Oil prices are higher this morning after API's overnight report signaled a sizable drawdown in US commercial crude inventories and Kazakhstan pledged to comply with OPEC+ production quotas.

The cartel member had earlier unsettled markets by signaling that it would adhere to its original plan of raising oil output by 190,000 barrels a day, according to Rebecca Babin, senior energy trader at CIBC Private Wealth Group, despite OPEC’s decision to delay production hikes.

Still,“the rally remains fragile, with broader macroeconomic factors continuing to dominate price movements,” Babin said.

“The upcoming Federal Reserve statement and potential shifts in China’s economic policy are key factors that will likely shape the medium-term direction for crude prices.”

in the even shorter-term, this morning's official inventory and supply data will be the focus.

API

Crude -4.7MM

Gasoline +2.4MM

Distillates -0.7MM

Cushing +0.8MM

DOE

Crude

Gasoline

Distillates

Cushing

Crude stocks declined for the 4th straight week, according to official data (but last week saw a far smaller drawdown than API reported). Gasoline stocks rose for the 5th straight week...

Source: Bloomberg

Despite a 519k barrel addition to the SPR, total crude stocks fell for the 4th week in a row...

Source: Bloomberg

Cushing stocks remain near tank bottoms again...

Source: Bloomberg.

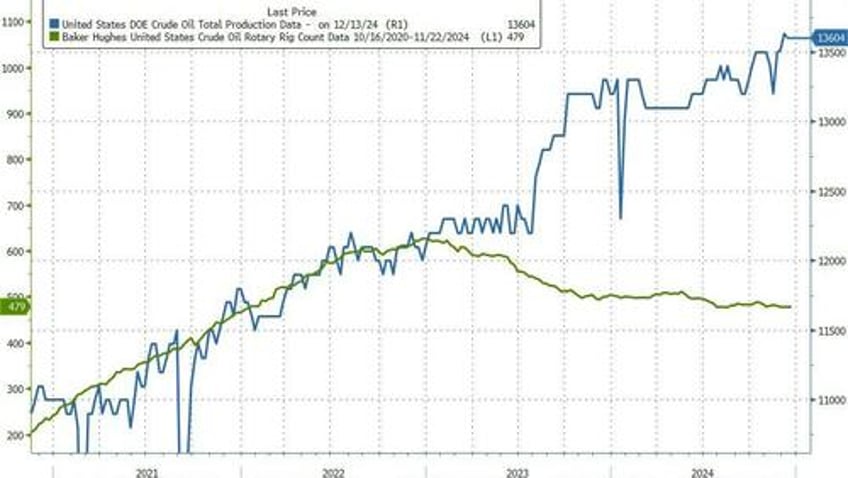

US crude production remains near record highs...

Source: Bloomberg

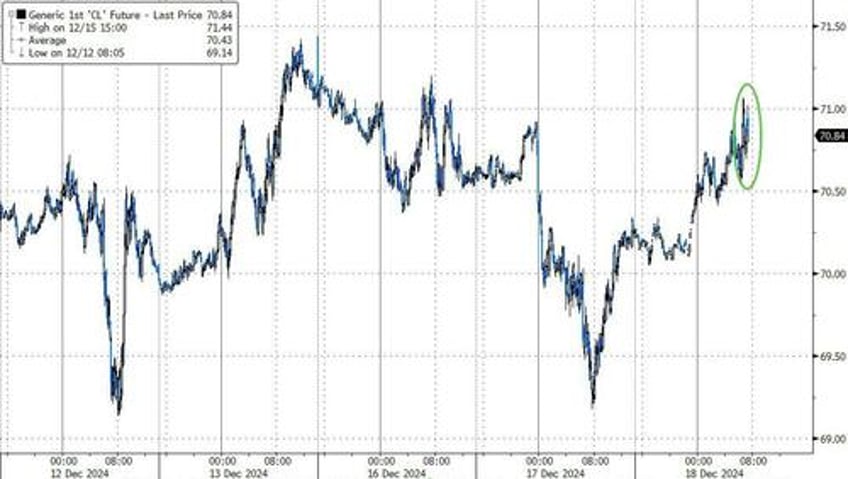

WTI was hovering just below $71 ahead of the official data, and is holding gains for now...

Source: Bloomberg

As Bloomberg reports, crude has traded in a narrow band for the past two months, supported by geopolitical tensions in the Middle East and Europe, and the threat of further sanctions on supplies from Iran and Russia.

Restraining prices are lackluster Chinese demand and expectations for robust production from non-OPEC+ nations such as the US, where President-elect Donald Trump has promised to encourage domestic development.