Greedy schools have benefited enormously from the $1.7 trillion student debt crisis

Biden approves $7.4 billion student loan debt cancelations

The 'Fox & Friends' co-hosts discussed the fallout from the student loan handout plan, which will cost a whopping $84 billion as Americans battle the sky-high cost of living.

After his first attempt at large-scale student loan forgiveness produced a last-minute surge of young voters to the polls in the 2022 midterms before it was struck down by the Supreme Court, President Joe Biden is trying the same trick again in 2024. In swing state Michigan on April 8, the president unveiled another plan to unilaterally reduce or eliminate the loans of 23 million undergraduate and graduate borrowers.

In announcing what is now a third round of student loan forgiveness after a more minor middle attempt, the Biden administration is performing a cynical dance for young voters: vote for me now and blame the courts when this latest gambit to avoid Congress pulls the rug out from under them. But because Republicans have advanced no serious alternative that addresses the growing student loan crisis, the oldest demagogue trick in the book is likely to succeed.

The student debt crisis is very real — $1.7 trillion and counting — and derives from a simple truth: the value of a college degree has not kept up with the skyrocketing cost of tuition. College costs have soared well above already-inflationary middle-class staples like health care and grocery bills for decades, a rise fueled by generous government loans and grants, as well as the greed of the universities themselves, even when labeled "nonprofit."

Universities have used that taxpayer-funded boom to hire disproportionate swarms of administrators and bureaucrats, as well as to construct fantasy-like facilities, like lazy rivers and rock-climbing walls, alongside classes on Harry Potter to attract the next graduating class of hapless 18-year-olds.

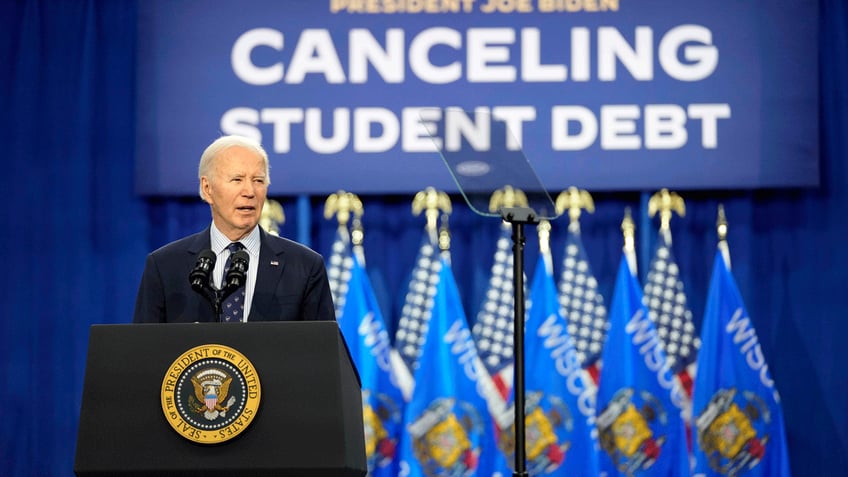

President Joe Biden has repeatedly tried to buy votes with student loan bailouts. Here, he speaks at an event about canceling student debt, at the Madison Area Technical College Truax campus on Monday, April 8, 2024, in Madison, Wis.

The same combination of federal incentives and lack of institutional scruples has led universities to drop academic standards for admission, to the extent that only 60% of incoming freshmen end up graduating in six — not four — years.

Four in 10 find themselves in the unenviable position of having college loans but no degree, a situation that predictably often leads to default. If it were private banks making these six-figure loans to 18-year-olds for trips to Machu Picchu, everyone would recognize the scheme as predatory, but for some reason universities get left off the hook. And private banks are basically nonexistent in the student debt market, where the federal government holds 93% of all loans.

All this has worked out well for universities, some of which have been able to build endowments the size of top-10 hedge funds, but badly for everyone else. Graduating high school students face Hobson’s choice between taking out ever-higher loans for degrees stagnating in value, or facing a shrinking market for jobs that don’t require a credential.

