stance on markets 18 months ago, only to be proven very wrong thus far).

(B of A chart of Fed cutting rates before market bottoms)

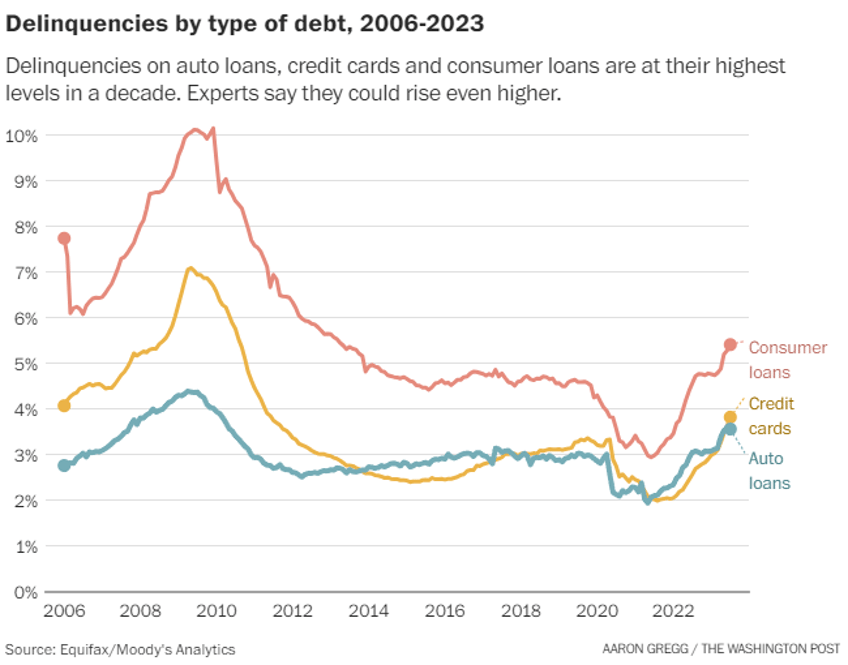

But don’t let rate cuts be the only signal that the market could be ready to tank. The macroeconomic data behind the scenes continues to pile up like a wreck on a highway. With the Fed in QE mode, bad news is looked at as good news. With the Fed engaged in quantitative tightening, make no mistake about it, bad news is simply just bad news. Want some proof?

Here’s a look at delinquencies curling upward — nowhere near 2008 levels but sure as hell moving in the wrong direction and eclipsing the figures immediately prior to the 2008 crash.

Debt delinquencies start a gnarly cycle for the economy.

Here’s the cycle in a nutshell. Debt delinquencies indicate borrowers are unable to meet their obligations. Most immediately...(READ THIS FULL ARTICLE HERE).