Some economists warn that central banks, including the Federal Reserve, have pushed their interest rate hiking cycle too far. Meanwhile, Chinese investors are wary of the growth prospects for the world's second-largest economy. The troubling trends in the world's two biggest economies have sparked concerns that the global economic landing might be far more turbulent than initially anticipated.

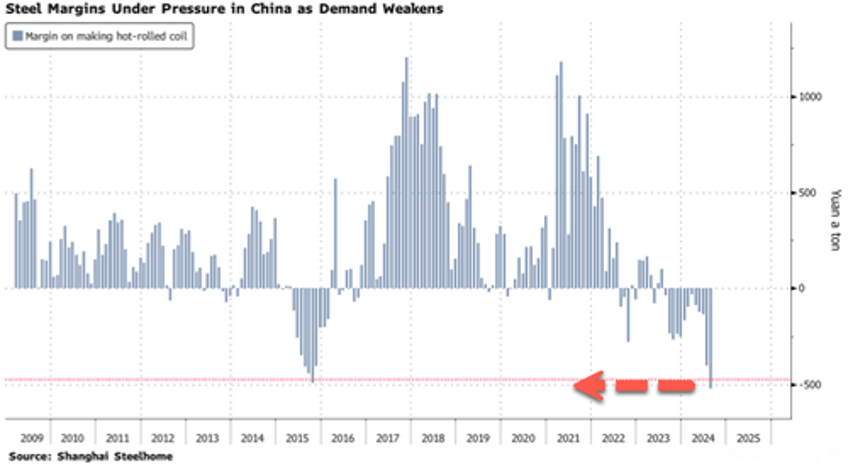

For instance, this morning, the world's biggest steel producer in China, China Baowu Steel Group, warned that the steel industry is plunging into a prolonged "harsh winter."

This downturn will be "longer, colder, and more difficult to endure than expected," Baowu Steel Chairman Hu Wangming said at the company's most recent half-year earnings result meeting.

"Financial departments at all levels should pay more attention to the security of the company's funding," Wangming said. He noted a need to strengthen controls over overdue payments and detect fake trades.

He said, "In the process of crossing the long and harsh winter, cash is more important than profit."

Hou Angui, general manager and deputy party secretary at Baowu Steel warned at the meeting, "The current situation in the steel industry is more severe than the downturns of 2008 and 2015."

For commodities, including steel and copper, the dire warning from Baowu Steel comes as the property market downturn in China continues to worsen. Factory activity in the world's second-largest economy remains under pressure, and investors are extremely cautious about China's growth outlook.

Goldman's Lisheng Wang recently met with onshore clients in Beijing and Shanghai. These clients include mutual funds, private equity funds, and asset managers in banks/insurance companies.

Wang said, "Compared with two months ago, local investors viewed signals from the Third Plenum and July Politburo meeting as neutral, remained cautious on China's growth outlook and policy implementation, and showed increased concerns on the US recession risk, election uncertainty, and potential impact on China."

In markets, Goldman's James Busby said iron ore prices moved lower in Singapore, down nearly 3% with "Macro fund selling." He noted to clients about Baowu Steel's warning and pointed out that iron ore prices slid to May 2023 lows.

BMO analyst Colin Hamilton said, "The entire Chinese steel industry is positioning for a consolidation."

As Chinese iron ore inventories swell, steel mills face mounting supply pressures, likely forcing them to cut production. Additionally, these mills are exporting deflation, with steel exports expected to exceed 100 million tons this year—the highest level since 2016.

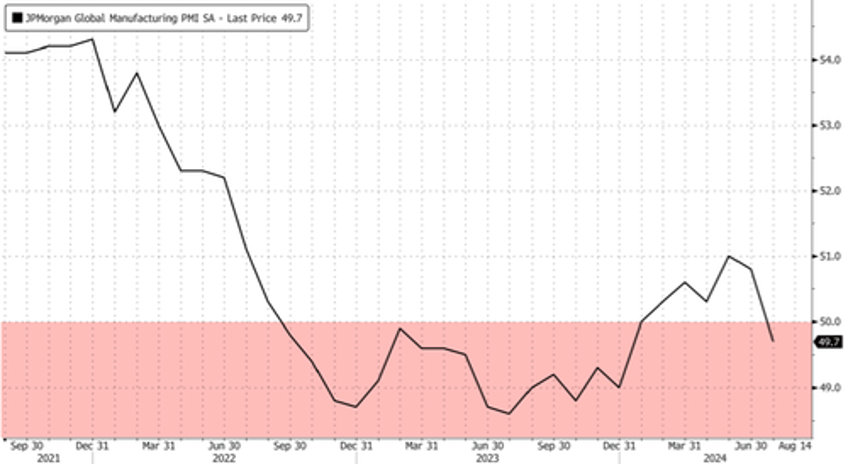

Talk of global economic slowdowns is heating up worldwide, with the JPM Global Manufacturing PMI sliding into a contraction (<50) earlier this summer.

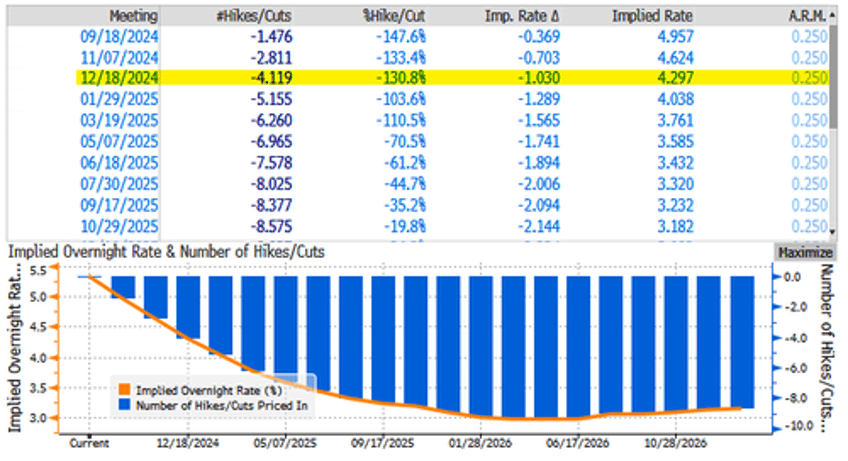

Meanwhile, US interest rate traders are pricing in four 25bps cuts by the end of the year.

All of this points to the economic storm clouds quickly gathering pace.