ZH: Reshoring US Gold "has nothing to do with Trump tariffs"

“[M]uch of the formerly freely available gold is now underground in New York…and it has nothing to do with Trump tariffs.” -ZH

“In Supply-Chain terms, Repatriation means re-shoring key assets to better secure a nation’s welfare, like Gold and Silver” - GF

1- Gold and Silver are Moving—And It’s Not Just Tariffs

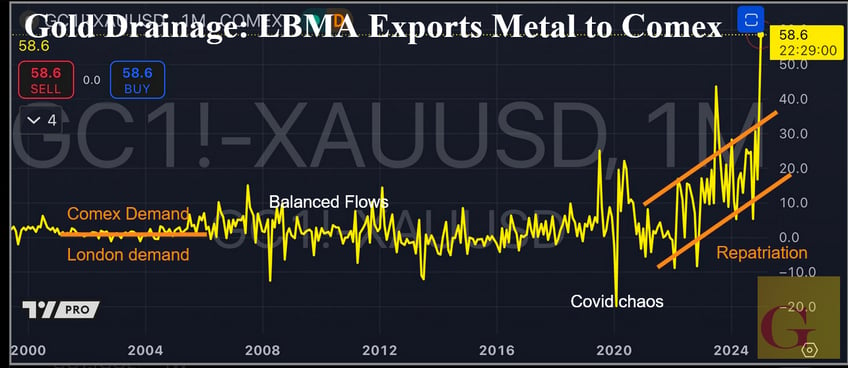

Gold and silver are being pulled into New York for reasons beyond tariffs. A new pipeline is now draining metal from the LBMA, just as another had already been pulling gold and silver toward China from the LBMA for years.Recently we labelled this phenomenon as repatriation.

Yesterday, ZeroHedge published a premium post on that issue.

2- Contradictions in the Official Story

The ZH post starts by questioning the official story out of London

The Financial Times (FT), usually indifferent to gold flows, made an exception this time. Their official explanation? Logistics. Too much gold moving too fast. Yet the same sources on their article also cite liquidity issues, a lack of free-floating gold, and the need to borrow from central banks.

Which is it? A temporary logistical issue or a shortage of metal?

Consider this contradiction from the same FT article as noted by ZH:

“The movement of gold needed to make its way into New York, that is basically what has been driving ‘stockpiling’,” said Joe Cavatoni, market strategist at the World Gold Council. “That is leading a lot of people to say, ‘we want to get ahead of it’, and that is driving the futures market into a premium.”

At the same time, the WGC official claimed:

“We are not getting a sense from the rhetoric from the administration that it intends to go after the monetary metals.”

If tariffs aren’t the issue, what’s the rush?

3- Gold Has Been Relocating for Quite a While

This isn’t new. The media ignored it, and bullion managers in London hoped it would go away. But it has been accelerating since August 2023, when the China premium emerged. China was first seen taking delivery of gold from the U.S. in October of that year.

In November 2023, we reported that a U.S. bullion bank facilitated this delivery. From Exclusive: China Took Delivery of US Gold Last

Now we can say here, that two unconnected sources [EDIT- One literally an FT person- VBL] confirm the delivery of Gold in China from the USA. One source with close Bullion bank ties stated: [T]he Chinese have definitely taken delivery of a bunch of physical New York gold in response to that arb.1

Despite this, U.S. demand for gold surged, likely to at first offset the outflow to China out of NY. But now it is overtaking China exports.

The bottom line: gold is being repatriated to the U.S.

