Oil prices extended recent gains today, despite chaos across other asset classes, on concerns supply could be disrupted as Iran tested a ballistic missile in the Gulf of Oman, while demand hopes were led by OPEC raising its economic forecasts.

Oil was also supported by a major technical break.

“A rare day to see crude decouple from equities” said Rebecca Babin, a senior energy trader at CIBC Private Wealth.

“Positioning, which has become increasingly important for the direction in crude, was pared down last week,” and “builds in inventories are expected this week and may temper upside.”

The question is, can oil maintain this through the inventory data.

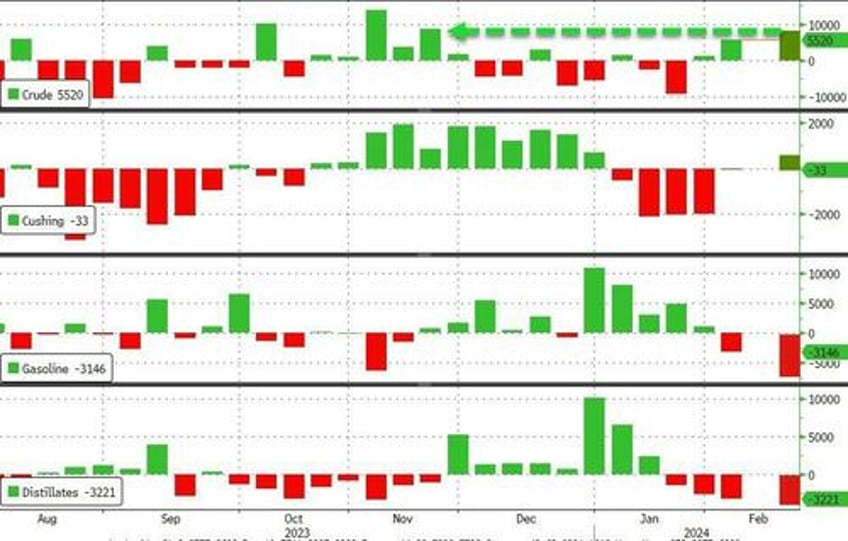

API

Crude +8.5mm (+2.8mm exp)

Cushing +512k

Gasoline -7.2mm (-1.0mm exp) - biggest draw since Sept 2021

Distillates -4.0mm (-2.2mm exp) - biggest draw since May 2023

According to API, crude stocks built by a bigger than expected 8.5mm barrels last week, but that was offset buy a major draw in products...

Source: Bloomberg

WTI was hovering around $77.80 ahead of the print and extended gains after...

WTI was helped technically by a break above its 100DMA and 200DMA...

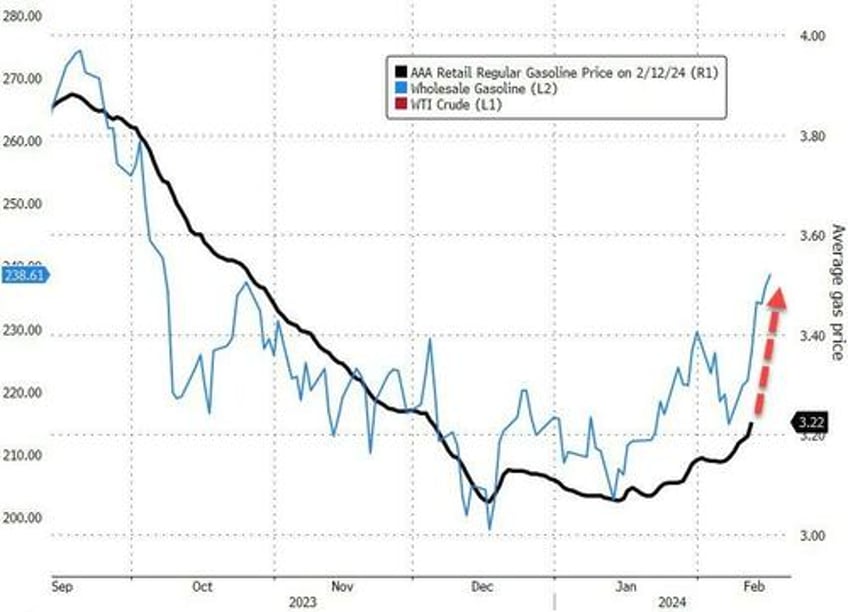

All of which means Messers Biden and Powell have a problem...

Source: Bloomberg

As rising crude and surging wholesale gasoline prices mean pump prices are due for a big jump.