Commercial ties with China have poured capital, technology and know-how into this authoritarian state for decades

US needs to 'reindustrialize' to compete with China: Dr. Jonathan Ward

Atlas Organization Founder Dr. Jonathan Ward weighs in on China's recent aggressive tone towards the U.S. as it competes to become 'dominant superpower.'

In late March on Capitol Hill, the commander of the U.S. Indo-Pacific Command, Adm. John C. Aquilino, warned congressional leaders in clear terms of the growing military threat from the People’s Republic of China.

He emphasized that Beijing "has continued the most extensive and rapid [military] buildup since World War II." His words should have had clear and forceful impact across the United States, not only in the halls of Congress and around American dinner tables, but also in our C-suites and boards where American business leaders make decisions that will determine the future strength and security of the U.S. economy – and by extension, the future of our military power.

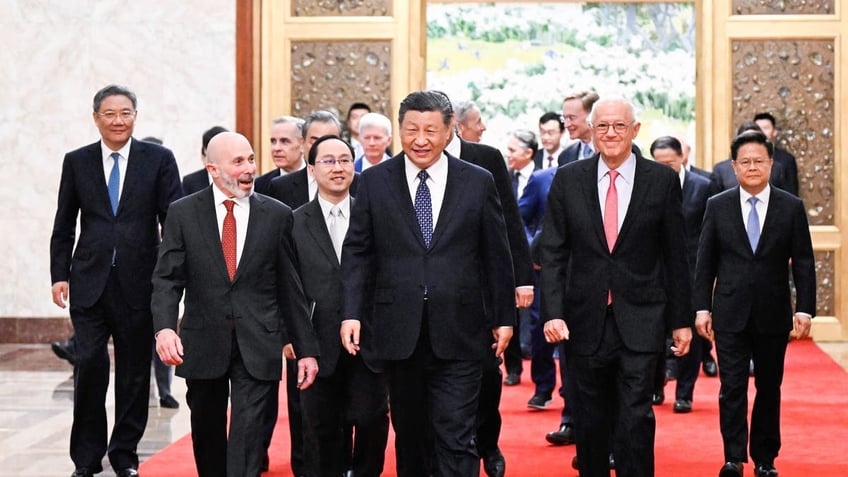

A week after Adm. Aquilino and other national defense leaders laid out a vivid update to the military challenge from China, American business leaders gathered in Beijing at the China Development Forum to explore further investment and expansion in the China market.

Chinese President Xi Jinping meets with representatives from American business, strategic and academic communities at the Great Hall of the People in Beijing, March 27, 2024. (Shen Hong/Xinhua via Getty Images)

There, American and European corporate leaders in a variety of strategic industries, including energy, pharmaceuticals, industrials, finance, and technology, met with Chinese Communist Party officials, including for some, a meeting with Chinese Communist Party Chairman Xi Jinping.

THE REAL DANGER OF DOING BUSINESS IN CHINA

According to the Wall Street Journal, an American corporate leader who is co-chair of the China Development Forum, "defended Chinese leaders’ prerogative to pursue their own vision of national security, but also emphasized the private sector’s critical role in helping China realize its goals."

Do the CEOs gathered in Beijing really understand the goals of the Chinese Communist Party? The contrast could not be starker when one compares the meetings in Beijing with the warnings of our military leaders.

As Aquilino testified on March 21 in Washington: "The PRC is the only country that has the capability, capacity, and intent to upend the international order. Even amid slowing economic growth, the PRC continues its aggressive military buildup, modernization and coercive gray-zone operations. All indications point to the PLA meeting President Xi Jinping’s directive to be ready to invade Taiwan by 2027."

Importantly, Aquilino also warned of the connection between Beijing’s military and its economic power: "The U.S. cannot spend its way to a position of preeminence as our economic and technological advantages over the PRC continue to narrow."

He had this to say as well about China’s economic power: "The PRC has helped Russia rebuild and reconstitute its defense industrial base, with real world battlefield impacts in Ukraine. Beijing has become the largest consumer of Russian oil and natural gas, essentially keeping the Russian economy afloat as it suffers from the economic consequences of its illegal invasion of Ukraine."

At the China Development Forum in Beijing, the forum’s American co-chair also stated that "China still needs capital, technology and know-how from the rest of the world." In other words – if one accounts for the broader strategic context – even as our economic and technological advantages over China "narrow," even as China’s military prepares for possible invasion of Taiwan, and even as the Chinese Communist Party helps to rebuild Putin’s military industrial base and keep his wartime economy afloat through trade, American businesses should continue to supply the Chinese Communist Party with capital, technology, and know-how.

There could be no more dangerous notion for the United States – not only for national security reasons, but also for the long-term interests of the very companies that gathered last week in Beijing.

Commercial ties with China have already poured capital, technology and know-how into this authoritarian state for decades. Indeed, the U.S.-China economic relationship transformed the People’s Republic of China into a superpower with an advanced military that now poses direct threats to the United States and our allies.

LEAKED DOCUMENTS EXPOSE ‘SHADY PRACTICES’ AT CHINESE HACKING COMPANY

Even today, American business remains a powerful factor in keeping capital and technology flowing into China, despite clear national security implications.

Xi Jinping, who also intends to keep American capital, technology and know-how flowing, understands that China is unlikely to reach its geopolitical goals without continued American investment. He had this to say to the business delegation: "It’s important to find things we agree on, while respecting our differences."

The corporate leaders who gathered in Beijing may believe that it is possible to separate business from national security or even that deepening commercial ties with China can help prevent a U.S.-China conflict.

But more likely, American investment will continue to play into China’s larger strategic programs, contributing not only to the erosion of our military advantages but also to the growing risks for our own companies both in the China market and beyond. For example, the rise of China’s corporate "national champions" that can compete fiercely against our own firms not only in China but around the world as part of the Chinese Communist Party’s broader economic strategy.

Our companies discount the geopolitical risks at their own peril. Additionally, the companies that gathered in Beijing represent case studies in every form of China-related business risk. Some may even be leading examples.

CHINA'S ECONOMY IS SICK AND COULD INFECT THE US

These risks include intellectual property theft, supply chain risk, sanctions and counter-sanctions exposure, revenue exposure, price competition both in China and in global growth markets, and many others, not least of which is the potential destruction of entire business models in the event of geopolitical conflict.

These will be increasingly important problems for corporate decision-makers that continue to focus on the China market. The consequences for shareholders could be very high.

It is not a stretch to anticipate that some of these companies just may not make it through this era of U.S.-China geopolitical competition. Unless, of course, they can see the bigger picture and change course.

CLICK HERE FOR MORE FOX NEWS OPINION

As our business leaders return from Beijing, they should contemplate some of the most important "differences" with their host, Xi Jinping, and the potential impact on the companies that they lead. This should include Xi’s focus on the largest military buildup since World War II and his repeated direction that China’s armed forces must "be able to fight and win wars."

There may still be time to move great American corporations out of harm’s way – to the benefit of both their shareholders and our national interests.

Jonathan Ward is a senior fellow at Hudson Institute where he conducts work on U.S.-China policy, with a focus on economics.