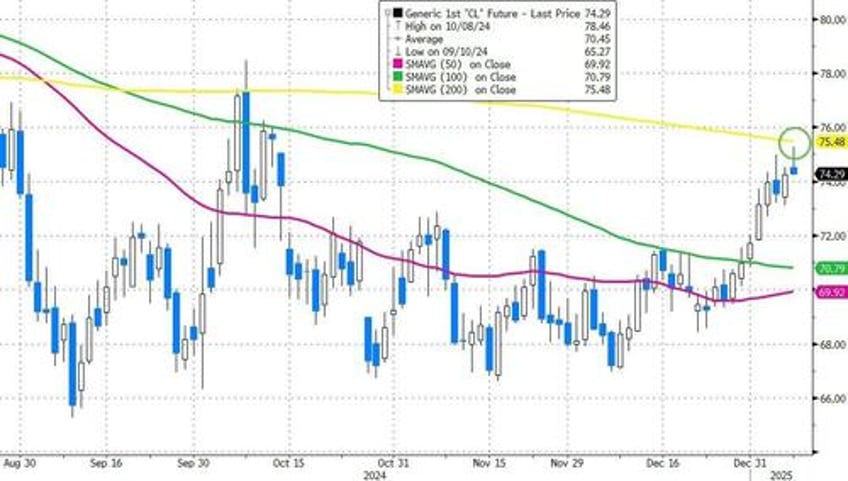

Oil prices are lower this morning after running up to test the 200DMA overnight (following API's report of a big crude draw). That would be a seventh straight drawdown and the longest streak of declines in three years if confirmed by government data.

Traders are also bracing for frigid weather in the US, which has boosted demand for heating fuel and raised the risk of freeze-offs in production areas.

“Cold fronts in the US and Europe are driving crude higher, with some support from concerns over the loss of Iranian barrels if the Trump administration tightens sanctions,” said Vandana Hari, founder of Vanda Insights in Singapore.

“Nonetheless, crude looks overbought. It may yield to profit-taking, though that might need a reminder of the global economic headwinds.”

In another sign of tightening supply, Russian data show that the country’s oil production was below its OPEC+ output target last month, after seaborne exports slumped to the lowest level since August 2023. Meanwhile, ports in the eastern Chinese province of Shandong, the top destination for Iranian crude, were urged to prevent US-sanctioned tankers from docking at their berths.

So will the official data confirm API's report?

API

Crude -4.02mm

Cushing -3.1mm

Gasoline +7.3mm

Distillates +3.2mm

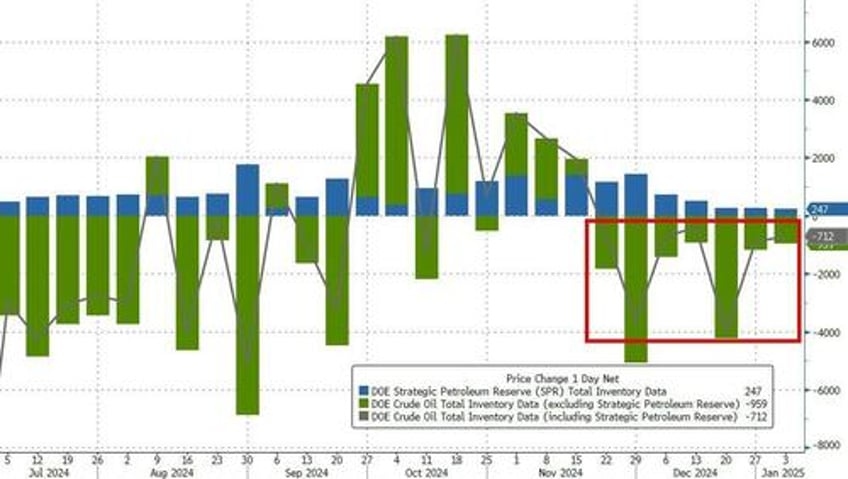

DOE

Crude -959k (-342k exp)

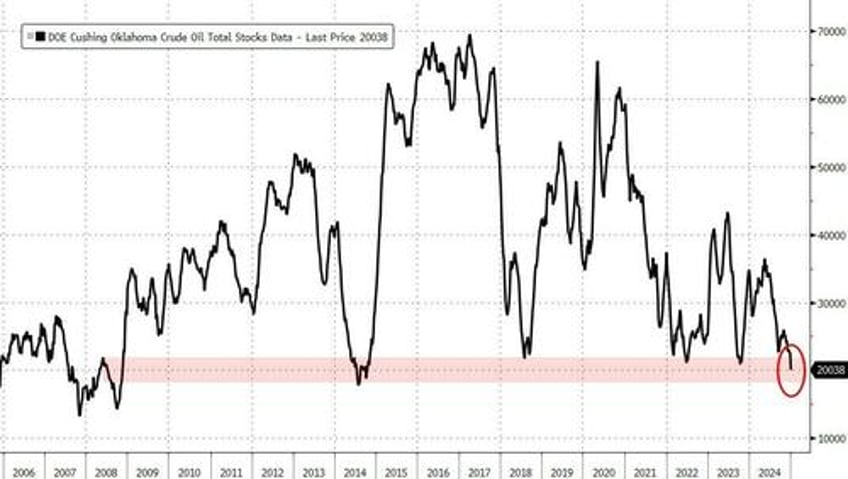

Cushing -2.50mm - biggest draw since Aug 2023

Gasoline +6.33mm

Distillates +6.07mm

Some shocking official prints with Crude seeing its 7th weekly draw in a row (longest streak in three years), stocks at the Cushing hub crashing by the most since Aug 2023, and products seeing huge builds.

