A note on the coming Financial Repression

Authored by GoldFix ZH Edit

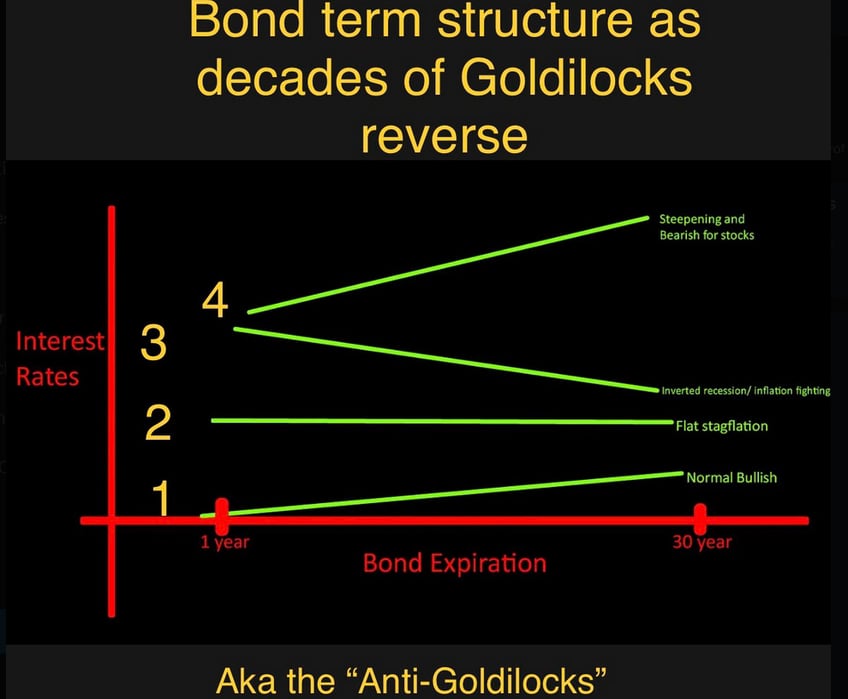

If, over the next year, the Fed can’t get inflation to stabilize at a lower level and they can’t raise interest rates anymore, they must let inflation manifest in the long term bond yield.

After that happens, then we will see YCC. We’re just getting started folks. YCC comes between 3 and 4 in the chart below.

These people, all they know is punting problems down the road and hoping the market, the free market, or what is left of the free market can sort out their errors. Eventually they run out of road on which to punt.

And when that happens, they manipulate even further and their monetary mistakes manifest in your standard of living. They did it in the 70s they did it in the 80s and they’re doing it again. This ends with a much weaker dollar because they can’t let long yields go too high too quickly or they will lose their credit rating.

Now how do they keep bond yields from going up? Good question. They need people to buy them. No one‘s buying them. That means the Fed's eventfully gonna buy them.. (among other tricks like US style capital controls) Which is yield curve control. But not yet.

Why do bond yields matter more than the dollar buying power to them? Another good question, Zoltan Pozsar gave us a clue about this about six months ago when he said “they must defend the treasury’s.“ Credit worthiness is determined by how your bonds behave.

Which all implies if the US treasury gets downgraded at the credit agencies, then the global reserve asset that everyone holds will be sold more and more.. or bought less and less. So given the choice between a defaulting bond, or a weaker dollar, they will let the back part of the curve rise at first but not too much. Then they will prevent inflation from manifesting too much in the long bond, cap the yield, and weaken the dollar with YCC.

Simply put, credit matters more than currency right now.

Bottom line: if inflation persists and goes back up, they will need to sit on Long bond yields once they rise too much and let that pain migrate to and manifest in the actual currency. That is the basically why they do YCC. And it brings financial repression! And it is coming.

When no one knows. But probably when the credit agencies start to worry about our bonds getting dumped again. When Yellen starts doing another Buy Bonds PR routine likely.

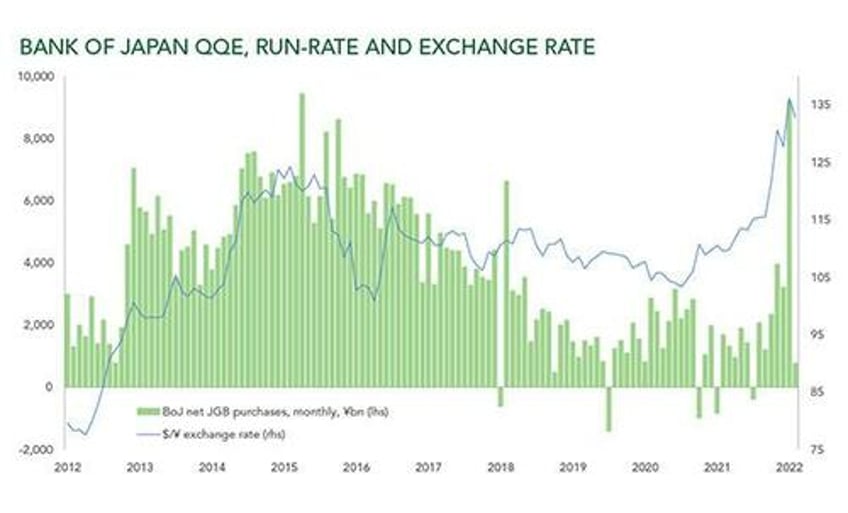

How long does YCC last? Let’s check in with Japan…

Japan YCC has been going on in earnest for 10 years…

Initially implemented to create debasement by forcing bond holders out of the JGB and into stocks, and thus foster inflation; now that inflation has arrived, it is used more and more to slow the JGBs rate rise, which further debases the currency.

What Negates the need for YCC? Frankly, the only real savior for the US from this eventuality coming here besides luck, is entrepreneurial ingenuity, once again. Things like AI, advanced, computer chips, innovations, that we haven’t thought of yet, they lift us out of this, make us productive, and the envy of every country on earth again.

But this time that brings another problem. That problem is unemployment would likely explode due to the nature of our debt and the mechanization of our economy. It’s a big big deal and that will either bring UBI or riots.

Cheers!

Related: Pozsar: "Keep an open mind or get financially repressed."

More here ...