After hotter-than-expected CPI and PPI (and various survey-based inflation expectations), today brings the Big Kahuna - The Fed's preferred inflation indicator, Core PCE - which is expected to show a dovish downturn (from +2.8% YoY to +2.6% YoY). And that is exactly what happened with headline PCE rising 0.3% MoM (as expected) and Core up 0.3% MoM (as expected). That pushed the YoY shifts lower on a sequential basis (Core PCE YoY at its lowest since June 2024)...

Source: Bloomberg

That is the biggest MoM jump in headline PCE since April 2024...

Source: Bloomberg

Core services prices - a closely watched category that excludes housing and energy - rose 0.2% from a month earlier.

Goods prices excluding food and energy were up 0.4%, the most since early 2023.

The so-called SuperCore PCE (Services ex-shelter) rose 0.2% MoM, dragging the YoY print down to 3.09% - its lowest since Feb 2021...

Source: Bloomberg

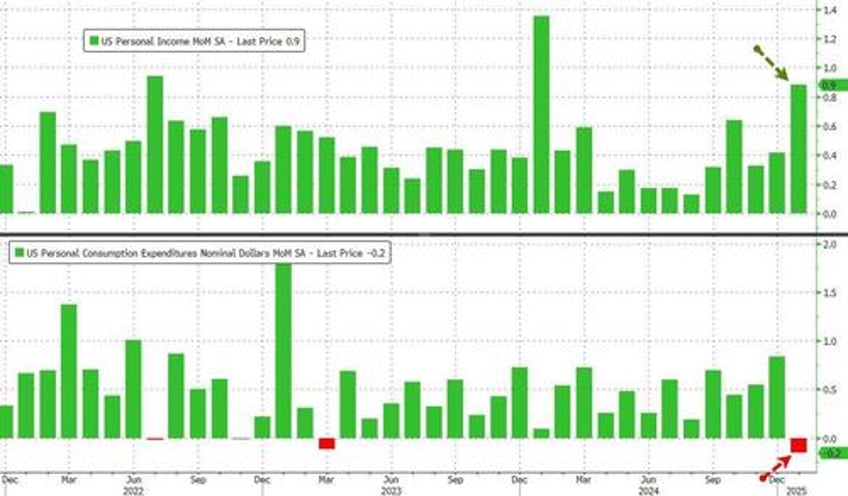

On the other side of today's data binge, Personal Spending tumbled 0.2% MoM in January (+0.2% MoM exp) even as incomes soared 0.9% MoM (+0.4% exp). That is the biggest drop in spending since Feb 2021

Source: Bloomberg

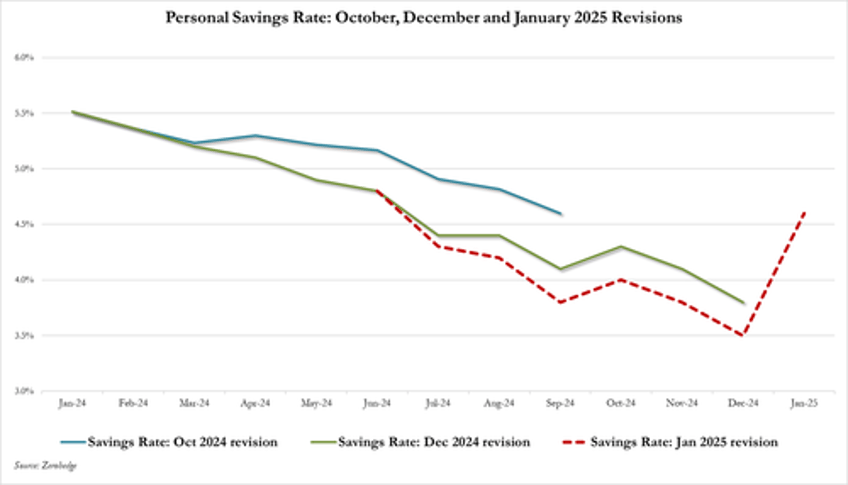

Sending the savings rate soaring (after all those revisions)...

