Oil prices continue to extend their gains as "price-supportive rhetoric" from OPEC and its allies forced algorithmic traders to switch from short to long as oil prices have tracked financial assets higher in recent weeks.

“Today we are waiting for the inventory data,” said Arne Lohmann Rasmussen, head of research at A/S Global Risk Management.

“After the API data, the market is prepared for a build, so I guess there is room for a positive surprise here.”

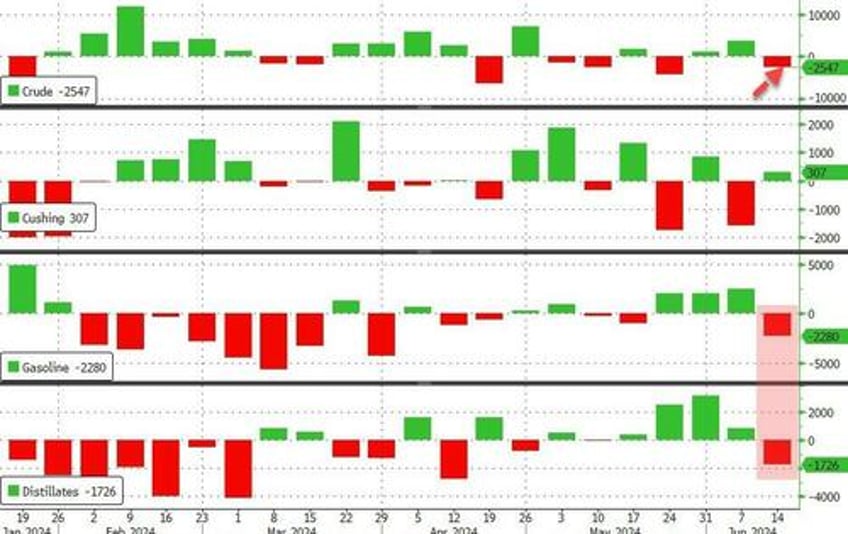

API

Crude +2.26mm

Cushing +524k

Gasoline -1.08mm

Distillates +538k

DOE

Crude -2.55mm

Cushing +307k

Gasoline -2.28mm

Distillates -1.73mm

Against the API report's build, the official data showed a decent crude inventory draw of 2.26mm barrels and products also saw notable draws. Gasoline stocks fell by the most since March...

Source: Bloomberg

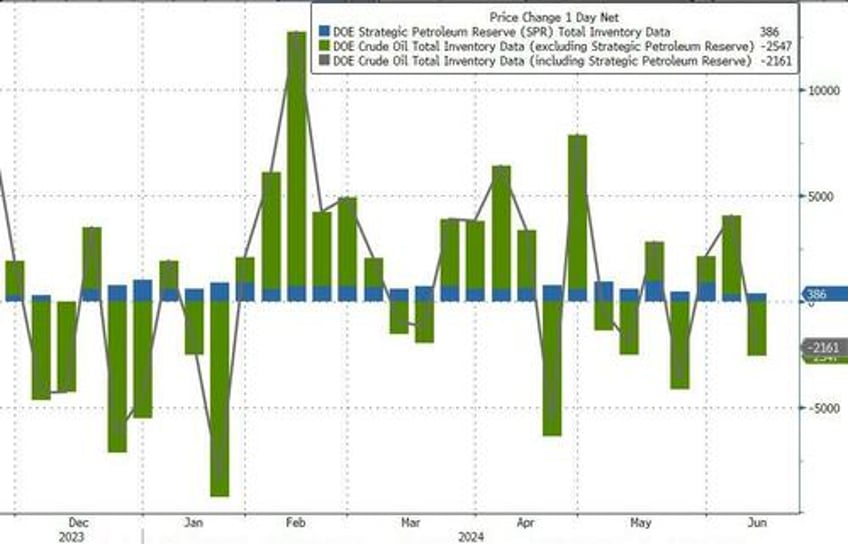

The Biden admin continued to add (only marginally) to the SPR...

