On Monday, January 22nd, China was almost melting down, with the CSI 1000 Index plunging nearly 6%.

As a result, China’s government prohibited short selling of stocks that same day.

That is always the failing remedy for interfering with market forces. What is next? Prohibiting all selling of stocks? Don’t laugh, it has happened in the past.

Now there is lots of speculation about different types of rescue packages China could be considering. Heavily shorted China stocks rallied the past two days on that news. However, getting a rescue package assembled in Beijing will take time.

Below we show the monthly chart of the popular ASHR ETF (CSI 300 index), which includes the top 300 Chinese stocks and is therefore commonly traded by the average investor. It has plunged nearly 45% so far in this bear market since December 2021.

Notice on the chart above how the ASHR is currently hovering around strong support. Therefore, this is not the time to sell this market short. Support areas at minimum create rallies.

Below is the weekly chart of Alibaba (BABA), the premier consumer company in China. It had a much more severe plunge, falling a whopping 80% in 2 years (from its October 2020 high to its October 2022 low).

Alibaba is not a favorite firm of the rulers of China. In fact, it went public as a VIE, special type of firm that allows foreign investors with permission of the government. BABA stock sold to Americans was not BABA CHINA, but a Cayman Island firm that is a VIE. Wall Street was careful not to divulge that.

We have read that the China government can rescind that status. What would happen to the stock traded in the US?

RECESSION: We have written all last year that we and the world economies are already in recessions.

The worst big country economy is China, formerly called the “locomotive for the world economies.” China’s economy has a serious problem; their unemployment of younger people is around 25%.

In fact, we have been warning for several years that “China will lead the global markets into the abyss” in our award-winning Wellington Letter.

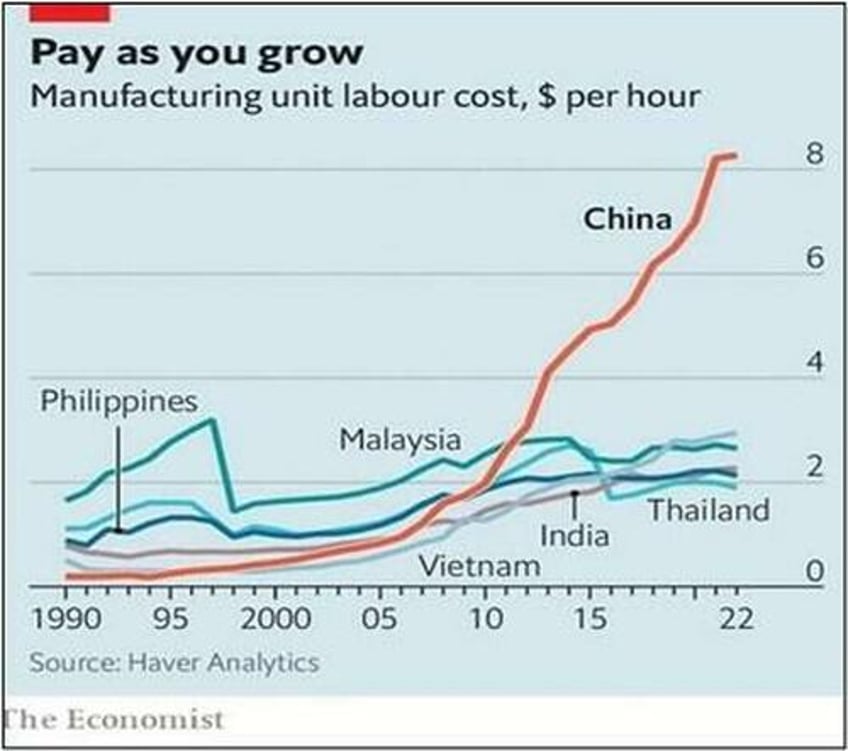

China is now faced with an economy that has not only stalled out but is actually showing negative growth. At the same time, manufacturing labor costs have soared and are now roughly 400% higher than other competing manufacturing countries in South East Asia.

Here is a chart comparing China’s labor costs (red line) to other Asian countries (via The Economist). As you can see, with China’s soaring costs it is no longer competitive.

