Oil extended its rally to a 10-month high as production cuts by leaders of the OPEC+ cartel strain global supplies, a setup that’s projected to create the tightest crude market in a decade in the months ahead.

“The upward momentum is exhausted for now,” said Vandana Hari, founder of Vanda Insights in Singapore.

“Crude needs fresh cues to pick a direction. We may see a holding pattern of around $90 for Brent.”

API

Crude +1.174mm (-1.9mm exp)

Cushing -2.417mm

Gasoline +4.21mm (-300k exp)

Distillates +2.59mm (+400k exp)

After four straight weekly draws, API reports an unexpected 1.1mm barrel build in crude stocks last week. Another big drop in Cushing hub stockpiles but products saw much bigger than expected builds...

Source: Bloomberg

WTI was hovering just below $89 ahead of the print and faded after...

As prominent forecasters such as JPMorgan and RBC say their core outlook doesn’t assume prices will reach $100 a barrel.

All of which is a major problem for Biden...

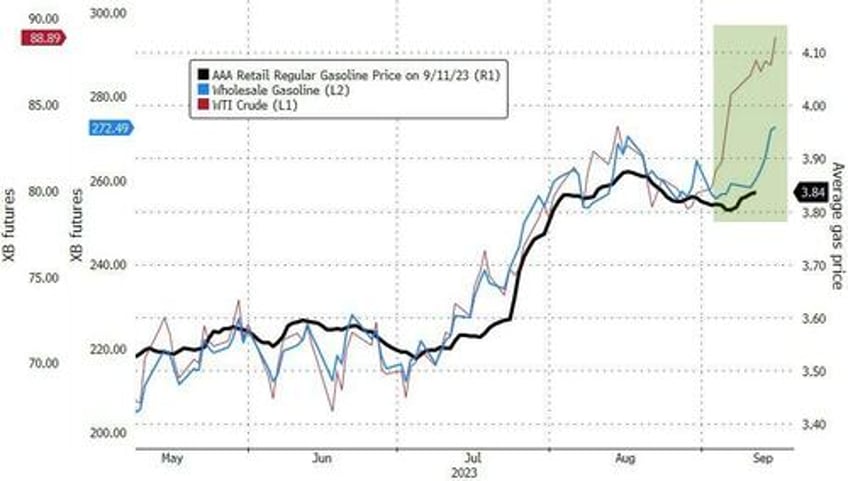

As higher gas prices loom for Americans and inflation expectations are resurgent.