Oil pries are lower overnight, despite API reporting an across the board inventory draw, as traders weigh up whether China's new stimulus measures will translate to higher energy demand in the world’s biggest oil importer.

Geopolitics also remained in focus as Iranian President Masoud Pezeshkian said that Israeli attacks in Lebanon “cannot go unanswered.”

"Though oil rebounded last week, we do not see the current price as accurately reflecting a wider Middle East war scenario. Many market participants have seemingly written off a threat to regional oil supplies," Helima Croft, head of global commodity strategy at RBC Capital Markets, said in a note.

"While we are not forecasting a closure of the Strait of Hormuz, we do think that direct Iranian involvement would raise the prospect of a repeat of the 2019 scenario when the IRGC (Islamic Revolutionary Guard Corps) and allies targeted tankers and critical energy infrastructure in the region," she wrote.

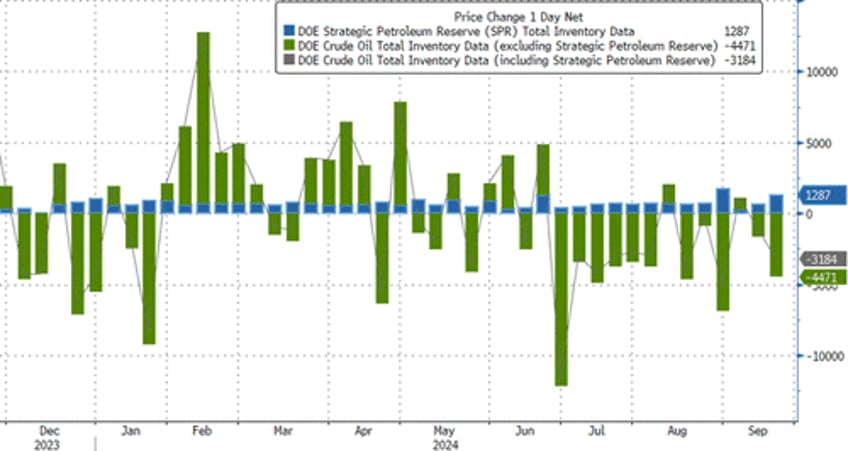

API

Crude -4.34mm (-800k exp)

Cushing -26k

Gasoline -3.44mm (-500k exp)

Distillates -1.12mm (-1.2mm exp)

DOE

Crude -4.47mm (-800k exp)

Cushing +116k - first build in seven weeks

Gasoline -1.54mm (-500k exp)

Distillates -2.23mm (-1.2mm exp)

The official DOE data confirmed sizable inventory draws for crude and products but saw a small build in stocks at the Cushing Hub (its first build in seven weeks)...

Source: Bloomberg

Total crude stocks are at their lowest since March 2022...

Source: Bloomberg

The Biden admin added a large 1.287mm barrels to the SPR last week...

Source: Bloomberg

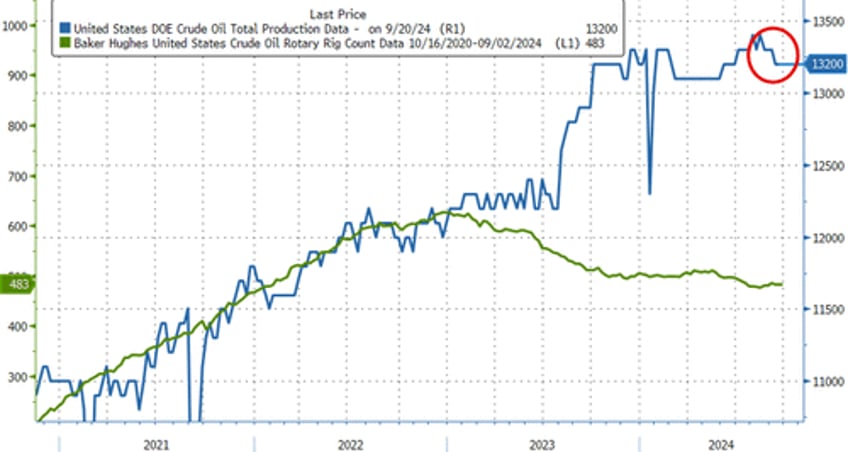

US Crude production was flat, just off record highs...

Source: Bloomberg

WTI is pushing slightly lower after the data...

Source: Bloomberg

Crude remains down this quarter on the dour outlook in Asia’s largest economy and the prospect of higher supply from OPEC and its allies. The producer group on Tuesday doubled down on its outlier view that global oil demand will keep growing to the middle of the century.

“The market remains at risk of a supply glut if OPEC+ proceeds with plans to return some of its sidelined production,” Rabobank analysts Joe DeLaura and Florence Schmit said in a report. “Geopolitical issues in the Middle East still support upward price risk in the long term.”