A dear, paid-up subscriber let me have it recently.

“You’re saying the majority of weight-loss drug users are going to keep eating as much as before despite the drug’s effectiveness to curb their appetite? I don’t think that’s the idea of it at all… The Novo Nordisk (NVO) stock price appreciation the past year or two is on expectations of the weight-loss drugs selling more and more. If that expectation holds true, then people are going to get those shots and eat less – and hurt sales at Hershey (HSY). If those expectations don’t play out because people don’t want to take drugs that basically force them to not enjoy overeating, then HSY won’t feel any impact but the stock of NVO will fall back to the pre weight loss story price… why are we invested in NVO?”

[Note: Novo Nordisk was added to The Big Secret on Wall Street portfolio on October 28, 2022, and the shares are up 69% since then.]

I don’t go “into the wild” much anymore.

I have done a lot of traveling in my life. I’ve been to virtually every state in the nation and every country in the Western hemisphere. And I’ve lived, at least for a while, in several foreign countries: Italy, France, Argentina, and Nicaragua.

Now, in my fifties with three children (and I hope more on the way), I’m very content to spend all of my time at home, at my farm in Maryland. I’ve built offices in my tractor barn, so I can simply walk, with my best pal Mr. Scouts, to work.

And, thanks to the miracle of Instacart (CART), I basically never have to leave my farm. But, when I do venture out, I’ve noticed: nobody looks any healthier than they did before.

I suspect those selling weight-loss drugs are going to have a great business. There are many people who obviously need these drugs. For most of my lifetime, people have steadily become more obese, all around the world. That’s not a conspiracy. That’s because all around the world people have become much wealthier, gaining access to richer diets, and having to do much less manual labor.

I suspect these trends will continue for a long, long time. And, while there’s certainly a subset of people who desire better health (and a healthier appearance), my bet is, much like gym memberships, demand for “fat shots” will ebb and flow with seasonality.

That doesn’t, in my view, mean that Novo Nordisk (NVO) is a bad investment. Its singular focus on diabetes and its unique ownership structure mean it’s a good bet – because, all around the world, the risks of obesity increase with rising wealth.

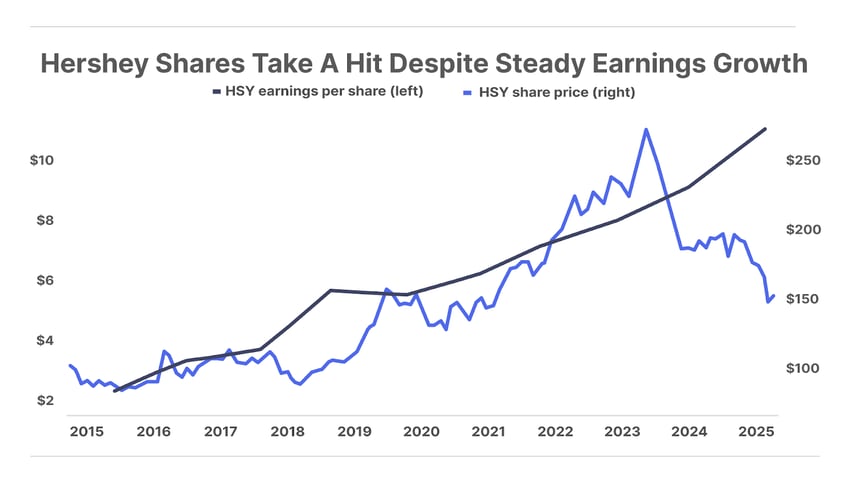

Many investors have been concerned that Hershey’s business would suffer as demand for the “fat shot” grew and people stopped eating as much candy.

I’ve thought those fears were vastly overblown. “Fat people gonna be fat” was my carefully considered analysis, based on years of experience and long walks through various airports over the last few weeks.

Hershey has been my “horse” since I first recommended it in 2007.

I’ve long cited Hershey as one of the world’s greatest businesses. And I’ve told investors it will be hard to beat the total return on an investment in Hershey over time, because of steady and unrelenting growth in sales and profits.

Today, Hershey has a dividend yield of almost 4% and is trading at less than 17x earnings for the first time in more than a decade. I think a long-term investment in Hershey today will certainly beat the market over the next decade and beyond. But… what about the fat shot?

Well, just as in the airports and the shopping malls, there’s no sign of the fat shot reducing Hershey’s earnings. Fat people apparently still like to eat a lot of candy.