Source: Bloomberg

Even with a small 247k barrel addition SPR, total crude stocks drewdown for the 7th week in a row...

Source: Bloomberg

Stocks are sufficient to meet 24.8 days of demand, which is the lowest since 2017 on a seasonal basis, testing 'tank bottoms' once again...

Source: Bloomberg

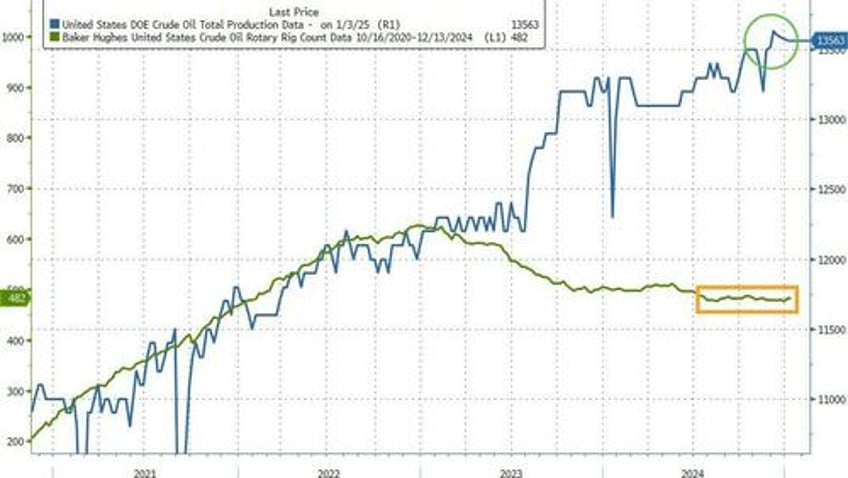

US Crude production remains near record highs as the rig count stabilizes...

Source: Bloomberg

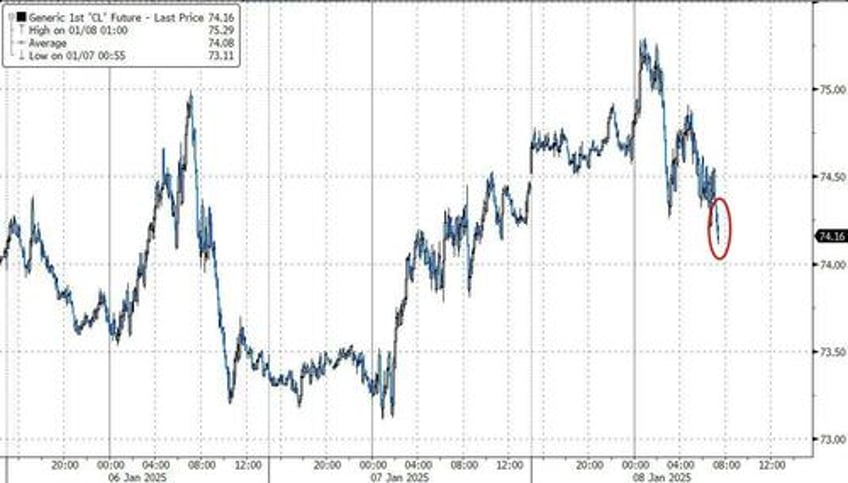

WTI was trading around $74.25 ahead of the official print and dipped towards $74 after the smaller Crude draw than API reported

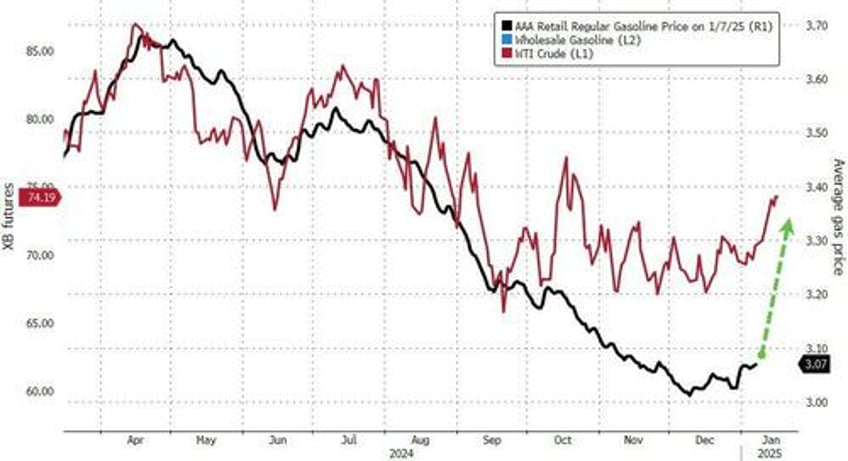

Oil has had a strong start to 2025 as prices break out of a monthslong range, but many analysts continue to warn of a glut this year, and technical indicators suggest the advance may have run too far.

“The backdrop for the crude oil price rally into the new year clearly seems to come from crude oil fundamentals,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

The market is also bracing for Donald Trump’s second presidential term, with threats of tougher sanctions on Iran and trade tariffs on China.

Finally, pump prices are due to surge any day now...

...just in time for Trump's inauguration.