Oil prices are extending gains to new cycle highs (WTI $86) ahead of the official inventory data (after API reported across the board draws).

The move followed reports that OPEC+ chose to stick with oil supply cuts for the first half of the year, keeping global markets tight and potentially sending prices higher.

API

Crude -2.29mm

Cushing -751k

Gasoline -1.46mm

Distillates -2.55mm

DOE

Crude +3.21mm

Cushing -377k

Gasoline -4.26mm

Distillates -1.27mm

The official data surprised with a crude inventory build (API draw) but product draws continued...

Source: Bloomberg

The Biden administration added 591k barrels to the SPR last week, but that might be it for a while as the Biden admin has now canceled new purchases (for taxpayers' own good)...

Source: Bloomberg

US crude production remained just off record highs...

Source: Bloomberg

WTI was trading at cycle high above $86 ahead of the official data and slide back below on the surprise build...

The market’s strength has also been reflected throughout the oil market curve.

“An escalation in tension in the Middle East has coincided with firmer oil fundamentals,” said Warren Patterson, head of commodities strategy for ING Groep NV.

“The market is tightening thanks to OPEC+ supply cuts, which is evident with the strength we have seen in timespreads.”

The US benchmark’s prompt spread has widened near $1 in backwardation, compared with as low as 54 cents three sessions ago. Meanwhile, the oil options market has flipped to a call skew, underscoring the magnitude of bullish sentiment for crude.

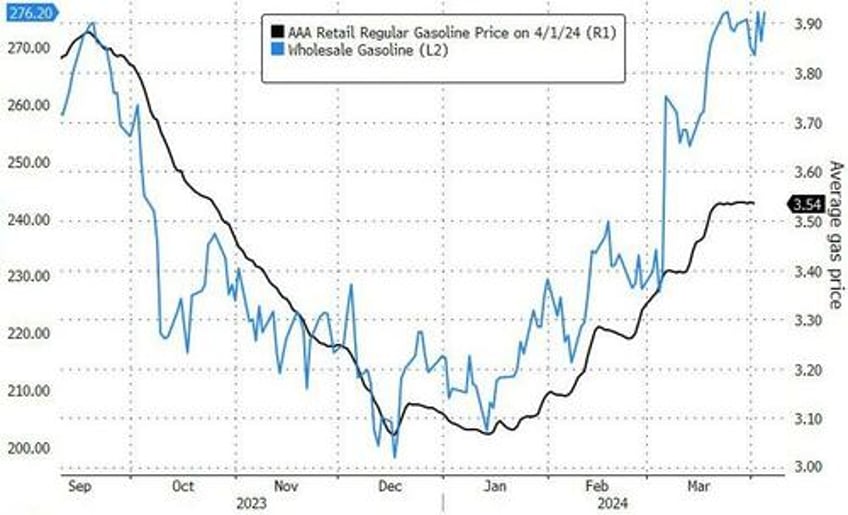

Meanwhile, pump prices remain near six-month highs as wholesale prices put increasing pressure to the upside...

Not good for Powell's or Biden's hopes.