Hershey’s core confectionery business saw Q4 sales growth of 6%, reaching $2.4 billion, and operating profit growth of 11.5% to $808 million.

Milton Hershey sold his first chocolate bar for five cents in 1900. Today, 125 years later, Hershey is still growing earnings at double digits, year after year. What a business!

Hershey has also built a new “salty snacks” business over the last decade.

This new business segment saw Q4 sales growth of 35% (!) to $279 million, with profits up 424% to $54.5 million. This portion of the business is finally reaching scale, and should continue to add to income materially next year.

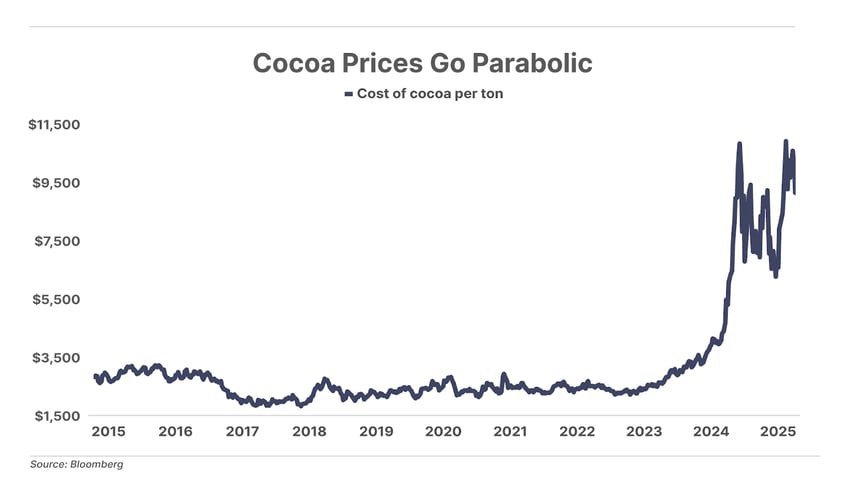

The other knock on Hershey has been that soaring cocoa prices would hurt margins and profits. Benchmark cocoa futures prices were up more than 300% this year, from less than $3,000 a ton to almost $12,000 a ton.

One thing I always like to ask people when they ask me about trading commodity futures is, “Well, do you think you know more about the likely future price of cocoa than Hershey?”

Much like guessing whether fat people will continue eating too much, I don’t think that’s a difficult question to answer.

Not surprisingly, Hershey’s management was prepared and heavily hedged their commodity costs. These hedges were cashed in late last year. As a result, net income in the fourth quarter rose more than 130% for the year, to almost $4 per share.

For the full year, profits were up 20% and reached almost $11 per share.

Unlike tech companies (see below), Hershey doesn’t expect any extraordinary capital expenses in the future, with capex running at roughly the same level it has for two decades, at under $500 million annually.

The company is guiding the market to expect a big drop in profitability next year, saying earnings could fall by 40% because of higher cocoa prices.

Don’t believe it. In the fine print, the management says:

“Projected earnings per share-diluted does not include the impact of mark-to-market gains and losses on our commodity derivative contracts that are reflected within corporate unallocated expense in segment results until the related inventory is sold since we are not able to forecast the impact of the market changes.”

Over the last decade, Hershey’s dividends have grown from $2.06 to $5.48, a jump of 166%. Some shorts were calling for Hershey to cut its dividend in the face of commodity cost increases and the fat shot. That won’t happen. As it virtually always does, Hershey will raise its dividend next year by more than 10%.

And, while I don’t expect it, if the shares were to fall lower than about 15x earnings, I’m certain you’d see management launch a major buyback. Long-term debt hasn’t grown for seven years and has fallen from 1.8x operating earnings to only 1.0x operating earnings, so there’s a lot more leverage Hershey could safely add to its balance sheet.

You can find companies that will grow more than Hershey over the next decade. And you can probably find businesses that are, like Hershey, very safe and very stable. But it’s difficult to find a company that offers this much growth and this much stability.

For people who are content to make 12% to 15% per year, with very little volatility, I continue to believe that Hershey remains one of the best investments in the market.

Porter & Co.

Stevenson, MD

Get Porter in your inbox… Every Monday, Wednesday, and Friday, Porter Stansberry will deliver his Porter & Co. Daily Journal directly to your inbox. He puts his 25+ years of investment knowledge into a punchy, fresh, and insightful issue… that is free to get, no strings attached. Everything is uncensored, and nothing is off limits. To get the Daily Journal, free, click here.