Kamala Harris' tax plans are a giant leap toward socialism

Alfredo Ortiz: Biden-Harris administration is out of touch with American public

CEO of Job Creators Network Alfredo Ortiz argues Kamala Harris is 'out of touch' with what is causing high costs under the Biden administration and calls out her price-fixing plan.

Gov. Tim Walz says a Harris administration would have no place in Americans' bedrooms. But judging by what we know from the Harris tax plan, it would have a bigger place than ever in our wallets and bank accounts.

Harris is proposing a $5 trillion tax increase, the biggest in American history. If passed, it would fundamentally reshape the American economy and the scale in which the government extracts funds from citizens. Her plans include:

Raising the corporate tax rate from 21% to 28%: This 33% tax hike would make American businesses less competitive globally. Combined with state levies, it would make American corporations among the highest taxed in the developed world. The country would return to the bad old days of corporate inversions, where businesses flee offshore to reduce their tax costs.

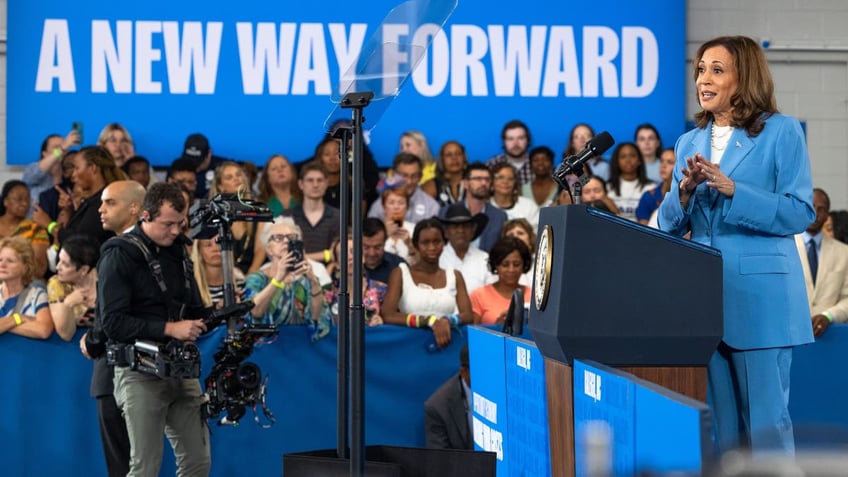

Vice President Kamala Harris speaks on her economic policy at the Hendrick Center For Automotive Excellence on Aug. 16, 2024 in Raleigh, North Carolina. (Grant Baldwin/Getty Images)

Economists and common sense say workers and customers pay for such corporate tax hikes because companies are forced to lower wages and increase prices to fund them. More than one million American small businesses file as corporations, so this tax hike wouldn't only hit massive corporations like Google and Apple as the Harris campaign implies.

KAMALA HARRIS AND HER TWO SOCIALIST PROPOSALS TO CRUSH THE US ECONOMY

Raising the capital gains tax rate to match the personal rate: This move would nearly double the capital gains tax rate, creating a huge disincentive to invest in America. Access to credit would further decline, and equity prices that ordinary Americans depend on for their retirement would plummet.

Harris overlooks the good reasons investment income is taxed at a lower rate. For one, it is not indexed to inflation, so investors already face a significant inflation tax on their appreciation. For another, investment income is already taxed at the corporate level, so it deserves to be taxed less when distributed to minimize double taxation.

Ending the step-up in basis for estates: Harris wants to end the tax-free transferring of most estates and treat death as a taxable event for capital gains purposes. This is a massive attack on baby boomers planning their wills and dramatically reduces what they will be able to pass down to their heirs.

This plan would prevent many small businesses and family farms from passing down their properties. Consider a business or farm that has appreciated from $100,000 to $1 million over the last generation. Many heirs could not afford the associated tax hit of several hundred thousand dollars and would have no choice but to sell to generate the liquidity needed to pay.

Harris' plan attacks a primary aspiration of many small business owners: the opportunity to create generational wealth.

Taxing unrealized capital gains (aka a wealth tax): Harris wants to fundamentally change how taxes are calculated by taxing paper gains in property and investments before they are realized. Such a move would tax expected profits that may not actually materialize if the market falls. Think of the massive penalty to investors in companies like Pelaton (stock price down 98%) or WeWork (delisted after bankruptcy) that would be taxed on phantom gains that never materialize.

Small business owners who work for decades to increase the value of their business would be hit with major tax bills year after year as punishment for this appreciation. Ordinary Americans would see their retirement accounts decline as investors pull out of public markets.

CLICK HERE FOR MORE FOX NEWS OPINION

Allowing the Tax Cuts and Jobs Act to expire: Harris opposes the Tax Cuts and Jobs Act of 2017 and plans to let it expire as scheduled at the end of next year. This would create a massive tax increase for Main Street, which would have to say goodbye to a 20% small business tax deduction, immediate expensing of capital, and lower tax rates.

The TCJA led to historic shared economic prosperity in 2018 and 2019, and it has allowed many small businesses to weather the Biden-Harris storm. The tax hike that would accompany its elimination would be the final straw for many small businesses.

These are just some of the tax hikes a Harris administration would seek. Harris also wants to increase the top marginal personal rate to 44.6% and quintuple the stock buyback tax.

Harris' tax plans are a giant leap toward socialism, especially when you consider how they'd be expanded to more and more taxpayers once implemented.

It's up to political independents, who may disagree with Republicans on some issues, to vote conservative this election to prevent this tax Armageddon from occurring.

CLICK HERE TO READ MORE FROM ALFREDO ORTIZ

Alfredo Ortiz is president and CEO of Job Creators Network, author of "The Real Race Revolutionaries," and co-host of "The Main Street Matters" podcast.