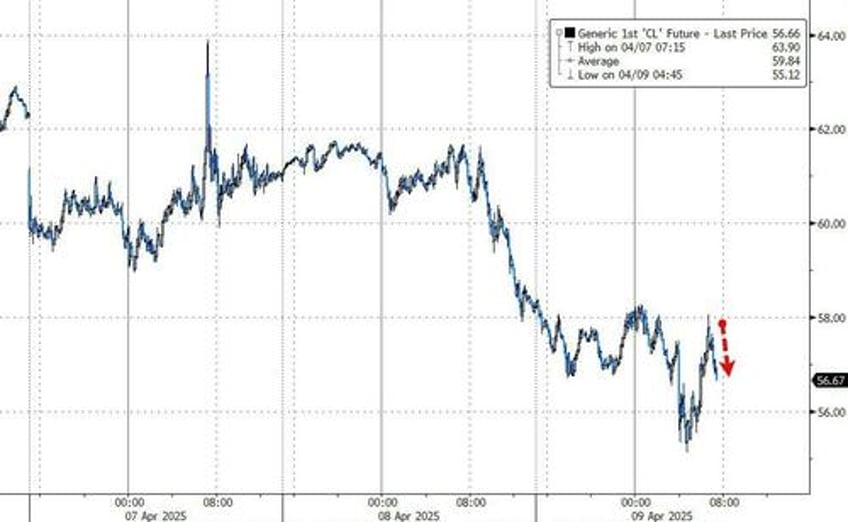

Oil prices fell to fresh four-year lows early on Wednesday on expectations economies will slump as China, Canada and the European Union push back against tariffs imposed by Trump, but are off the lows ahead of the official inventory and supply data.

"Crude prices slumped to a four-year low with focus squarely on the escalating global trade war and its potential negative impact on growth and demand for energy," Saxo Bank noted.

A mixed bag from API overnight (small crude draw) is being overwhelmed by the global geopolitical picture being adjusted by Trump.

API

Crude: -1.057M

Cushing: +0.636M

Gasoline: +0.207M

Distillates: -1.844M

DOE

Crude: +2.55mm (+2.6mm exp)

Cushing: +681k

Gasoline: -1.60mm

Distillates: -3.55mm

US crude stocks rose for the second week in a row (along with inventories at the Cushing Hub). Products saw drawdowns...

Source: Bloomberg

The Trump admin added 276k barrels to the SPR last week...

Source: Bloomberg

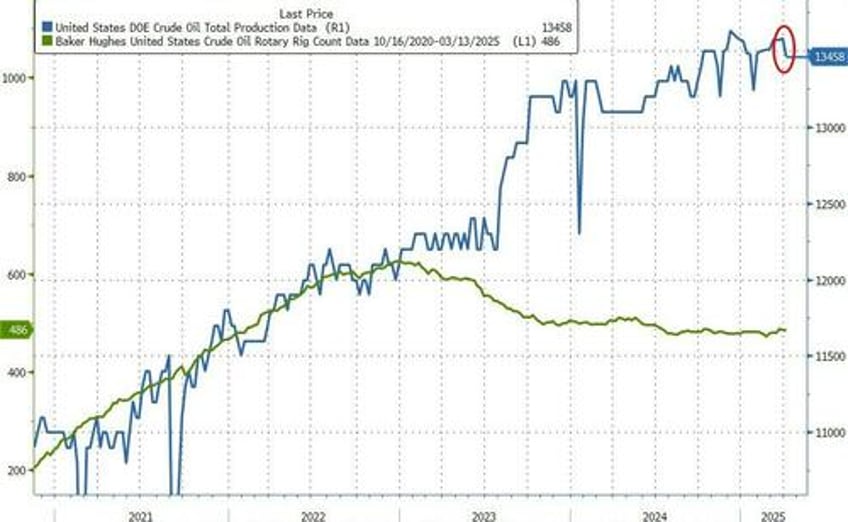

US Crude production slipped notably last week

Source: Bloomberg

WTI is trading lower after the print...

Source: Bloomberg

The shape of the oil futures curve is rapidly shifting into contango - a fresh sign that traders are hastily dialing back their expectations for global demand this year.

“The contango implies deteriorating demand perspectives,” said Tamas Varga an analyst at brokerage PVM Oil Associates Ltd.

“Evidence of worsening Chinese oil demand growth will put immense pressure on the front-end.”

Finally, there is a potential silver for Main Street as crude prices have collapsed, so gasoline prices at the pump are set to follow...

...and along with gasoline prices, disinflation.