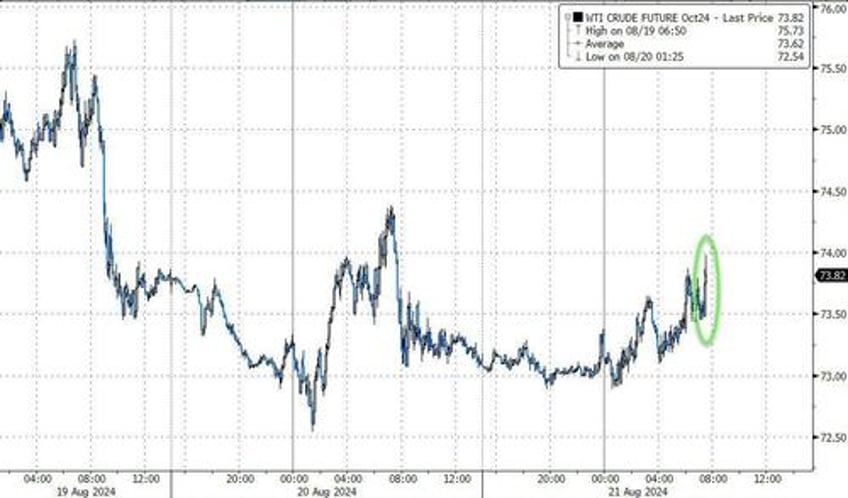

Oil edged higher following a short run of declines as traders readied for weekly stockpile data in the US and Washington continues to push for a cease-fire between Israel and Hamas.

US Secretary of State Antony Blinken left the Middle East late Tuesday without a cease-fire agreement, but reiterated that Israel had agreed to a “bridging” deal to create space for the two sides to hammer out details.

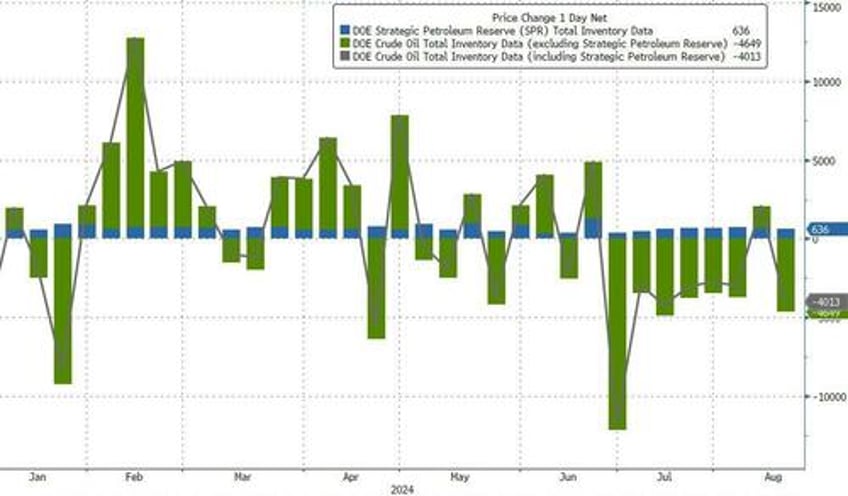

API

Crude +347k (-2.9mm exp)

Cushing -648k

Gasoline -1.04mm

Distillates -2.24mm

DOE

Crude (-2.9mm exp)

Cushing -648k

Gasoline -1.04mm

Distillates -2.24mm

Refuting API's reported small crude build, the official data showed across the board inventory drawdowns last week with crude stockpiles down for the 7th week in the last 8 and distillates stocks falling by the most since March...

Source: Bloomberg

The Biden admin continues to add (marginally) to the SPR (+636k barrels last week)...

Source: Bloomberg

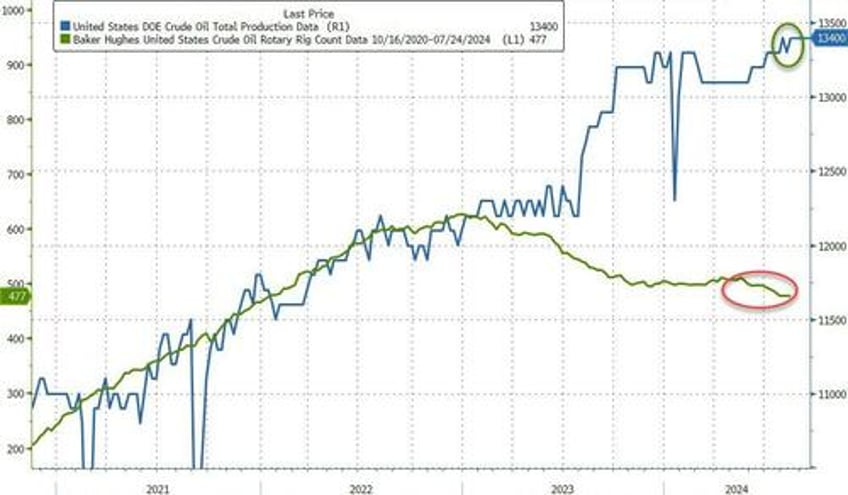

US crude production increased back to record highs (as rig counts continued to slide)...

Source: Bloomberg

Total US Crude inventories fell to their lowest since February...

Source: Bloomberg

WTI extended its (modest) gains after the official data...

Source: Bloomberg

Crude has given up most of its gains this year as China’s lackluster economy overshadowed OPEC+ supply cutbacks.

Investors are also watching US economic data and await Powell's speech on Friday at Jackson Hole hoping that lower inflation could lead the the Fed to cut rates — a boon to wider energy demand.