Latest White House effort would boost Biden with a $13.5 billion bailout of student loans

Washington Democrats have long used large federal spending and welfare programs to their political benefit. Until now, however, there have been few chapters in American history that could measure up to President Joe Biden’s brazen attempts to buy good will by unilaterally canceling student loan debt.

It is without historical precedent. Just weeks ago, the president unveiled new executive actions even after the Supreme Court shut down previous attempts to let people off the hook for their loans. His federal agencies have been working to make the student loan repayment process dysfunctional.

Let’s recap how we got here.

It wasn’t so long ago that canceling student loan debt was a far-left policy championed by progressives and trumpeted by Vermont Independent Sen. Bernie Sanders as he campaigned for president.

Student loan debt holders take part in a demonstration outside the White House to demand that President Joe Biden cancel student loan debt on July 27, 2022, at the Executive Offices in Washington, DC. (Photo by Jemal Countess/Getty Images for We, The 45 Million)

After Biden’s election in 2020, he took unprecedented executive action. In his first attempt at loan cancelation, he tried a multi-prong approach based on the premise that Americans were continuing to experience financial pressures from the COVID-19 pandemic.

President Donald Trump temporarily paused student loan repayment during the pandemic. Biden, however, extended this period long past any emergency we experienced. This extended period of non-repayment flooded the American economy with extra cash, fueling Biden’s inflation problem.

This didn’t last. Nebraska’s attorney general filed a lawsuit along with several other states, which went all the way to the Supreme Court. In a 6-3 decision, justices determined that the president had unlawfully used his executive authority, shutting down his first attempt.

Now, Biden is making another attempt and this time he wants to cancel debt for millions under what he’s calling the "SAVE Plan." His administration is moving quickly — the Department of Education quickly announced it is wiping $7.4 billion off the books under this new plan, and then they announced an additional $6.1 billion.

Nebraska is also stepping up and suing again. After Biden’s new announcement, our state joined a coalition of other states working to stop the Biden administration from making an end run around the Supreme Court.

The Biden administration’s attempts to give people a pass on student loans isn’t stopping with his executive orders. There’s more: The president isn’t just trying to let people off the hook for paying the loans they took out for college. His administration is actively trying to make it harder for contractors who service loans to ensure that they get paid back.

On the one hand, the Federal Student Aid (FSA) agency is paying contractors who service student loans less money and has acknowledged that the level of service for student loan holders will suffer as a result.

On the other hand, the Consumer Financial Protection Bureau — led by Massachusetts Democrat Sen. Elizabeth Warren’s disciple, Rohit Chopra — is using its enforcement authority to pursue these contractors for the reduced levels of service that are a result of those same FSA cuts.

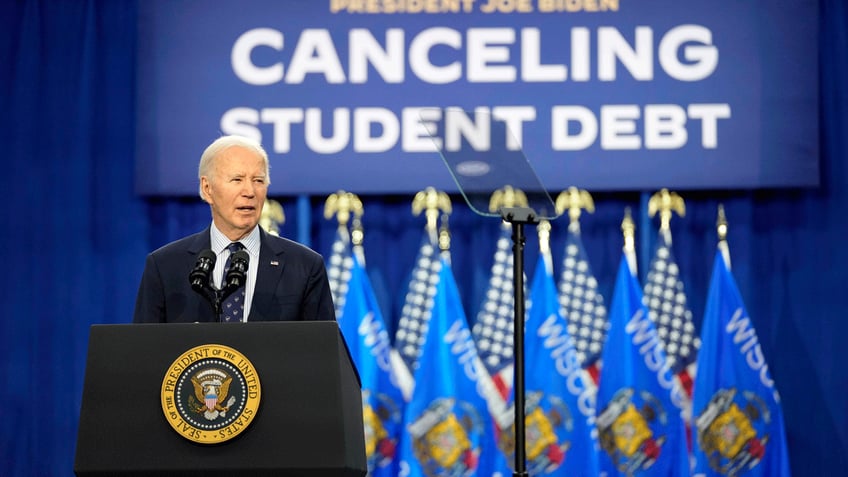

President Joe Biden speaks at an event about canceling student debt, at the Madison Area Technical College Truax campus on Monday, April 8, 2024, in Madison, Wis. (AP)

CLICK HERE FOR MORE FOX NEWS OPINION

It’s no surprise that many Americans have faced confusion about when their loans enter repayment. Instead of working to ease the path to repayment for borrowers, the administration is sowing confusion by undertaking a systematic attack on student loan servicing writ large.

Why do this? They’re making a bet that demonizing servicers will ultimately move public policy in the direction they wanted to take from the start: toward massive loan forgiveness and away from any sort of repayment.

Americans can’t let the Biden administration’s plan succeed. Unilateral student loan forgiveness is terrible policy for multiple reasons. First, it’s fundamentally unfair to Americans without a degree and those who have already paid their loans. They shouldn’t have to pay for someone else’s post-secondary degree.

The Biden administration’s attempts to give people a pass on student loans isn’t stopping with his executive orders. There’s more: The president isn’t just trying to let people off the hook for paying the loans they took out for college. His administration is actively trying to make it harder for contractors who service loans to ensure that they get paid back.

Second, the impact of student loan forgiveness fuels inflation and will only make Biden’s inflation problem even worse. And third, the Biden administration has opened a Pandora’s box by forgiving non-emergency loans on a widespread basis. What happens when the far left starts clamoring for more? We can’t simply hope that Biden or a future progressive leader will draw the line here.

It’s time for America to show restraint. We need a return to principled fiscal policy from the White House that encourages Americans to exercise personal fiscal responsibility — a responsibility that underpins the health and success of the American free enterprise system.

CLICK HERE TO READ MORE FROM REP. MIKE FLOOD

Rep. Mike Flood, a Republican, represents Nebraska's 1st Congressional District.