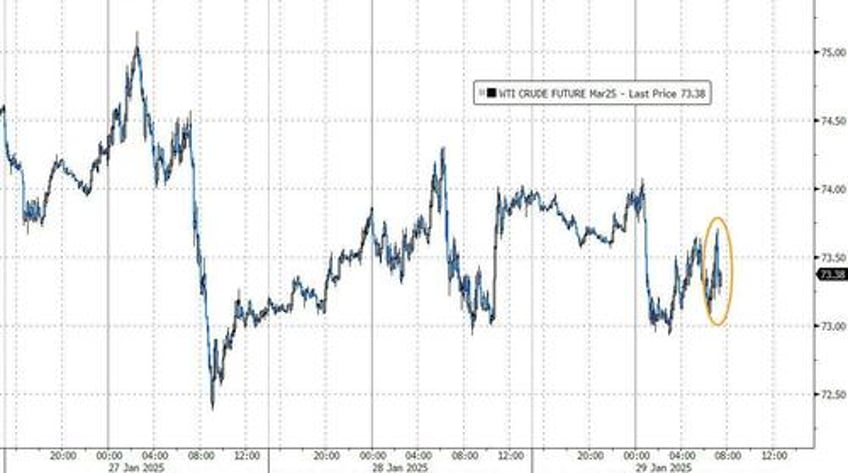

Oil pries continues to churn sideways since tumbling in the big risk-off slump from DeepSeek on Monday as traders weigh the possible fallout from President Donald Trump’s planned tariffs on major US crude supplier Canada and other countries and reports OPEC will evaluate potential changes to America’s energy policy.

“Crude prices keep dancing to the rhythm of Trump’s tariff orchestra, with Canada tariffs in focus as they go into effect on Saturday,” said Ole Hansen, head of commodities strategy at Saxo Bank. Wednesday’s price decline represents “a sour sentiment across an overall rangebound market,” he added.

API

Crude +2.68mm

Cushing +144k

Gasoline +1.89mm

Distillates -3.75mm

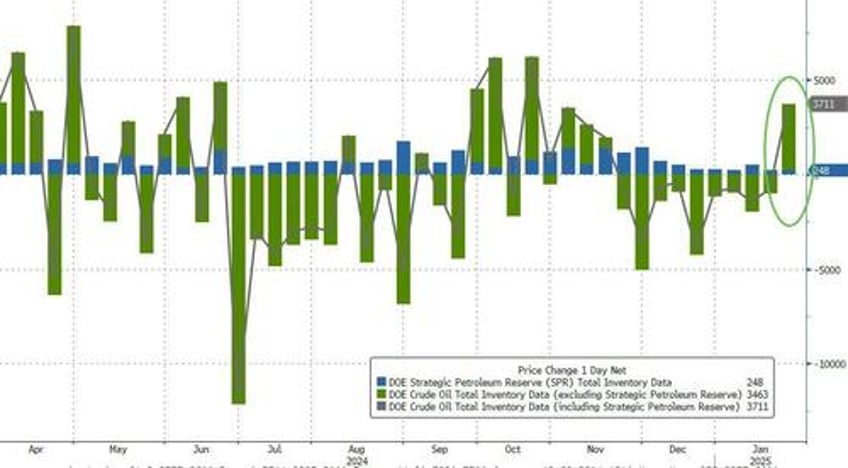

DOE

Crude +3.46mm

Cushing +326k

Gasoline +2.96mm

Distillates -4.99mm - biggest draw since March 2022

After 9 straight weeks of draws, crude stocks built last week (by 3.5mm barrels). Gasoline stocks rose for the 11th straight week while Distillate stocks plunged by the most since March 2022...

Source: Bloomberg

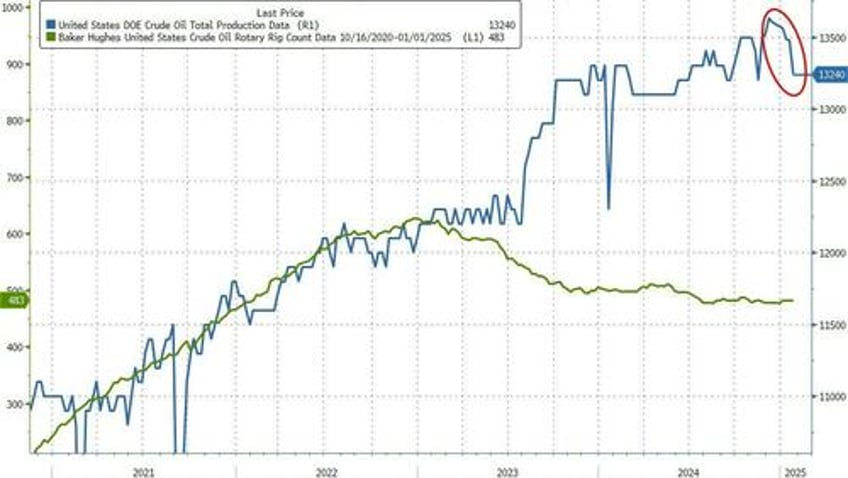

US crude production plunged last week, tumbling 237k barrels/day...

Source: Bloomberg

Including the 248k barrel addition to the SPR, total US crude stocks jumped by 3.71mm barrels - the biggest build since October 2024...

Source: Bloomberg

WTI remains lower on the day after the DOE data...

Source: Bloomberg

It appears the cold-weather snap was the big driver of crude production's decline as well as Distillates drawdown.