The Fed is screwing up... again. And investors who don't prepare for what's coming are in for a NASTY surprise in the coming months.

To understand what I mean by this, let me provide some context.

Starting in November of 2023, Fed officials began proclaiming that inflation had been tamed. The argument, at the time, was that inflation data was clearly trending down, while rates were much higher, so the Fed would need to start cutting rates soon to avoid crushing the economy.

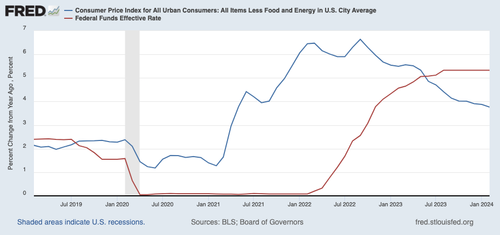

I realize this is difficult to picture, so I've included the below image for you. The Fed Funds Rate is the red line. The official inflation measure, the Consumer Price Index, or CPI for short, is the blue line. As you can see, starting in mid-2023, the red line was much higher than the blue line.

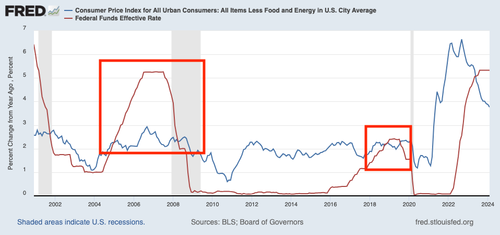

During the last 25 years, any time the Fed Funds Rate has been much higher than inflation for long, something BAD has happened (a recession or crisis). I've illustrated this on the below chart with red rectangles.

This is why the Fed started talking about cutting interest rates in November 2023, despite the fact inflation was still well above 3%, while the Fed's target for inflation was 2%. In the very simplest of terms, the Fed was "betting" that inflation would continue to trend down, therefore giving the Fed the excuse to cut rates.

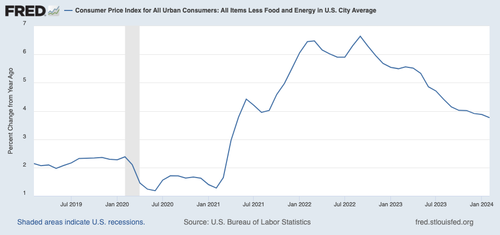

However, since that time, the CPI has stopped declining as rapidly. The trend, while still down, isn't nearly as strong.

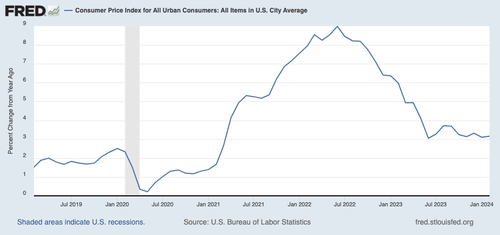

Indeed, the situation looks much uglier when we include food and energy prices to inflation. As I noted in yesterday's article, the ONLY reason inflation appears to have declined as much as it has is because energy prices have collapsed year over year. Once you include energy data in the inflation measure, things look like this:

Put simply, the Fed has screwed up... again. The Fed promised it would cut rates base on an assumption that has proven false. This opens the door to a serious upset for the markets in the coming weeks.

If you've yet to take action to profit a resurgence in inflation, we just published a Special Investment Report outlining the clear signals that inflation is back as well as THREE unique investments that could profit beautifully as inflation takes hold of the financial system later in 2024.

To pick up your copy, go to:

https://phoenixcapitalmarketing.com/inflationstorm.html

Best Regards,

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research