Oil prices jumped overnight (near YTD highs) after API reported a massive (record) crude inventory drawdown, but have tumbled this morning as the dollar rallies and bonds & stocks are dumped.

"The OPEC+ Joint Ministerial Monitoring Committee will meet online on Friday, providing Saudi Arabia an excellent opportunity to roll its voluntary 1 million bpd production cut announced on June 3 for July production for another month to September. It would be the second time the Saudis have extended the voluntary 1 million bpd production cut. There is speculation that another 1 million roll forward could slow the global war on inflation, and kill the "golden goose," especially heading into the end of summer driving season, and the beginning of shoulder season," Robert Yawger, executive director of energy futures at Mizuho Securities USA, wrote in a Monday note.

Volumes also remain muted in light summer trading, while volatility is at the lowest since January 2020.

API

Crude -15.4mm (-1.3mm exp) - biggest weekly draw on record

Cushing -1.76mm

Gasoline -1.68mm (-1.3mm exp)

Distillates -512k (-100k exp)

DOE

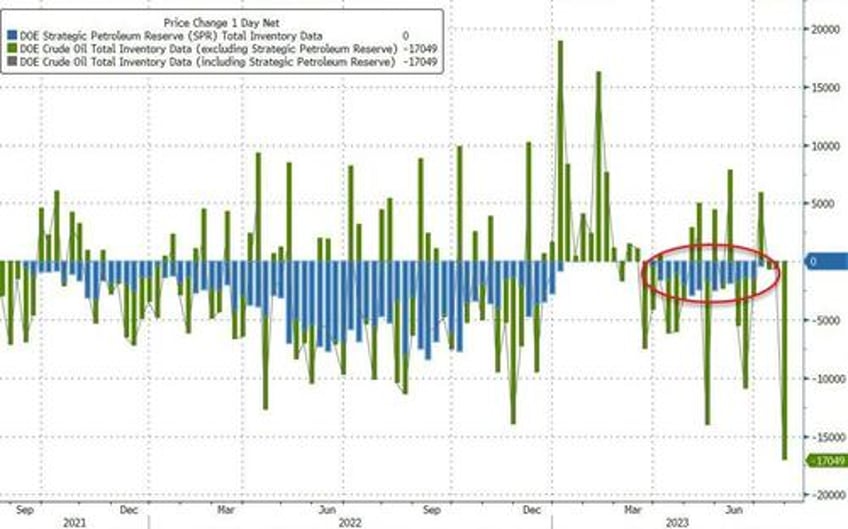

Crude -17.05mm (-1.3mm exp) - biggest weekly draw on record

Cushing -1.259mm

Gasoline +1.481mm (-1.3mm exp)

Distillates -796k (-100k exp)

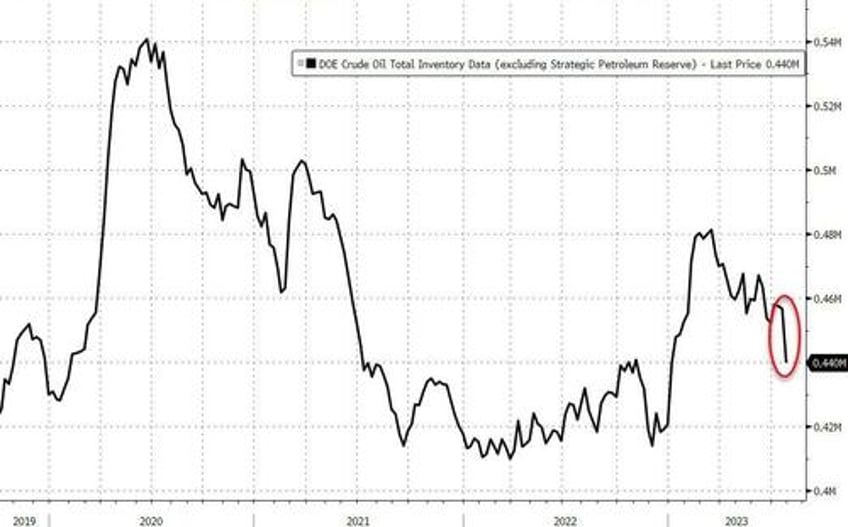

Confirming API's report, the official data shows a massive 17 million barrel crude draw last week - the biggest ever (in at least 40 years)...

Source: Bloomberg

The total US Crude inventory is now back at its lowest since Jan...