The latter pool is shrinking less because entry level positions that didn’t require a bachelor’s 20 years ago suddenly discovered how much better a receptionist with a Queer Studies degree performs, and more because employers have been forbidden, under regulatory expansions of the Civil Rights Act never intended by its authors, to administer virtually any other assessment of basic competency.

Simple screening tests asking potential employees to prove some level of aptitude for the tasks of the job produce a "disparate impact" on the racial group level, a reality unforgivable to the DEI crowd. It’s a rigged system aptly described by legal scholar Gail Heriot, who holds a longtime position on the U.S. Commission on Civil Rights, as an interpretation of the law that "makes almost everything presumptively illegal."

Everything, that is, that the EEOC, the committee made up of unelected bureaucrats who govern the application of Title VII, chooses to look at. Conveniently, the EEOC has never applied that same disparate impact lens to $100,000 college credentials, which also produce racial disparities alongside burdensome debt.

Coupled with degree inflation, escalating government loans, and the increasing academic unseriousness of universities themselves, this dynamic has produced a kind of "credentialing treadmill," which forces young Americans to take out more and more debt in order to stay in place, getting the same jobs their parents did without six-figure loans.

It’s a treadmill that’s unsustainable, which is why if Biden’s first unconstitutional attempt at forgiveness had succeeded, we would be back at the current level of debt crisis in a mere four years.

Supporters of student debt forgiveness demonstrate outside the Supreme Court on June 30, 2023, in Washington, DC. (Photo by OLIVIER DOULIERY/AFP via Getty Images)

Loan forgiveness without reform of the system and without giving universities any reason to provide a better value for a lower cost, as the Biden administration proposes, is a temporary band-aid; an extremely unfair one to the millions of taxpaying Americans who either did not go to college or have painstakingly paid off their loans who now find themselves stuck with the bill.

But, as with any scheme to rob Peter to pay Paul, it’s popular with the desperate young voters starting out in life with a debt burden that would have been unthinkable a couple decades ago.

CLICK HERE FOR MORE FOX NEWS OPINION

The reality is that college cost and the attendant debt catastrophe are not going away, and affect millions of Americans — Americans who vote. Democrats will continue to cynically use public debt giveaways to bolster their poll numbers while doing nothing to address the underlying problems in higher education.

The only fair solution is to place the bill — a bill which is currently looming over taxpayers whether we like it or not — where it justly belongs, with the universities that have profited generously from a system that leaves everyone else indebted or on the hook.

Republicans should propose debt forgiveness and restructuring for the same borrowers the Biden administration is appealing to, but instead of asking the mechanic without a four-year degree to pay the check, they should pay it by raising the tax on university endowments, and closing loopholes around other university moneymaking enterprises.

Unlike any of the three forgiveness plans from the current administration, this solution would not blow a hole in an already deficit-laden federal budget, nor would it ask economically struggling Americans to dig into their own pockets to pay off the loans of others.

Even more importantly, tying the university sector itself to the problem of student debt would finally force higher ed to put some skin in the game, and provide a sharp incentive to take responsibility for the debt burdens of their graduates.

The same combination of federal incentives and lack of institutional scruples has led universities to drop academic standards for admission, to the extent that only 60% of incoming freshmen end up graduating in six — not four — years.

Since the 1960s, we have been lavishing benefits and honors on universities, and the government has been spending trillions in service of sending as many people through their halls as possible. Universities have proven themselves wholly unworthy of that special treatment.

Instead of cynical stopgaps and election-year ploys, we should deliver real debt relief to millions, not from one group of citizens to another, but out of the pockets of the universities that have become rich selling a product that’s bad for their students and bad for America.

Inez Stepman is a senior policy analyst at Independent Women’s Forum (iwf.org) and the host of "High Noon" podcast.