4- The Data Confirms It

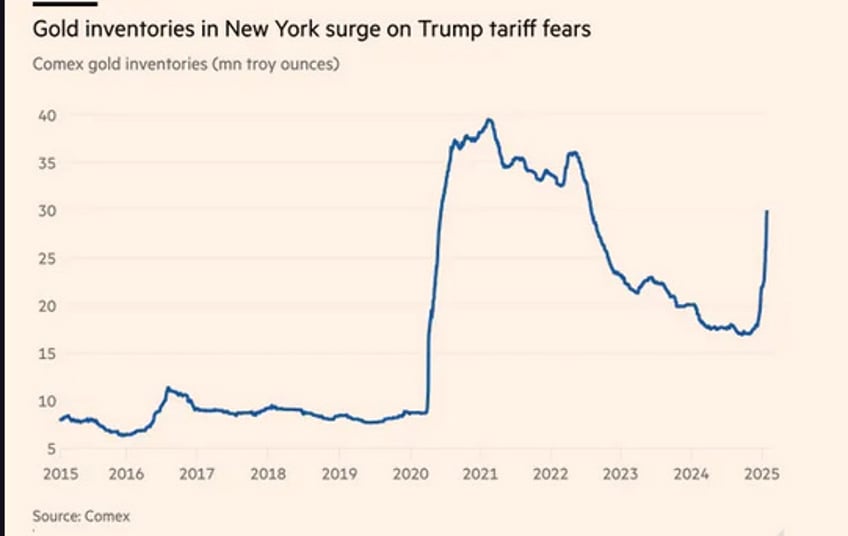

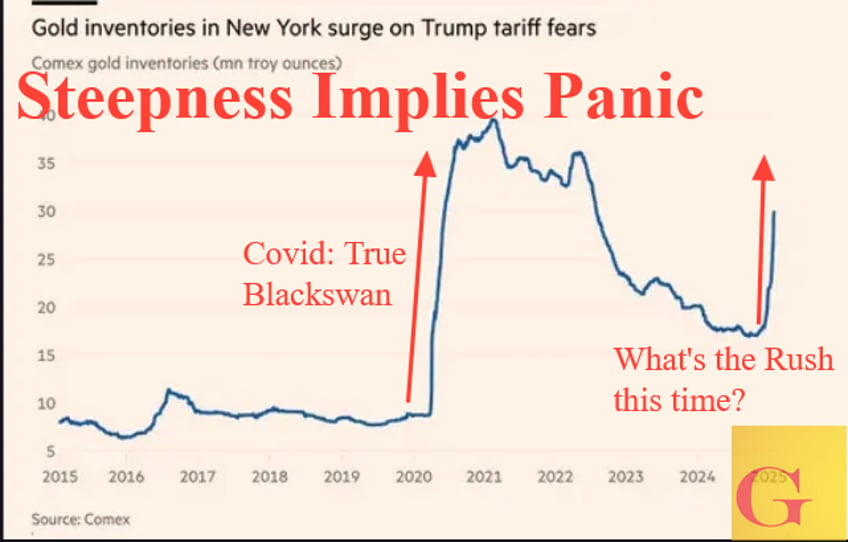

The two charts below shows this shift, reflecting COMEX demand vs. London’s physical supply. First we can see the change in metal stored using a chart provided by the FT itself.

Source: FT

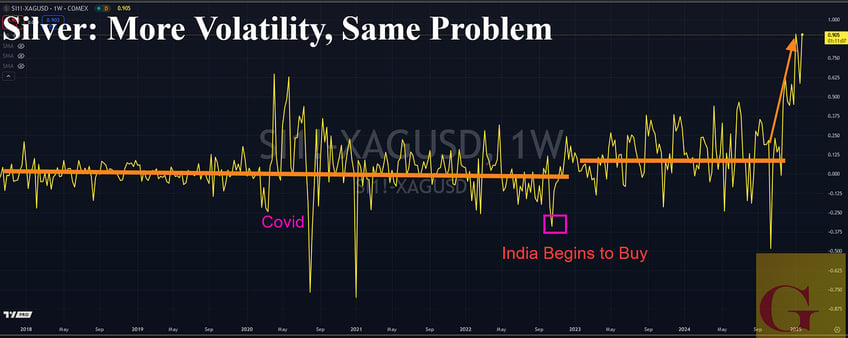

The same pattern can be seen in Silver as well despite the metal's higher volatility....

