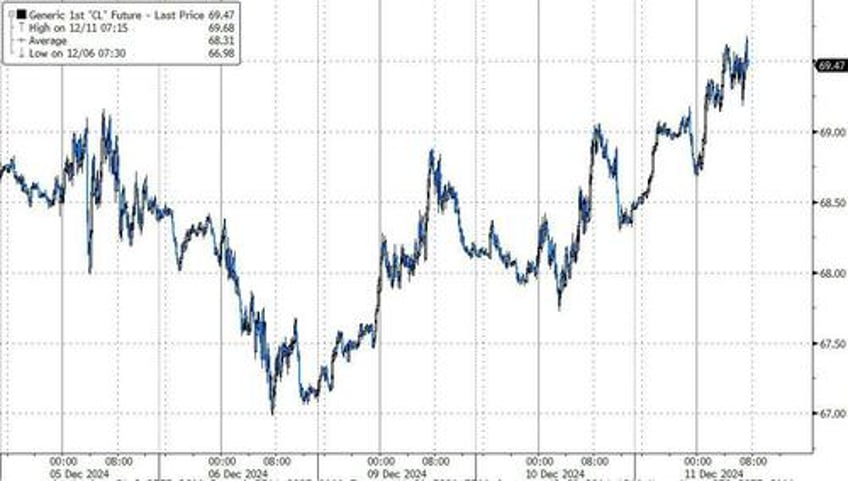

Oil prices are up this morning on the possibility of tighter sanctions on Russian crude and held its gains after US inflation data matched expectations.

US consumer prices rose 0.3% in November, meeting expectations and leaving traders to focus on a report that the Biden administration is considering tougher sanctions on Russia’s oil trade. Curtailing Russian barrels could tighten the market and drive up prices before President-elect Donald Trump takes office. Details of the possible measures were still being worked out, according to people familiar with the matter.

The market is focused on the official crude inventory data from the US Department of Energy after API reported a small buildup last week.

API

Crude +500k

Cushing -1.5mm

Gasoline +2.85mm

Distillates +2.45mm

DOE

Crude -1.425mm

Cushing -1.298mm

Gasoline +5.086mm - biggest build since January

Distillates +3.235mm

The official data made somewhat of a mockery of the API data overnight with a large drawdown in crude stocks and at the Cushing and major product builds...

Source: Bloomberg

Despite another weekly addition to the SPR, total crude stocks fell for the third week in a row...

Source: Bloomberg

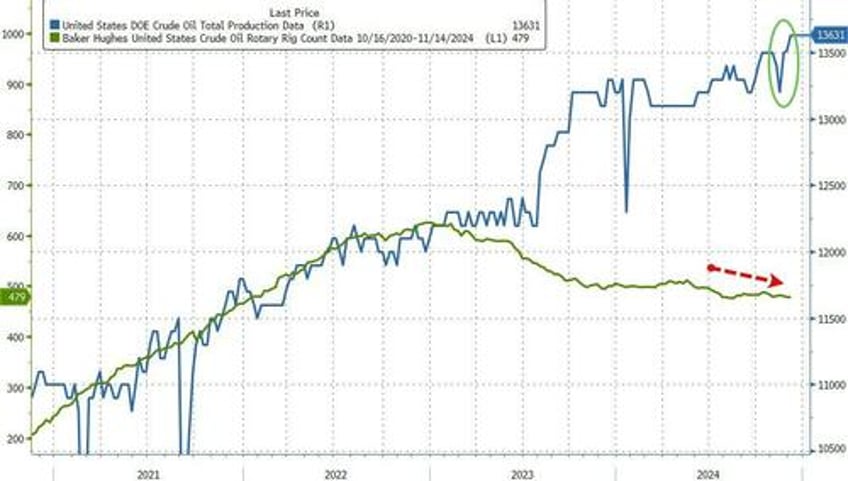

US Crude production surged to a new record high last week (13.6mm b/d)...

Source: Bloomberg

WTI dipped modestly on the official data but is holding gains for the day for now...

Source: Bloomberg

Meanwhile, OPEC made its deepest cut yet to global demand growth forecasts for this year, slashing projections by 27% since July.

The Organization of Petroleum Exporting Countries lowered projections for consumption growth in 2024 by 210,000 barrels a day.

As the cartel belatedly recognizes the deteriorating market picture, the US Energy Information reversed its prediction for a surplus and now calls for a small deficit next year.

“The latest EIA report has caught some by surprise with a forecast of a mostly balanced oil market in 2025, versus some calling for a strongly oversupplied market,” UBS Group AG commodity analyst Giovanni Staunovo said.