Source: Bloomberg

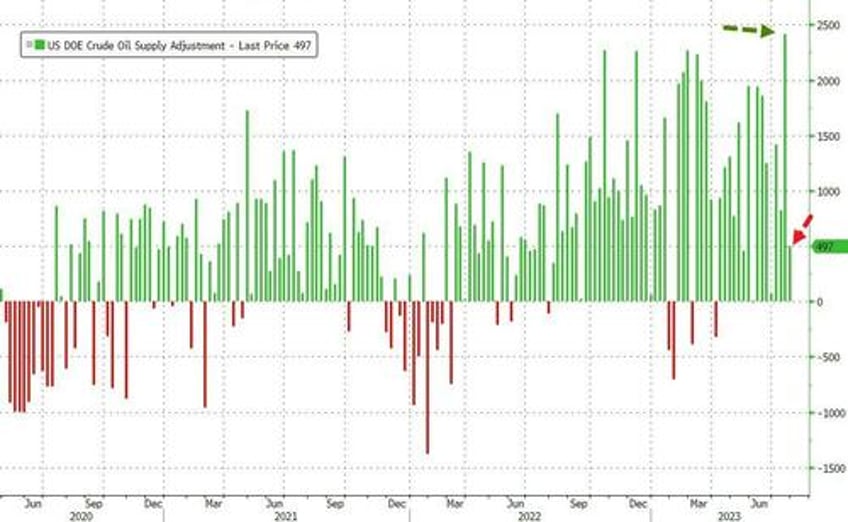

The so-called adjustment factor tumbled last week from a record positive...

Source: Bloomberg

As a reminder, the Biden admin has been drawing down on the SPR for the last 14 weeks and - despite all the promises - has not refilled the "STRATEGIC" political petroleum reserve one little bit.

Source: Bloomberg

So yeah: just 3 weeks after the DOE said it would buy a "whopping" 6 million barrels of sour crude - an amount which the SPR drained every 2 weeks for much of the past year - the Biden administration pulled said offer, an Energy Department spokesperson said on Tuesday, as oil prices are expected to keep rising after a output cut from Saudi Arabia.

The U.S. made the latest solicitation to buy the sour crude oil for the SPR on July 7, and follows the release of a record 180 million barrels from the reserve last year to prevent a Democrat rout in the midterms following Russia's invasion of Ukraine. Having vowed it would refill the SPR eventually, the Energy Department bought back 6.3 million barrels in recent month... and that appears to be it.

The move was not a rejection of oil companies' offers to sell oil to the SPR but a decision made on "market conditions," the spokesperson said. The person not specify what that meant, but tight oil supplies that have caused global oil prices to rise above $80 per barrel in recent weeks. Of course, by refusing to refill now, it only ensures that when the need truly arises, Biden, or rather his successor, will be forced to buy the oil at triple digits.

hey @SecGranholm how's that SPR refill coming? We gonna buy very, very high?

— zerohedge (@zerohedge) August 1, 2023

Translation: $65 was too cheap, we'd rather wait until oil is $130 https://t.co/wYlcciUiof

— zerohedge (@zerohedge) August 1, 2023

To be sure, the Energy Department headed by the consummately incompetent Jennifer Granholm said that it "remains committed to its replenishment strategy for the SPR" which includes direct purchases, returns of oil that was loaned to companies in the wake of hurricanes and other supply disruptions, and cancellation of planned sales where drawdown is unnecessary, in coordination with Congress.

What it really means is that the only time the SPR can possibly be refilled is when the US economy plunges into a crippling recession when Bidenomics crashes and burns the moment Biden's $1+ trillion stimmy no longer flies.

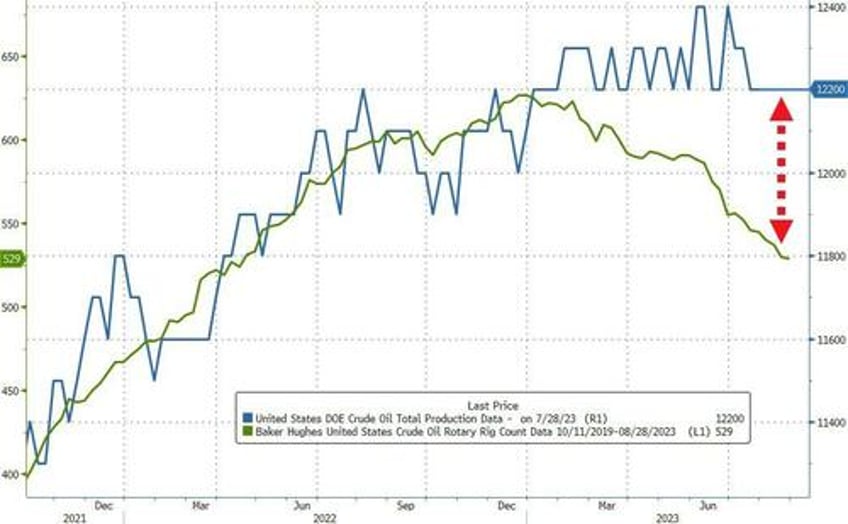

US Crude production was flat week-over-week, despite the ongoing slide in the rig count...

