Oil prices fell for the second day in a row (albeit very modestly today) as the 'WW3-on / WW3-off' headline-swings (supply) are wearing on traders, and less-and-less dovish expectations for The Fed weigh on demand expectations

"Oil traders are hunkering down as bears are increasingly afraid to bet on lower prices," Phil Flynn, senior market analyst at the Price Futures Group, told MarketWatch.

At the same time, "bulls are pulling in their horns until they get clarity on what the Israeli response may be."

Oil traders are waiting to see how the "diplomatic push for Israel to show restraint pays off," said Flynn.

Traders are expecting another crude build (the fourth in a row, albeit small), and a return to gasoline draws...

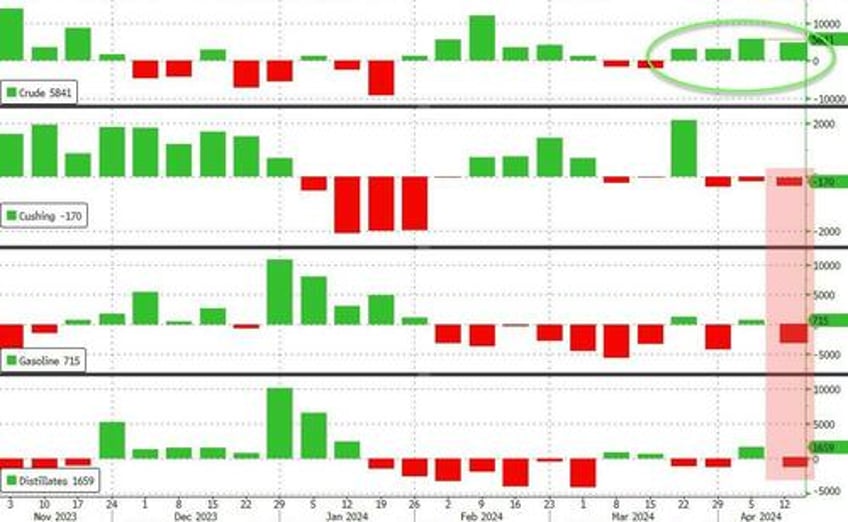

API

Crude +4.09mm (+600k exp)

Cushing -169k

Gasoline -2.51mm (-1.0mm exp)

Distillates -427k (-400k exp)

API reported a much bigger than expected crude build (and offset that with a large gasoline draw)...

Source: Bloomberg

WTI was hovering around $85.3 ahead of the API print and was thoroughly unimpressed by the mixed inventory data...

However, Joe and Jerome have a problem as pump-prices just keep going higher...

Source: Bloomberg

President Biden “wants to keep the price of gasoline affordable, and we’ll do what we can to make sure that that happens,” White House senior adviser John Podesta says at the BloombergNEF Summit in New York, responding to a question about a potential release of oil from the nation’s Strategic Petroleum Reserve amid forecasts that already rising prices at the pump will spike this summer.

JOE BIDEN'S APPROVAL RATING FALLS TO 38% FROM 40% IN MARCH - REUTERS/IPSOS POLL

Source: Bloomberg

Who could have seen that coming?

And there it is

— zerohedge (@zerohedge) April 16, 2024

SENIOR WHITE HOUSE ADVISOR: US COULD RELEASE MORE SPR OIL TO KEEP GAS PRICES LOW https://t.co/AzEQ5K9XFY

'Strategic' - "you keep using that word... I do not think it means what you think it does."