Focusing on Silver for just a moment: Bank of America just last week raised the point that Silver may become monetized again by Central Banks and Sovereign wealth funds which we covered just last week in a post published on Scottsdale Mint’s site.

Here is BOA's analyst quoted in Silver EFPs: The Canary in the Mine

"[S]mall shifts in central bank FX reserves could make a difference to the white metal: at current spot prices, the silver market is valued at around $30BN versus total foreign exchange reserves of $15TN. Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply."

We wonder if the monetary potentiality raised by the Bank is somehow related to Silver's also being reshored in light of the relentless significant China and Indian demand discussed in this space since 2022

Ultimately, since 2023 both Comex precious metals had been going in one door. But now, for some unspoken reason, the US has stopped making deliveries while accelerating its reshoring activities. The fresh incoming Gold and Silver are staying in NY. Why?

5- Legacy Media Misses the Point

The FT and others frame this new drainage event as a tariff-driven shift which provides a convenient scapegoat:

“Trump’s tariffs are why gold is leaving London.”

In reality, the volume of gold leaving the LBMA far exceeds what tariffs alone would explain. The U.S. is pulling gold back, just as China has been.

Tariffs were not a black swan event. They were seen coming for months. What’s more, it is not even certain the Tariffs will be levied to their full capability against bullion. Trump has already indicated a partial carve-out might be made for Oil

This kind of steepness is reserved for true panic repatriation. Tariffs on Canada and Mexico are not why this is happening. Something else has triggered Bullion repatriation. It is very hard to believe the Banks and their clients did not see this risk coming. It is more likely the onshoring of Gold and Silver has to do with what comes next combined with a fear that some of the Bullion held offshore may be encumbered unethically

6- Where the Gold Is Really Going

Next ZeroHedge highlights what we’ve also been saying: London’s gold pool is drying up. But ZH also notes the disparity in China's demand versus the US. They make a special point of noting media ignores the bigger picture—that gold has been flowing out of London to China at a far greater scale than to the U.S.for years

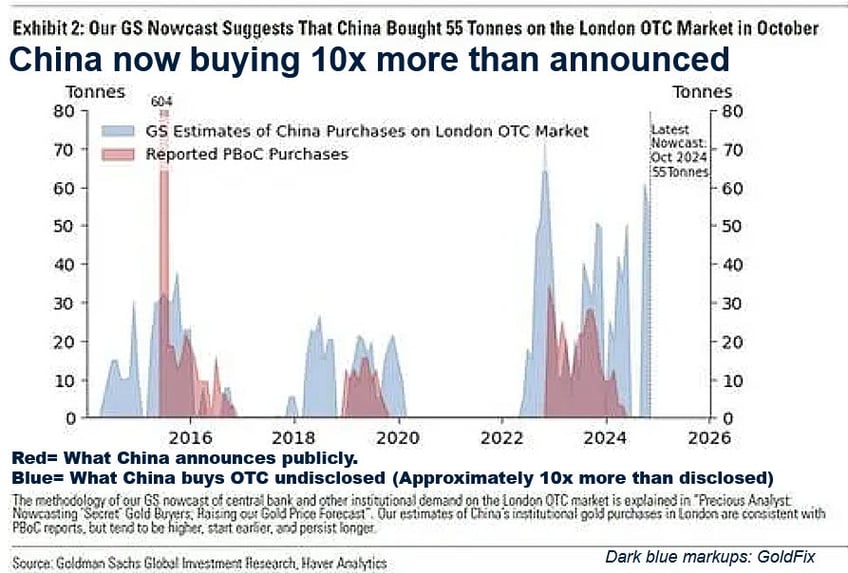

Since late 2024, central banks have ramped up gold purchases, pushing prices to $2,800 per ounce. The biggest buyer? China.

The China-tell is in this Goldman Sachs’ analysis, which shows China’s real demand far exceeds official numbers.

