Oil prices closed higher today, back inside their YTD range, following OPEC's forecast that global oil demand will continue to increase strongly next year and exceed growth in supplies.

OPEC is publishing estimates for the year ahead a few months earlier than normal “to offer more transparency and support for both consumers and producers,” its Vienna-based secretariat said.

The organization expects global oil demand to increase by 2.25 million barrels a day this year to a record 104.36 million a day, unchanged from the forecasts in last month’s report.

Additionally, its projections imply a market deficit of about 1.8 million barrels a day on average in 2024, even before OPEC and its allies implement additional output curbs pledged for the first quarter.

Will that start showing up in the inventory data yet?

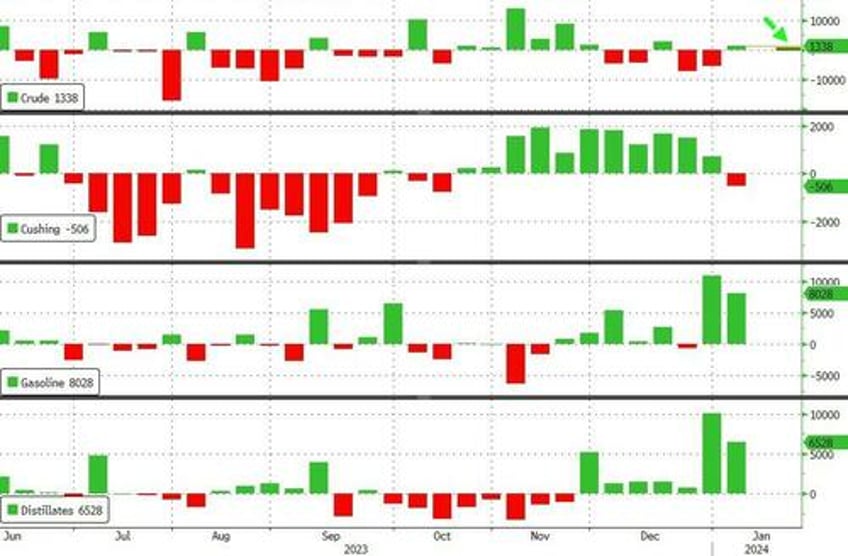

API

Crude +483k (-900k exp)

Cushing

Gasoline (+2.5mm exp)

Distillates (+600k exp)

For the second week in a row, crude inventories rose unexpectedly. API reports a crude build of 48k barrels (vs expectations of a 900k draw)...

Source: Bloomberg

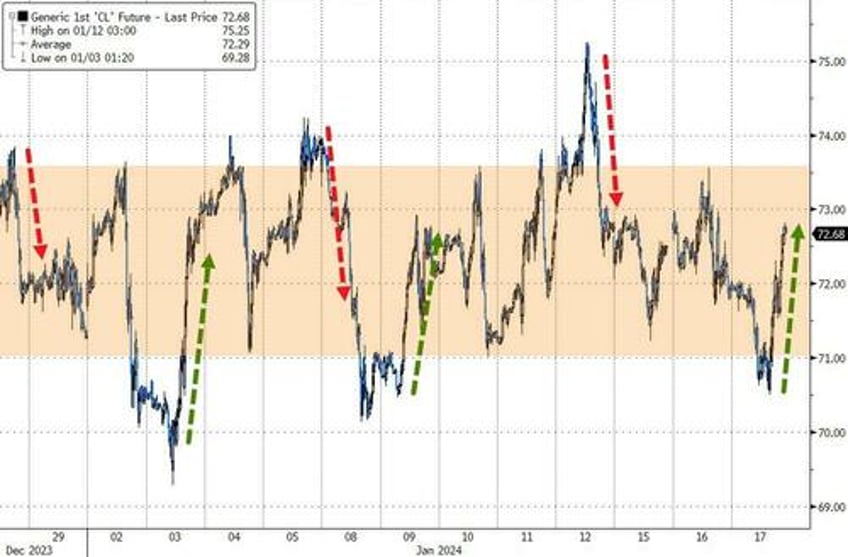

Having traded in a narrow range all year...

WTI was hovering just below $73 ahead of the API print. and held the day's gains after the small build...

“Peak oil demand is not showing up in any reliable and robust short- and medium-term forecasts,” OPEC Secretary-General Haitham Al Ghais said in a separate statement, pushing back against expectations that climate change will cap the use of fossil fuels.

On the entirely opposite side of the spectrum, The International Energy Agency, which advises major oil consumers, projects that demand will decelerate sharply this year, and ultimately peak this decade thanks to the adoption of renewable energy and electric vehicles.

Who'll be right?