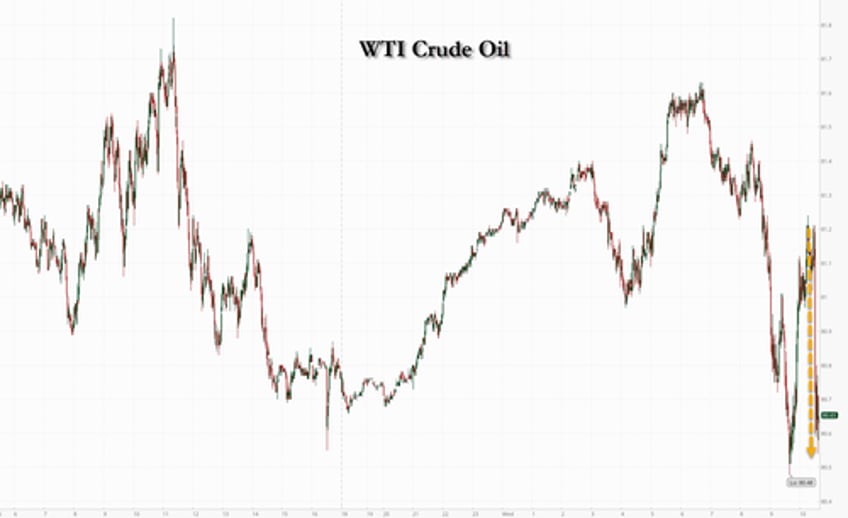

Crude prices have roller-coastered over the last 12 hours or so as last night's API (large gasoline build) sparked selling, then buying waves hit during the late-Asia/early-Europe session, then selling returned with a vengance during the early US session as Kanda's comments sparked dollar strength and sent commodities lower.

The dismal home sales print sparked dollar weakness and sent oil prices back up into the green ahead of the official inventory data.

API

Crude +914k (-200k exp)

Cushing -350k

Gasoline +3.84mm (-900k exp) - biggest build since Jan 2024

Distillates -1.18mm

DOE

Crude +3.59mm (-200k exp, whis +800k)

Cushing -226k

Gasoline +2.65mm - biggest build since Jan 2024

Distillates -377k

Confirming API's report, the official data shows a considerable crude inventory build and the largest rise in gasoline stocks since January...

Source: Bloomberg

The Biden admin added a shockingly large 1.285mm barrels to the SPR last week - the largest since June 2020. Overall this was the biggest weekly increase in stocks in two months...

Source: Bloomberg

US implied crude demand plunged last week...

Source: Bloomberg

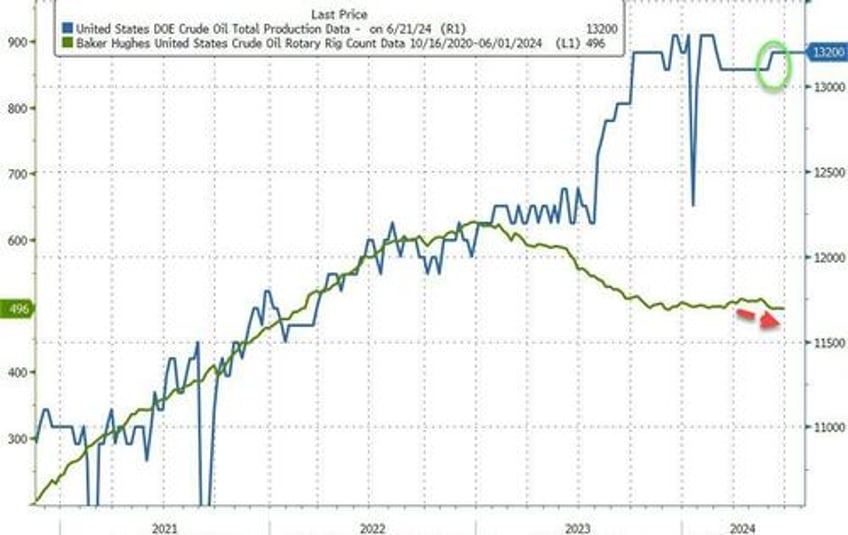

US Crude production was unchanged just shy of record highs as rig counts slipped south...

Source: Bloomberg

WTI was trading just in the green ahead of the official data, around $81.20; and dropped back towards the $80 level on the print...

Finally, despite this build and data-driven news of demand declines, as we noted last night, there are signs of strong summer demand in the Northern Hemisphere (after earlier jitters over a shaky start to the U.S. summer driving season, which runs from Memorial Day to Labor Day).

Galimberti said expectations for a summer surge in fuel demand have been aided by strong growth in aviation. Jet fuel is expected to see an increase in demand of 550,000 barrels a day, according to Rystad, after a 1.2 million barrel-a-day jump last year.

"For the time being, this strength in aviation activity signals a positive trend for oil demand, particularly in the context of summer travel, economic recovery and consumer optimism," he wrote.

Analysts at JPMorgan Chase & Co. on Tuesday maintained a forecast that Brent would average $84 a barrel in the third quarter and hit $90 by August or September, “underpinned by our expectations that global demand will outpace supply in the summer quarter.”

Meanwhile, analysts at Macquarie revised their Brent third-quarter forecast up to $86 per barrel, from $83, on projections of rising demand.