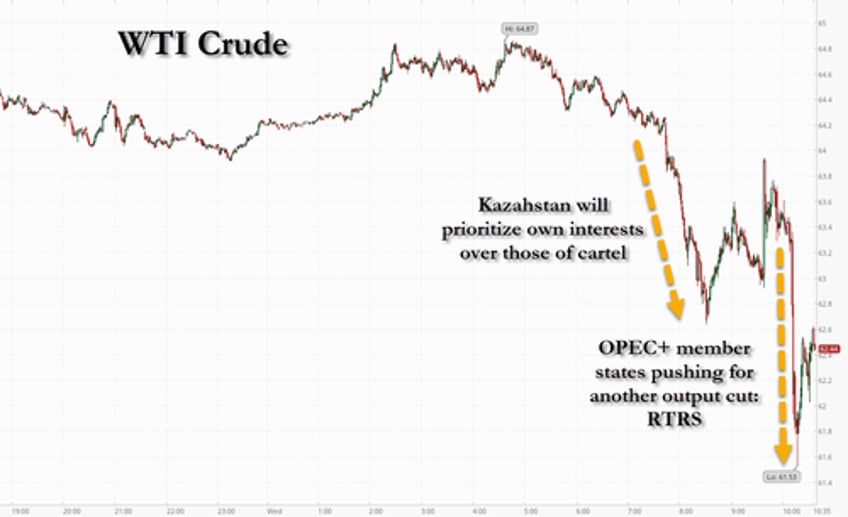

Overnight gains on the heels of across the board inventory draws reported by API (and some optimism on easing China tensions) have been dashed this morning after comments from the new Kazakh energy minister (pushing back against production cuts for his always over-producing nation). This was then amplified with headlines that other OPEC nations were pushing for accelerated output increases.

But for now, all eyes are on the official data...

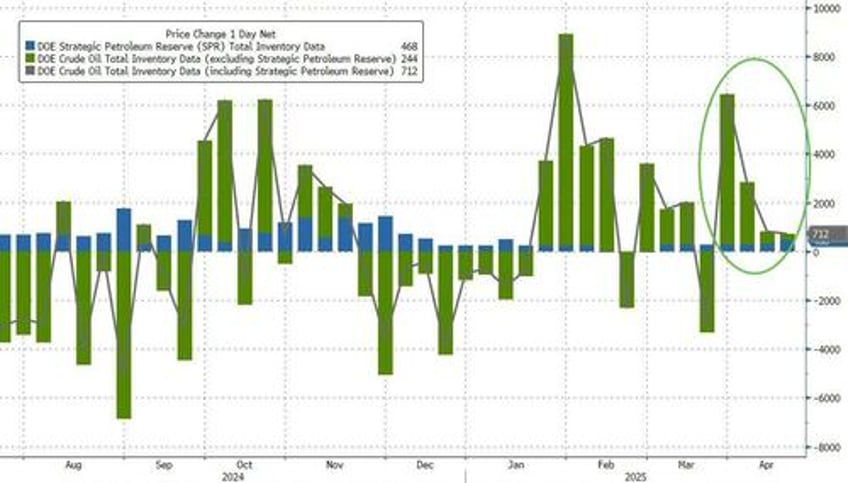

API

Crude: -4.57mm

Cushing: -354k

Gasoline: -2.18mm

Distillate: -1.64mm

DOE

Crude: +244k

Cushing: -86k

Gasoline: -4.476mm

Distillate: -2.35mm

The official data was considerably worse than API's with DOE reporting a small crude build vs API's big draw. Products did see major drawdowns...

Source: Bloomberg

Imports of Canadian crude oil fell for the third consecutive week to 3.3 million barrels a day. The decline is partly explained by the weeklong outage of the Keystone pipeline, the conduit that delivers supplies from the oil sands to US refineries. The drop-off weighed on overall crude imports into the US.

Gasoline imports climbed to the highest since August as we gear up for summer driving season.

Total US crude stocks rose for the fourth week helped by the addition of 468k barrels to the SPR...

Source: Bloomberg

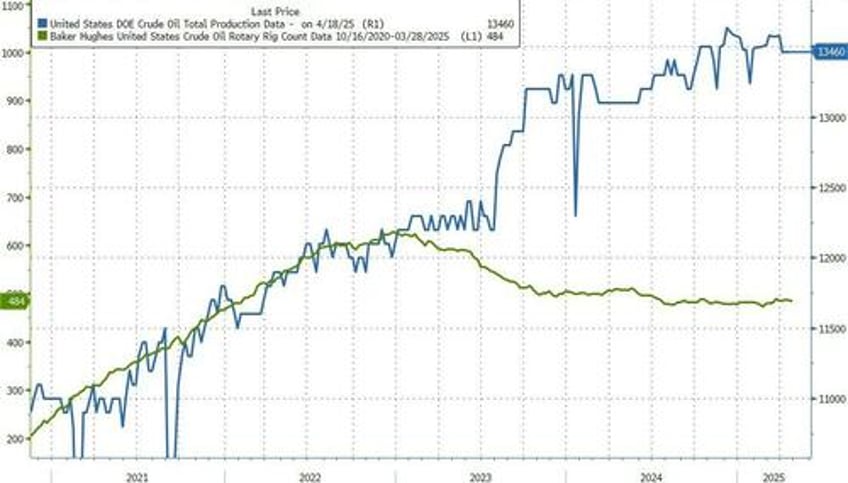

US Crude production remains near record highs...

Source: Bloomberg

WTI prices are tumbling following the OPEC comments...

Earlier this month the Organization of the Petroleum Exporting Countries and its allies unexpectedly announced plans to hike output at three times the pace previously expected in May. That move was designed to keep perennial overproducers like Kazakhstan in line with their targets, and Saudi Arabia’s energy minister said at the time the hike would be just an “aperitif” if those countries didn’t improve their performance.

“The comment about ‘own interest’ is new to me,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management.

“It underlines that OPEC+ has some tough quarters ahead with the global economy/demand under pressure from the trade-war. Certainly not bullish for oil.”

The comments raise fresh concerns about whether OPEC+ will continue to press ahead with a faster-than-expected pace of output hikes in the coming months. That could add supplies to a market that has been relatively strong in the short-term, but that analysts widely expect to be oversupplied later this year.