Crude prices have given back the brief gains overnight (following API's report of a big crude draw) as US GDP slowed and weighed on demand expectations (offsetting nervousness from another attack on a ship in the Red Sea, and Israeli comments that it probably wouldn’t be able to defeat Hamas before the end of this year).

Additionally, traders are anxiously awaiting the OPEC+ meeting over the weekend for more clarity on the supply-demand outlook.

“There’s some caution in the market, with attention on slowing consumption just before the high-demand summer season,” said Will Sungchil Yun, a senior commodities analyst at SI Securities Corp.

“But a surprise from OPEC+ can’t be completely ruled out and that could drive prices immediately higher.”

The official inventory data will trigger the next leg if it confirms API's print.

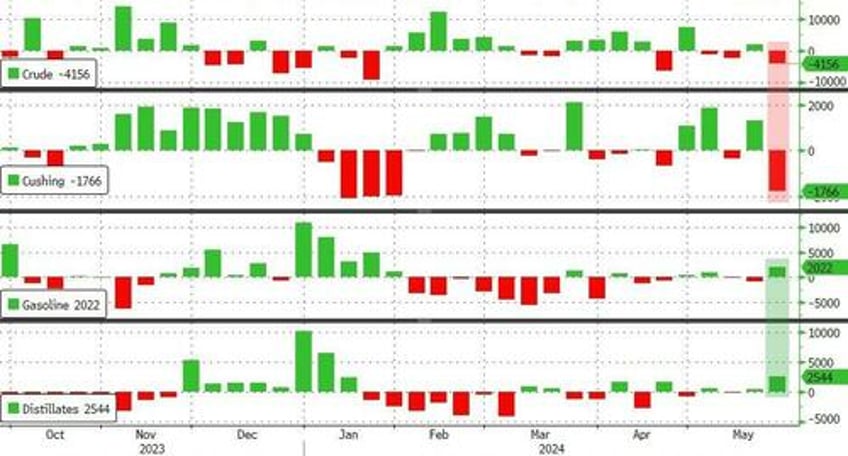

API

Crude -6.49mm (-1.9mm exp)

Cushing -1.71mm

Gasoline -452k

Distillates +2.05mm

DOE

Crude -4.16mm (-1.9mm exp)

Cushing -1.76mm

Gasoline +2.02mm

Distillates +2.54mm

Crude inventories and stocks at the Cushing Hub tumbled last week, confirming API's overnight report. Inventories built though on the product side...

Source: Bloomberg

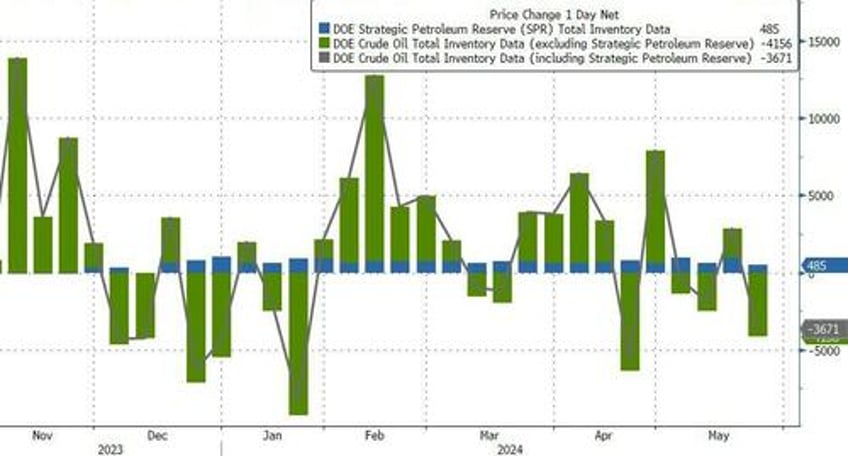

The Biden admin added 485k barrels to the SPR (while drawing down from the gasoline reserve)...

Source: Bloomberg

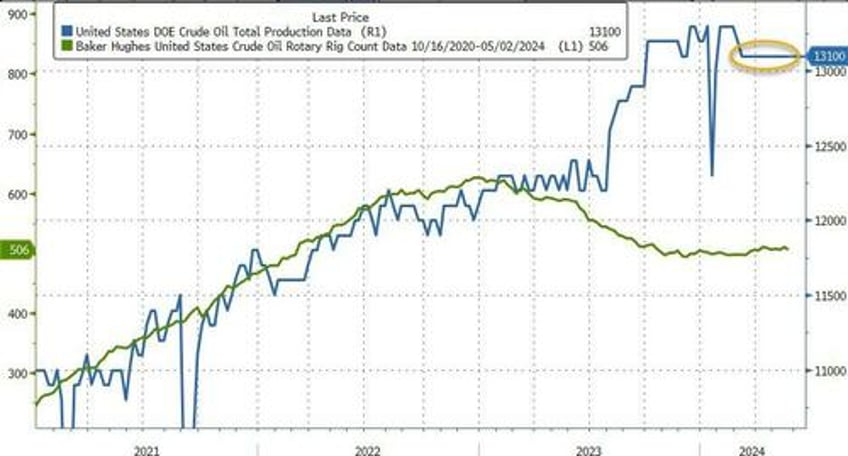

US Crude production remained flat near record highs...

Source: Bloomberg

WTI was hovering around $79 ahead of the official data having fallen this morning after the GDP print. WTI extended losses after the official print...

Finally, Bloomberg notes that the prompt timespread for Brent crude is getting closer again to a bearish contango structure that indicates supply is abundant when compared with demand.