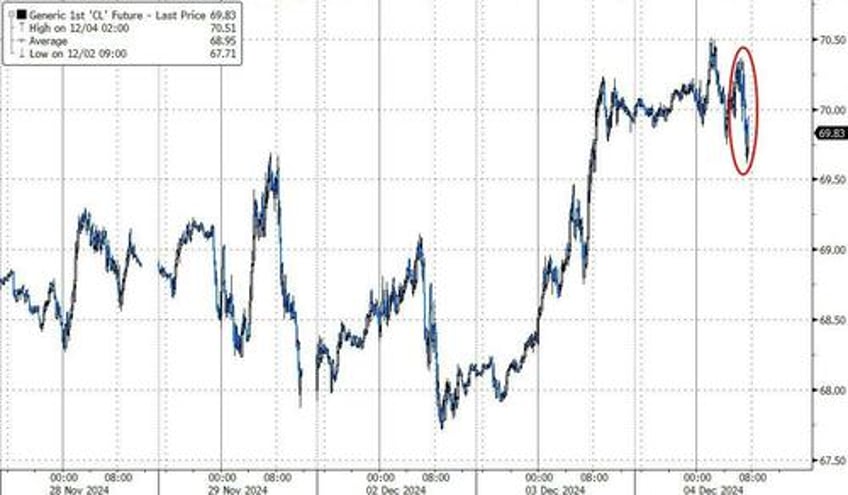

Oil prices were limping lower this morning (after yesterday's surge) after the weak ISM Services print as traders await this week's OPEC+ decision.

API

Crude +1.23mm

Cushing +112k

Gasoline +4.62mm

Distillates +1.01mm

DOE

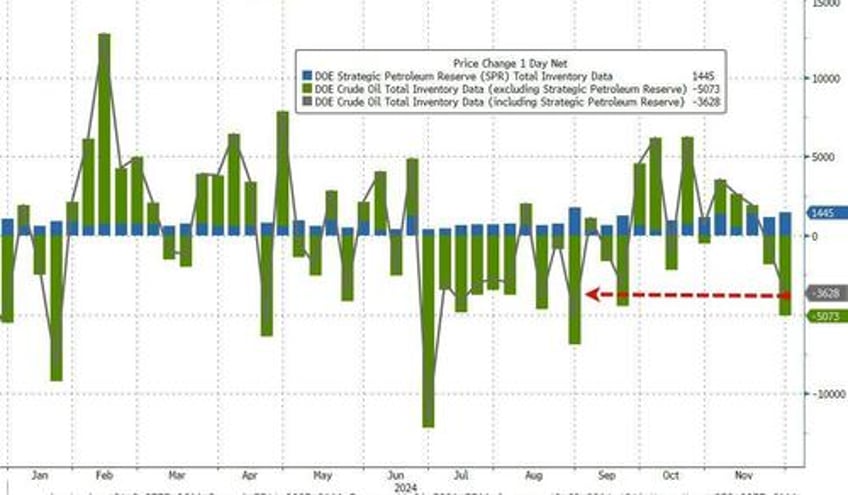

Crude -5.07mm - biggest draw since August

Cushing +50k

Gasoline +2.36mm

Distillates +3.38mm - biggest build since July

Completely the opposite of API's reported small build, the official data showed a large crude draw last week, but products saw large builds...

Source: Bloomberg

Even with the large addition to the SPR - total crude stocks still drew down by the most since August...

Source: Bloomberg

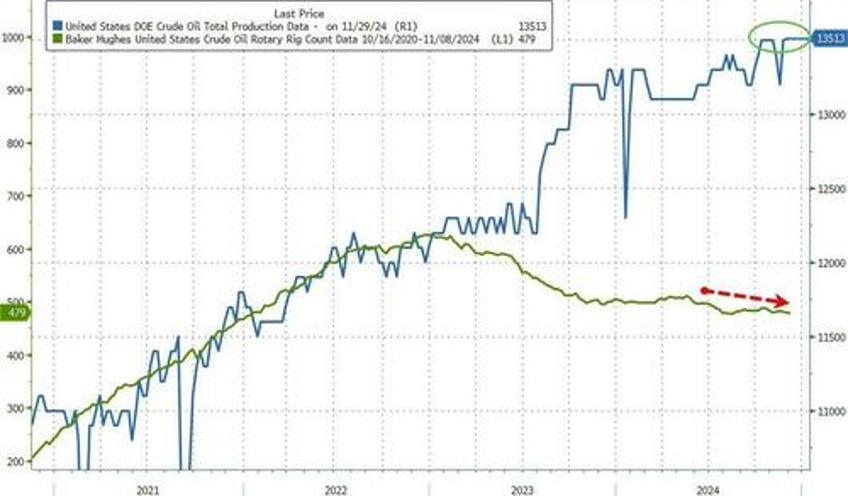

US Crude production held at 13.5mm b/d - a record high...

Source: Bloomberg

Algorithmic traders have been dumping bearish positions after futures surpassed both the $70-a-barrel psychological level and the 50-day moving average, which have provided resistance for previous rallies, said Dennis Kissler, senior vice president for trading at BOK Financial Securities.

WTI Is holding right around that $70 level...

As Bloomberg's Grant Smith reports, even before OPEC+ ministers start tomorrow’s meeting on oil production, traders are looking beyond it.

For the past week, the cartel led by Saudi Arabia and Russia has been holding preliminary talks to once again delay plans for reviving halted barrels.

The group is firming up an agreement — to be finalized at Thursday’s gathering — that would push back a sequence of monthly hikes from January until the second quarter.

Unfortunately for the alliance, crude traders already assumed the pause was unavoidable and have priced it in. Benchmark Brent futures have barely budged in the week since OPEC+ began negotiations, hovering around $74 a barrel.

That could be complacency: The Saudis have a habit of springing bullish surprises to deter short sellers.

Nonetheless, investors are looking past the decision, focusing on oil-market conditions in early 2025 — and those don’t augur well for prices.

Global demand growth is cooling as top consumer China falters, while supplies from the US, Guyana and Canada are booming, according to the International Energy Agency.

A hefty surplus looms, even if OPEC+ doesn’t add a single barrel next year.