After a strong run in the last week, oil prices are lower this morning following API's report last night indicated a large increase in US crude stockpiles adding to pressure as the market continued to watch for more trade salvos from President Trump.

Also contributing to the decline was US consumer price data that came in hotter than expected, causing a surge in the dollar surged that makes commodities priced in the currency less appealing.

“The oil market is trading with marginal declines this morning as the API numbers released overnight were largely bearish,” ING analysts including Ewa Manthey said in a note.

Will the official data confirm API's?

API

Crude +9mm

Cushing +400k

Gasoline -2.5mm

Distillates -600k

DOE

Crude +4.07mm (+4.5mm exp)

Cushing +872k

Gasoline -3.035mm

Distillates +135k

The official crude inventory data showed a sizable build but less than expected and less than half that reported by API (which appears to have played catch up from the prior week). Gasoline stocks tumbled for the first time in 13 weeks...

Source: Bloomberg

Including the 249k barrel addition to SPR, total crude inventories rose for the 3rd week in a row...

Source: Bloomberg

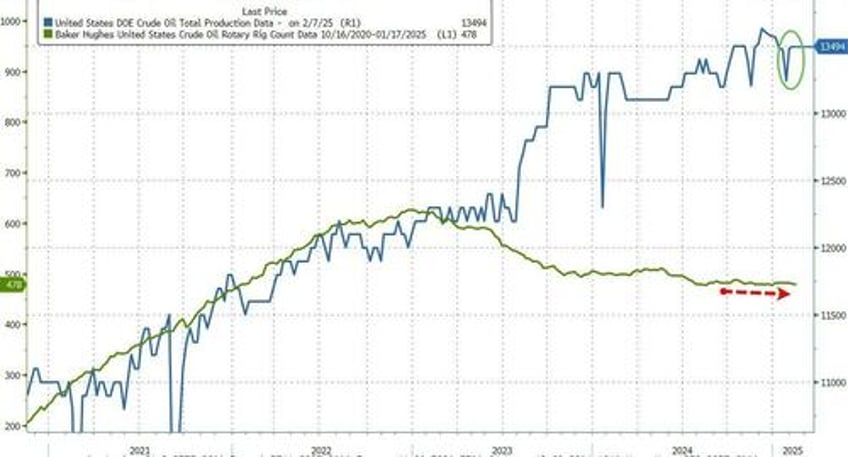

US Crude production rose modestly last week, back up near record highs...

Source: Bloomberg

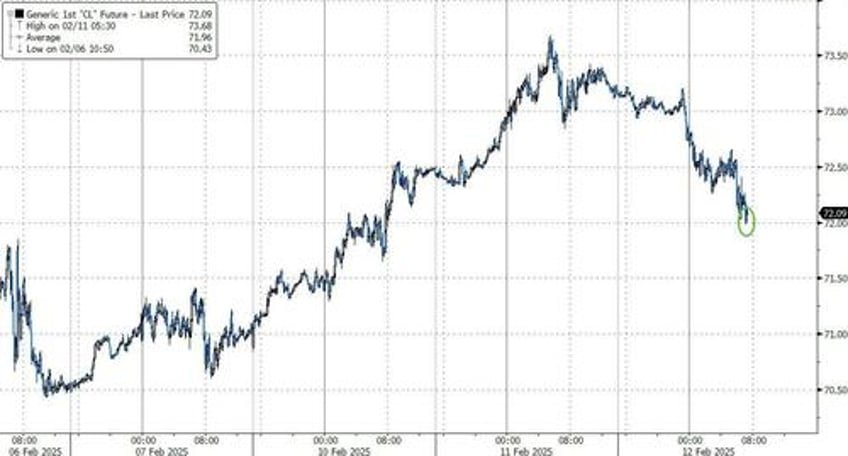

WTI was trading around $72.00 ahead of the official print and is holding it for now...

Source: Bloomberg

The start of the year has been bumpy for oil.

Prices initially gained on higher heating demand due to a cold Northern Hemisphere winter and US sanctions against Russia’s crude industry, but Trump’s tariffs have threatened trade wars on multiple fronts and dragged futures lower the past three weeks.

There are tentative signs that US sanctions are hampering Russian crude flows.

Several million barrels from platforms in the Pacific are stranded after the shuttle tankers that hauled them to China were blacklisted.

Still, the US Energy Information Administration said Tuesday that it doesn’t currently expect a large hit to Russian output.