Submitted by Jesse Colombo of The Bubble Bubble Report

A report from the Russian news agency Interfax last week reveals Russia's plans to substantially increase its precious metals reserves in the coming years. The report states that Russia's State Fund plans to acquire gold, silver, platinum, palladium, and gemstones. Russia's decision to add silver to its reserves distinguishes it from most other central banks, which have largely focused on accumulating gold while overlooking silver. Along with several other bullish factors, Russia's silver purchases could be a key driver in pushing prices to $50 and beyond.

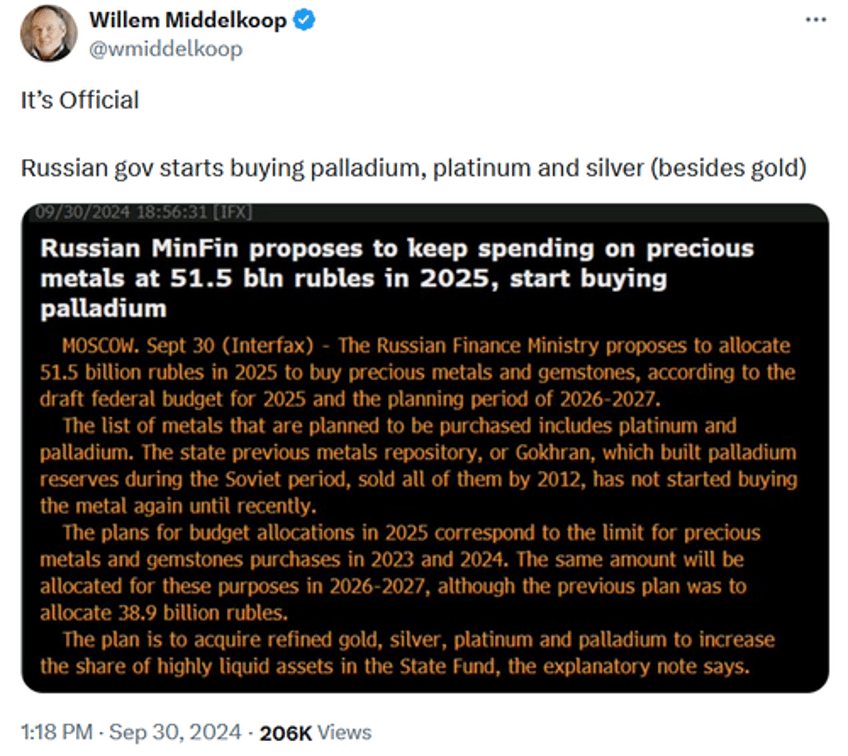

Bloomberg's translation of the original Interfax report reveals that Russia's State Fund plans to allocate 51.5 billion rubles (or $538.7 million) to precious metals and gemstones in 2025, with the same amount set for 2026 and 2027:

In recent years, central banks worldwide have rapidly diversified their reserves, with gold being the primary beneficiary. In 2023, central banks added 1,037 tons of gold, just shy of the record-breaking 1,082 tons purchased in 2022. Central banks added a net 483 tons of gold in the first half of 2024, a 5% increase over the previous record of 460 tons set during the same period in 2023.

Amid surging global debt and a rapidly expanding money supply, central banks are wisely diversifying their reserves into hard assets like gold and, now, silver. As fiat currencies rapidly lose value and government bonds become increasingly risky, these assets offer a safer alternative. It's entirely logical for Russia to further diversify its reserves with an assortment of precious metals, especially in light of the economic sanctions that have cut the country off from the SWIFT banking system.

While the Interfax report did not specify how much silver Russia's State Fund plans to acquire, this move is noteworthy as Russia becomes one of the first countries to diversify its reserves into silver. With gold prices continuing to surge, other nations may also consider adding silver to their reserves—a trend that, alongside numerous bullish factors, could drive silver to $50 an ounce and potentially much higher.

The latest news from Russia reinforces the technical chart patterns I’ve been tracking, which suggest that silver could reach $50 and beyond in the near future. In a recent article, I highlighted how silver’s monthly chart reveals a breakout from a massive, two-decade-long triangle pattern. This breakout signals that silver is on the verge of a powerful bull market:

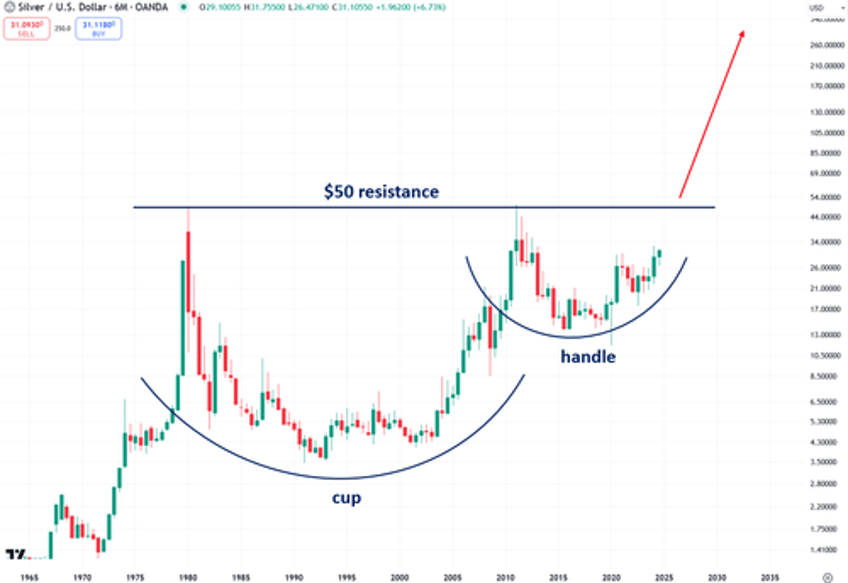

If that isn’t exciting enough, silver’s logarithmic chart, dating back to the 1960s, reveals a cup and handle pattern that suggests silver could reach several hundred dollars per ounce during this bull market. However, a close above the $50 resistance is necessary to confirm this scenario.

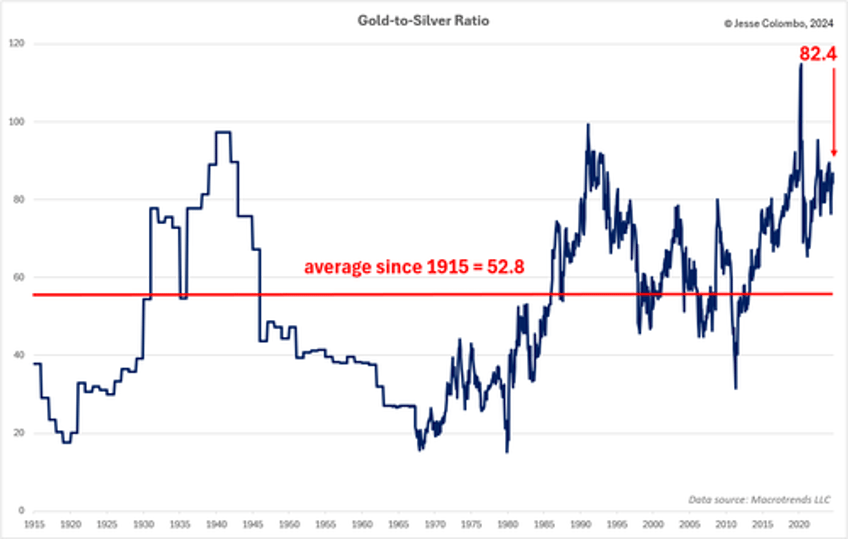

The long-term gold-to-silver ratio chart indicates that silver is currently extremely undervalued relative to gold. If the ratio were to revert to its historical average of 52.8 since 1915, even without any increase in gold’s price, silver would be valued at a solid $50 per ounce.

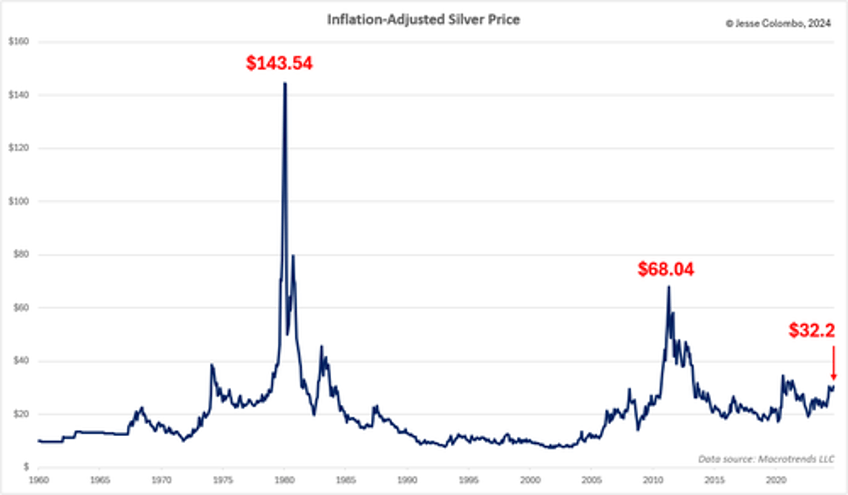

Adjusting silver’s price for inflation further highlights how undervalued it is by historical standards. During the Hunt brothers-induced spike in 1980, silver reached an inflation-adjusted price of $143.54. In the 2011 bull market, driven by quantitative easing, it hit $68.04. Currently trading at just $32.20, silver has significant room to rise if it’s to catch up with these previous inflation-adjusted peaks.

Russia's recent move to add silver to its state reserves signals a potential turning point for the white metal, setting it apart from other central banks that have primarily focused on gold. This decision, along with ongoing bullish trends, should significantly impact silver prices. As global economic uncertainty pushes central banks to diversify into hard assets, silver is poised to benefit, especially with technical charts showing signs of a powerful bull run. With Russia leading the charge and other countries potentially following suit, silver could break through its long-standing resistance levels, reaching $50 and possibly climbing even higher. These developments, coupled with historical trends and inflation-adjusted valuations, suggest that silver is severely undervalued and has substantial upside potential in the coming years.

If you enjoyed this article, please visit Jesse's Substack for more content like this...