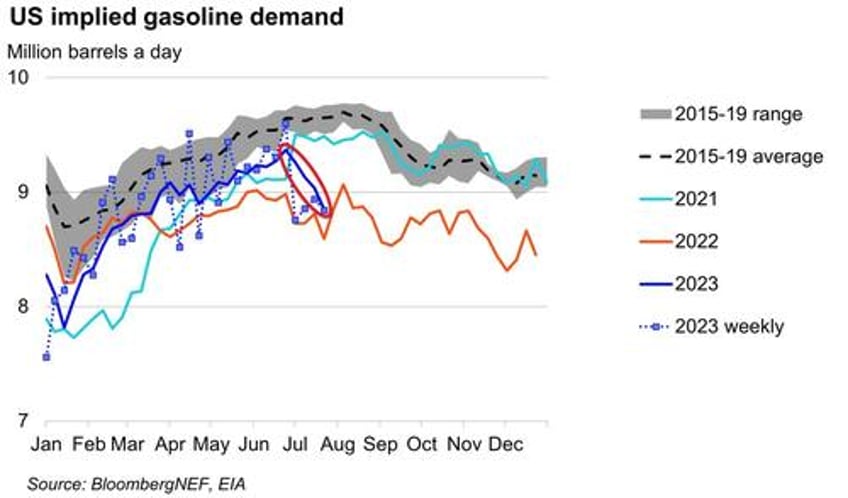

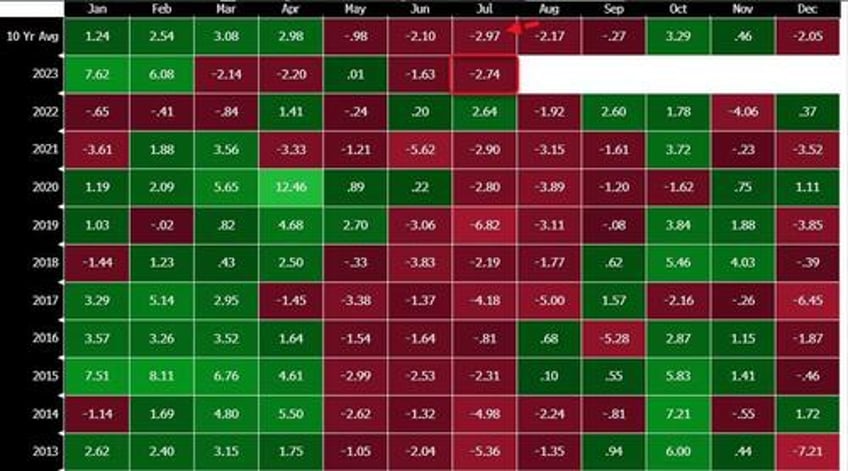

Gasoline demand’s plunge over the last four-weeks is unprecedented for this time of year. The four-week moving average of product supplied, a proxy for demand, has plummeted by 520,000 barrels a day -- that is more than double the largest decline on record over the same time period for the EIA figure.

WTI bounced higher on the massive crude draw but that didn't last long...

In case you're confused at the price action (after a record crude inventory draw), Bloomberg notes that traders are noting that the monthly number for July makes sense overall - that a draw of about 12 million was what traders had priced in.

So it seems many view this single record week of decline as the EIA mostly squaring its numbers for the month.

But, with wholesale gasoline prices soaring, President Biden still has a problem...

Source: Bloomberg

Meanwhile, in a gift to refiners, the 3-2-1 crack spread is blowing out.

As a reminder, when one product spread is blowing out, the market is saying that there needs to be more output of said product. When all spreads are blowing out simultaneously, that may be the market's way of signaling it needs more refining capacity to satisfy growing product demand.

We are seeing more of the latter (as Jet Fuel and Diesel cracks are also blowing out).

Finally, we note that Goldman Sachs analysts wrote in a note this week that:

"The significant rise in OPEC spare capacity over the past year, the return to growth in international offshore projects, and declining U.S. oil production costs limit the upside to prices,"

However, the bank held off from adjusting its forecasts.