Source: Bloomberg

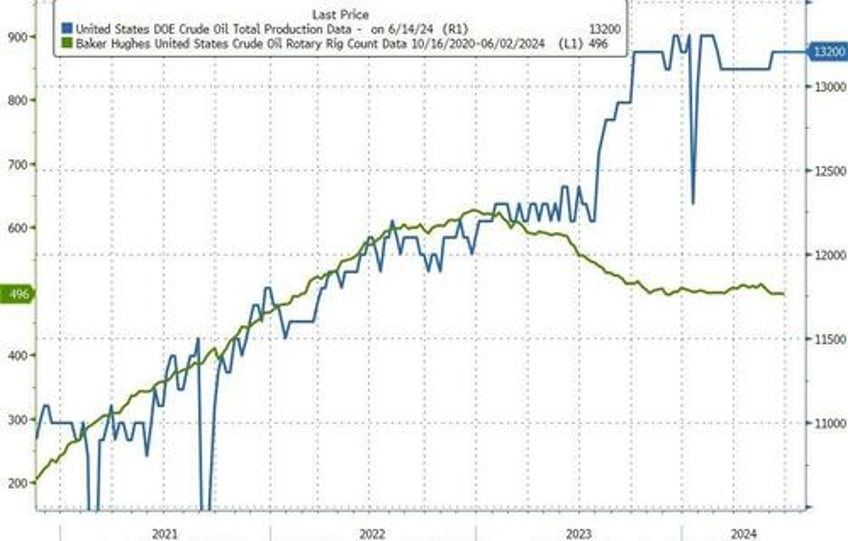

Crude production was flat near record highs as the rig count trends lower...

Source: Bloomberg

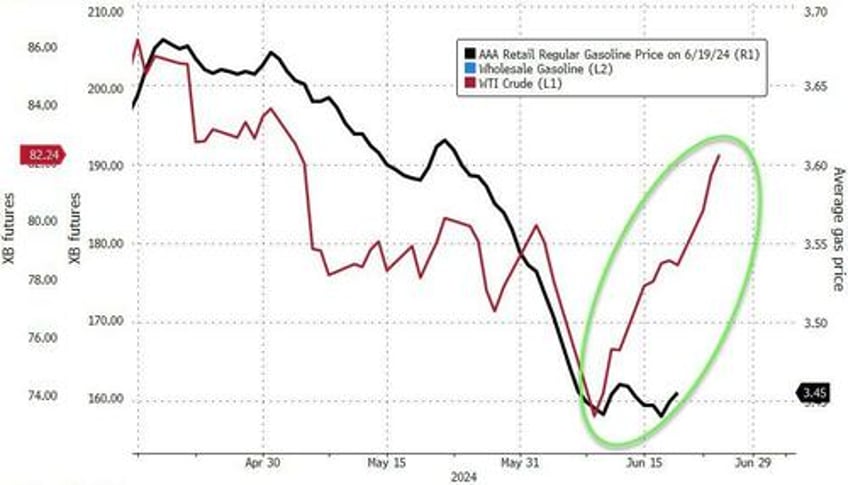

WTI prices are pushing new cycle highs on the back of this surprise draw...

Geopolitics "returned as a meaningful influence on the markets in recent weeks, as there has been a resurgence in ship attacks in the Red Sea related to the ongoing Israel-Hamas/Hezbollah conflict," Richey said. Ukrainian drone attacks on Russian oil and energy infrastructure resumed this week, with a strike at a refined-product terminal in Azov resulting in an explosion and sizeable fire at the facility, he said.

Sentiment in the oil market, however, is "fragile," Richey said. "If we see any headlines that contradict any of those factors that have supported the latest rally, or even just an uptick in broad market volatility into the end of the quarter, we could see oil markets correct back towards the mid $70 a barrel range."

Finally, we note that the disinflation that has buoyed hopes for The Fed's first rate-cut, and helped Biden out, may be about to abruptly stall...

Source: Bloomberg

Of course, we are sure mom-and-pop gas station owners will be blamed though if prices do rise again!