Submitted by QTR's Fringe Finance

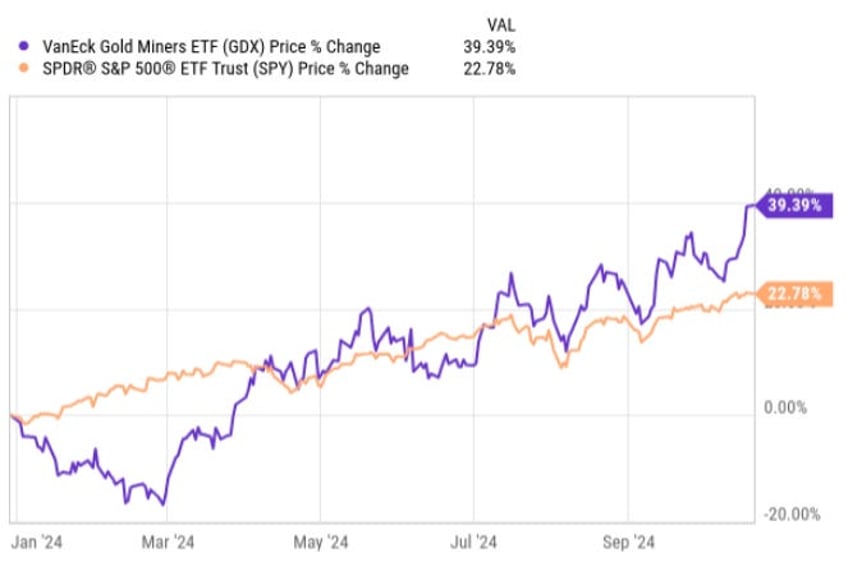

For the most part, things have gone as I predicted this year, with the exception of overall market indices declining. Gold is kicking ass, as I recently wrote about in my article, “Gold: Ride the Lightning”. Gold miners, one of my top picks for the year, are up almost 40% compared to the S&P, which is up about 23%.

Furthermore, one of my favorite new stocks, Oklo (OKLO), which I pointed out just about eight weeks ago, is already up more than 150% since I brought it to the attention of my readers. Here’s how I’m handling these positions, a preview of some of my favorite ideas for 2025, and what I think about the market in general going forward.

First off, I did take off a fair amount of my Oklo position as it rose over the last 5-6 sessions, trying to leave myself with a core position since I have a 5-10 year outlook for the name. However, such short-term spikes—with the stock rocketing more than 150% over just eight weeks—made it difficult for me to hold onto a lot of shorter-dated options and equity that I had. For the record, my outlook on the name remains 5-10 years, and I will look to reestablish a sizable core position again on future dips.

Market Outlook Going Into 2025

Gold has blown away all expectations, and it’s done so during a tightening and hiking cycle. Ergo, I believe there are significantly more gains ahead for gold as the rest of the world shifts to quantitative easing. Additionally, I expect gold and silver miners to outperform the spot prices of the metals, as analysts will need to adjust their estimates to reflect higher sustained prices. From a technical analysis standpoint, it’s difficult to look at gold and silver charts right now and say that we aren’t in the midst of a significant breakout, where I’ll buy dips on the way up

That said, I don’t think gold and silver will continue rising in a straight line; I expect some pullbacks of 5% to 20% along the way. However, it’s hard to describe the current action in gold as anything other than a serious bullish signal. As Larry Lepard wrote in his most recent investor letter, gold isn’t just responding to geopolitical unrest—it’s also reacting to failing central bank policies. To this day, it remains a perfect hedge in my opinion.

I'm also buying a new position that'll be one of my key holds in 2025...(READ THIS FULL ARTICLE HERE).