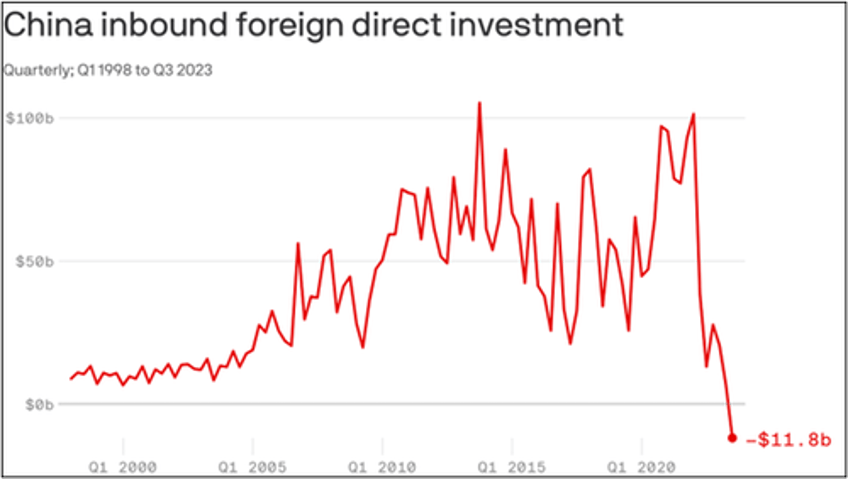

China is already in deflation. Below is the chart of foreign capital inflows/outflows in China (FDI). See the chart below going back to the year 2000 (via axios), which shows the inbound FDI flows to China has plunged significantly recently.

Note on the chart how suddenly in late 2023 over $100 billion of foreign capital flowed out of China. It is a record plunge in inflows. This is a huge problem for China and the world as foreign capital is fleeing out of China as fast as it can.

CONCLUSION: We think the crisis in China may have arrived, but very few seem to have noticed.

Watching financial TV, we have heard very few discussions about China. Amazing! Apparently, Wall Street doesn’t consider China very important.

Or is it that Wall Street now has to quickly change their own portfolios before they send their minions out into the media to warn about China? That will come when they have made their own portfolio changes needed to prepare for a collapse and bear market.

Eventually, over the coming decade, the flight out of China may even be positive for the US as manufacturing comes back to the US. Another beneficiary could be India. The attractive low labor costs in China have mostly vanished.

US firms are tired of having to give away their Intellectual Property (IP) to China and putting up with their coercive policies. It is time to come home to the US once the radical left has been ousted. India is still not ready to be the alternative because of the huge and corrupt bureaucracy. Will it ever change? Probably not.

Perhaps this coming November we’ll see a change in leadership that will put America first. The path the US has been on over the past 3 years cannot be sustained for the republic to survive.

In the near-term, we will have to see how the China crisis affects the US markets and the rest of the world.

Will it prompt China to invade Taiwan in order to distract from their own domestic problems? That is what dictators do.

In our September 4, 2023 Wellington Letter, we warned our members about this possibility:

“When a totalitarian government as in China orders the media not to report on the economy, you know the situation is serious…

The biggest danger: when a powerful dictatorship finds that its policies have driven the economy to the wall, it has to divert attention from the internal misery. How? Start a war!

It is obvious that China will never have a weaker opponent in the US than now…

Therefore, we believe that probability of an invasion of Taiwan has risen significantly.”

Or will the China crisis cause a renewed rush out of stocks and back into cash here in the US, just as we saw one year ago in early 2023?

During the stock market rally over the past 2+ months, the bullish enthusiasm here in the US, by numerous measures, was at or near record highs. That is typically seen when the markets are forming an important top.

We will continue to keep our Wellington Letter members informed as the China crisis, and their government’s response efforts, develop.

Wishing you successful investing

Bert Dohmen

Founder, Dohmen Capital Research

P.S. If you enjoy reading research and insights like this, we encourage you to read our recent “double-issue” (31 pages) award-winning Wellington Letter titled “Rally Tops Are Forming.” Get it today at DohmenCapital.com.

Members gain instant access to our 2024 Market Outlook with our top bullish and bearish sectors investors could have great opportunities in over the coming months.