Crude prices are extending recent gains this morning - albeit modestly - as geopolitical risk premia are rebuilding amid missiles flying in Russia, MidEast tensions continuing, and Biden seems set on WW3 as his legacy.

Last night's API report showed a larger than expected crude inventory build and traders are on the lookout for whether a contango market structure is here to stay after the WTI prompt spread dipped into negative territory this week for the first time since February, signaling near-term oversupply.

API

Crude +4.75mm

Cushing -288k

Gasoline -2.48mm

Distillates -688k

DOE

Crude +545k (-620k exp)

Cushing -140k

Gasoline +2.05mm

Distillates -114k

The official DOE data was very different from the API reported data with a small crude build and large gasoline build. This is the third straight weekly crude build and the biggest gasoline build since early September...

Source: Bloomberg

The Biden admin added 1.4mm barrels to the SPR last week - the biggest addition since August - making its the fifth straight week of total crude stocks rising...

Source: Bloomberg

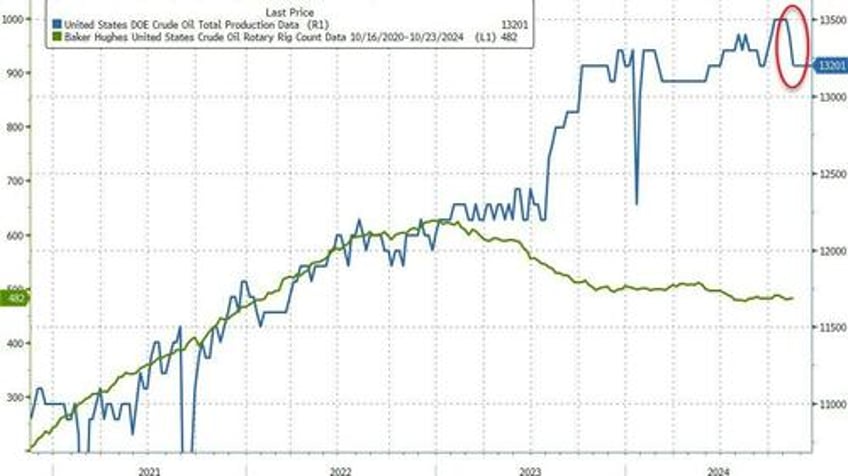

US Crude production plunged by 200k b/d and does not look hurricane-related...

Source: Bloomberg

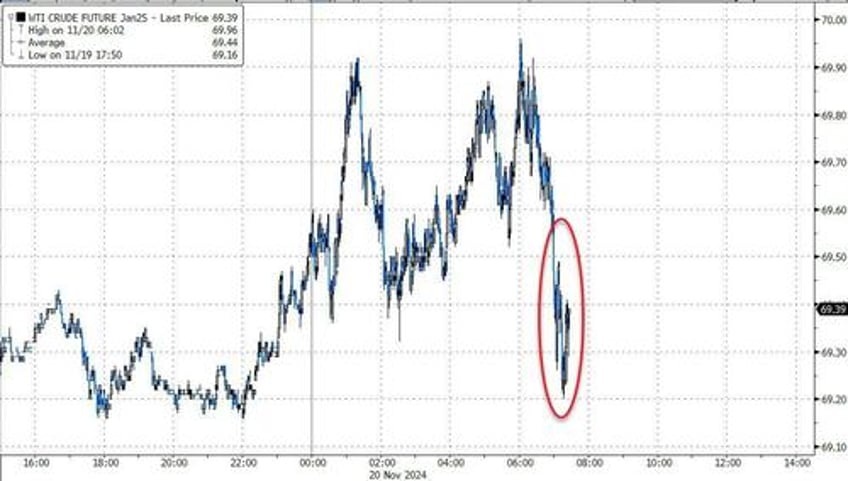

WTI dipped after the data...

Source: Bloomberg

Oil investors are pricing in Trump’s foreign policy approach as bearish. Of 10 traders surveyed by Bloomberg, eight said that Trump’s proposals will limit price increases, with some suggesting a trade war with China will erode demand and potentially offset any new sanctions on Iran.