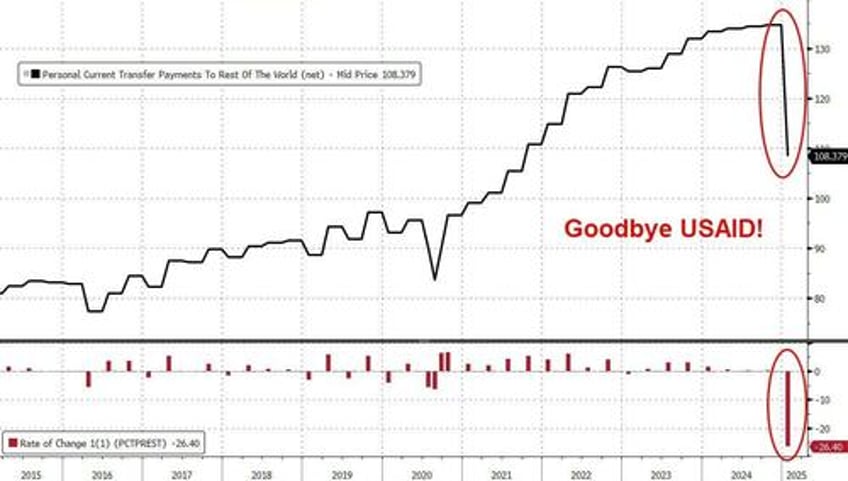

Where did the sudden jump in incomes come from? Why, the dear old government of course - transfer payments spiked over $80BN...

Source: Bloomberg

BUT - and it's a big but!!

Why the sudden plunge in spending?

Simple - goodbye USAID - and the billions of outflows to foreign nations...

Source: Bloomberg

The first step to fixing the US economy is here: US govt transfer payments "to the rest of the world" collapse (i.e. goodbye USAID), and the overall US savings rate soars

— zerohedge (@zerohedge) February 28, 2025

More of this. Much more of this pic.twitter.com/LHSTKDeXoC

Inflation-adjusted consumer spending fell 0.5%, marking the biggest monthly decline in almost four years...

Source: Bloomberg

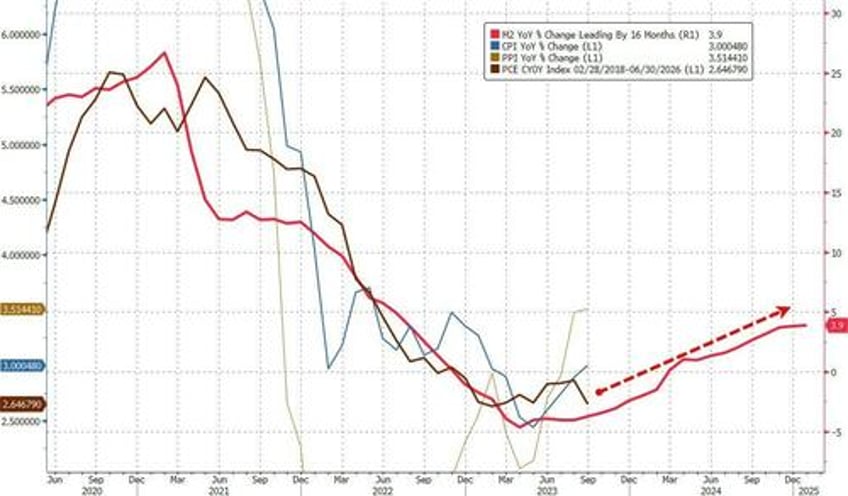

Finally, we note that PCE was the only one of the 'hard' inflation indices to drop in January...

Source: Bloomberg

How long can The Fed rely on this gauge with liquidity rebounding?