With $4.4 trillion in revenue, US could manage a sane budget, but Democrats want to tax and spend

The Democrats are telegraphing their next financial move: they want to tax your wealth. From provisions of President Joe Biden’s budget proposal to Massachusetts Democrat Senator Elizabeth Warren’s re-proposal of a wealth tax only for the wealthiest, it’s clear that we need to remain vigilant against this nefarious obsession.

Last fiscal year, the U.S. took in as "revenue" (primarily in taxes) north of $4.4 trillion. This is a staggering amount that is hard to get your head wrapped around, so let me provide some context. This amount is more than the entire GDP of every single country on earth other than the U.S. and China.

With $4.4 trillion in revenue, if the government had kept their spending levels equal to FY 2019 spending, the U.S.’s yearly financial position would be about break even; FY 2018 spending levels would put us in a surplus.

IRS SAYS 940,000 PEOPLE HAVE NOT CLAIMED EXPIRING 2020 TAX REFUNDS TOTALING OVER $1B

The reality is that the government does not need any more money. It does, however, need to be severely restructured and downsized.

Sen. Elizabeth Warren, D-Mass., is pushing for a tax on the super wealthy. But it won't stay that way. (AP Photo/Jacquelyn Martin, File)

Despite that, the government keeps spending trillions of dollars in excess of the trillions they take in each year and are looking for more ways to pay for their spending wish list.

When entities get bigger, there should be some economies of scale — in layman’s terms, getting more bang for your buck. With our government, as it gets larger, we use more buck for very little bang. While their spending has created an unsustainable fiscal path and a severely fractured financial foundation, you and your family are not made better off by this spending.

As spending has increased, the safety of our country has been threatened by a porous border, which has let more than 7 million illegals into the U.S. under Biden’s administration alone. Dangerous drugs are also making their way into the country, accounting for more and more deaths. Our infrastructure remains in disrepair.

Financially, the policies enacted by the government and the Fed have continued to destroy your purchasing power, with Americans suffering through the effects of inflation that reached a 40+-year high in the last couple of years and continues to run above the targeted level.

All the while, the government continues to rack up debt, and it was estimated late last year by the Heritage Foundation that 40% of personal income taxes are being consumed just by interest payments on that debt.

Today, we don’t have a financial cushion for any emergencies. And as the government continues to spend irresponsibly, they will continue to erode the value of what you earn.

In any business around the world, management outcomes like this would not only get the individuals fired, but they would likely be so ridiculed they wouldn’t be able to find another job in their industry.

Yet, the same people keep getting put into government positions.

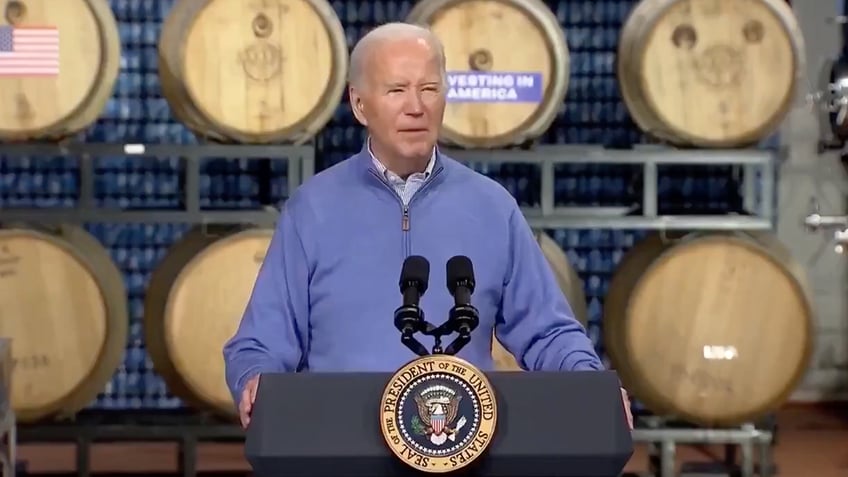

President Joe Biden has embraced the Democratic Party strategy of taxing more and spending more. (Screenshot/Biden speech)

With the U.S. financial situation being precarious and the politicians’ desire to gain more power at your expense increasing, the money needs to come from somewhere. So, Biden, Warren, Vermont Independent Sen. Bernie Sanders, et al., are trying to float the wealth tax again to see if they can trick people by saying it is targeted at the wealthy.

It’s reminiscent of when the government wanted to monitor and report $600 Venmo and Etsy transactions "for the billionaires."

The reality is that the middle class has trillions of dollars in hard-earned wealth tied up in 401(k)s, pensions, homes, businesses and other assets. That’s money that politicians see and are salivating over to expand their government directives.

CLICK HERE FOR MORE FOX NEWS OPINION

They hope that they can pass off lies like the White House’s assertion that the wealthiest pay single-digit tax rates (based on their own misleading study of unrealized wealth estimates, not income). And they want to ignore that, per recent data, the wealthiest 1% paid almost 46% of all federal income taxes paid and the top 10% paid nearly 76%. Their class warfare propaganda trumps basic financial literacy and common sense.

In any business around the world, management outcomes like this would not only get the individuals fired, but they would likely be so ridiculed they wouldn’t be able to find another job in their industry. Yet, the same people keep getting put into government positions.

If they can get the population to agree to tax wealth for the billionaires, it will soon spread to the middle class, much like the way the income tax was only supposed to be a temporary tax aimed at the wealthiest Americans. How did that work out?

Not to mention that if those who own businesses are forced to sell their ownership stakes to pay the government, the entire stock market could collapse. But, as we noted, finance and economics are not their strong suits.

Don’t concede your property rights, which are your natural rights and what the prosperity of individuals in America is based upon.

Creating wealth is an infinite opportunity. Redistributing wealth is a finite exercise.

CLICK HERE TO READ MORE FROM CAROL ROTH

Carol Roth is a former investment banker, entrepreneur and author of the new book "You Will Own Nothing" Broadside Books. Her previous books are "The War on Small Business" and the New York Times bestseller "The Entrepreneur Equation."