London’s role as the world’s gold hub is thusly fading. The LBMA's dealers have operated on the assumption that gold can always be leased. That model is breaking down. Basel III, deglobalization, and central bank accumulation are reshaping the market. Nations are preparing to use their Gold and Silver in Trade once again

7- Global Stackers: Repatriating Gold and Silver

The repatriation trend started in 2016 with Germany finally getting its gold back 3 years after asking for it, then the trend moved to China, India, and now the U.S. Everyone wants their gold back.

The LBMA is losing relevance as a centralized depository. Gold is going regional. The global order is shifting. And the East-West divide is now final, with assets being divided. Why? Because in a world where gold is tier-one capital, owning it outright matters. Stackers are indeed ascendant.

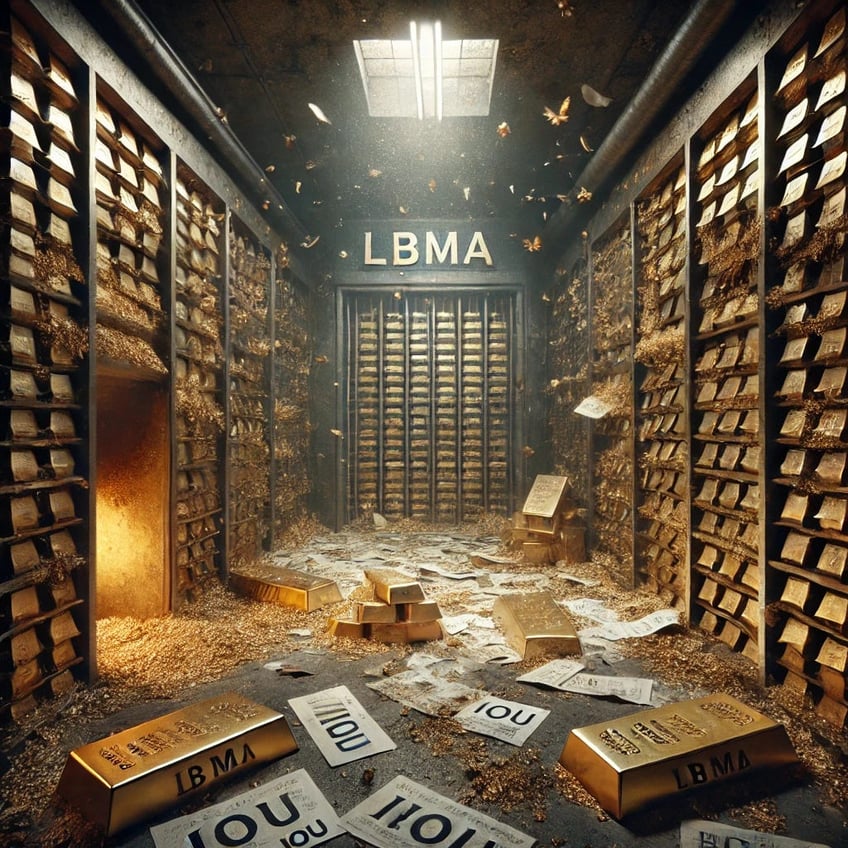

London’s Gold Pool is Running Dry

The rapid outflow of gold has raised alarms. Critics of the LBMA—long suspicious of double claims and commingled metal—are seeing their concerns validated.

We’re not saying London doesn’t have the gold. But the freely available supply looks much smaller than assumed.

We once said that Fort Knox, were it opened, might have nothing but Moths and half-eaten IOUs in it. It’s quite possible those IOUs and the munching moths are headed to London right now in exchange for the actual Gold and Silver.

Why is The Old System is Breaking Down?

In an era of Basel III, deglobalization, and rising demand for gold as money, the model of leasing and rehypothecation no longer holds.

The gold is leaving. The world is taking it home.

And the U.S. is no exception. Fort Knox jokes aside, the acceleration of this trend suggests something bigger is at play. The U.S. wants its gold back—just like everyone else.

8- Final Thoughts

Continues here unlocked