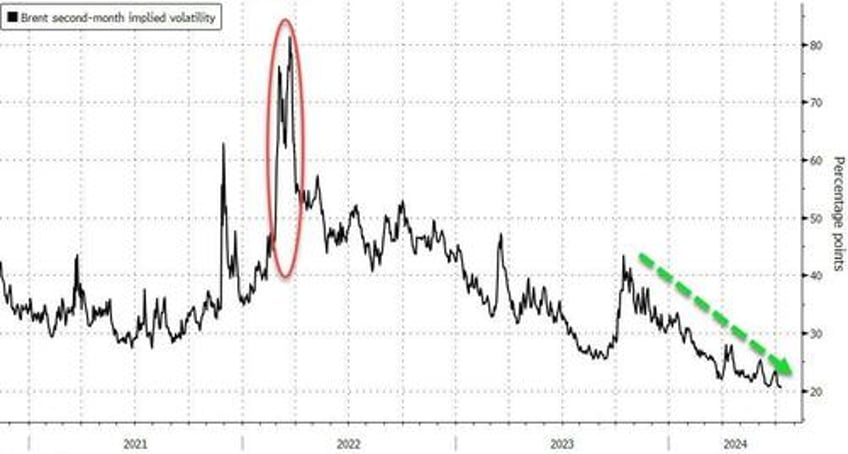

Crude prices remain lower this morning ahead of the official inventory data - though continuing yesterday's somewhat chaotic intraday swings. This is notable as oil options markets are pricing in the lowest volatility in six years - despite the potential geopolitical chaos.

“The market has been buffeted by opposing forces, with OPEC, geopolitics, weather on the one hand providing a floor and weak economic data and relatively strong dollar, Fed on hold providing the cap which has ultimately left us range bound,” said Harry Tchilinguirian, group head of research at Onyx Capital Group.

Overnight, API reported a bigger than expected crude and gasoline draw; traders are anxiously awaiting the official confirmation.

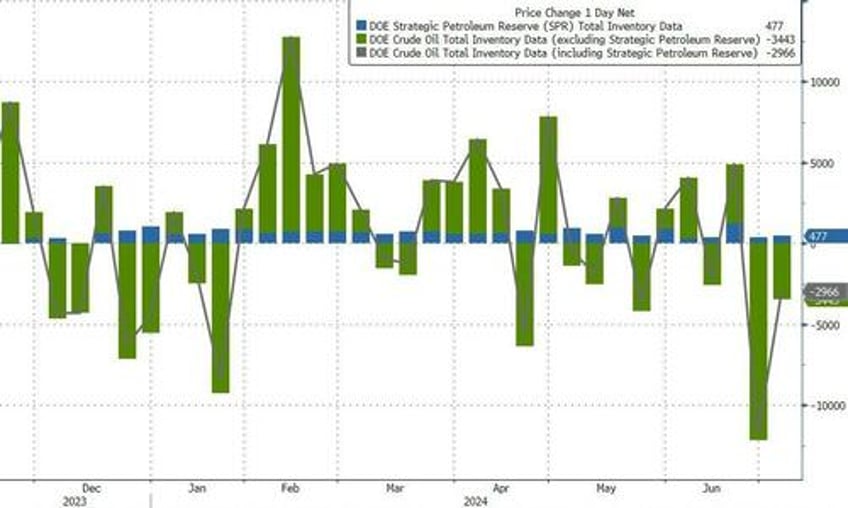

API

Crude -1.9mm (-1.3mm exp)

Cushing-1.2mm

Gasoline -3.0mm

Distillates +2.3mm

DOE

Crude -3.44mm (-1.3mm exp)

Cushing -702k

Gasoline -2mm

Distillates +4.88mm

The official data confirmed an even larger crude inventory draw. Distillates stocks rose more than exp3ected - perhaps drioven by refinery outages from Beryl....

Source: Bloomberg

The Biden admin added to SPR once again (+477k barrels)

Source: Bloomberg

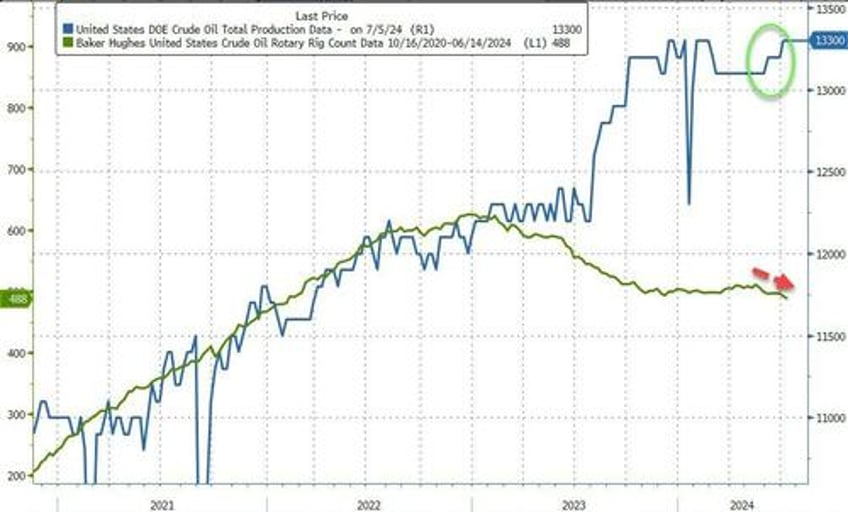

US Crude production rose back to a record high 13.3mm b/d...

Source: Bloomberg

As Bloomberg reports, swings in volatility in recent months have been shaped by the outlook for Israel’s war with Hamas. The same gauge spiked in October when the conflict began, and jumped again in April when Iran fired a salvo toward Israel.

Last week, Hamas dropped its objections to a US-backed cease-fire in the conflict with Israel, the clearest sign yet that a truce in the conflict is possible.