Biden's failure negotiating with the OECD has weakened the US's economic standing

It’s been said that there are two things certain in life: death and taxes. With Joe Biden as president of the United States, you can also be sure that you will be paying more than your fair share of the taxes you owe.

Americans have already been crushed by inflation caused by the Biden administration. But now, they want to add fuel to the fire by giving American taxes to foreign countries, raising costs for Americans, and sticking us with the bill for funding a global socialist agenda.

Over the past two years, President Biden and Treasury Secretary Janet Yellen have negotiated a global minimum tax through the Organization for Economic Co-Operation and Development (OECD). This organization surrenders America’s sovereignty over our tax code and allows foreign countries to take our taxes that were meant for our own essential programs and military.

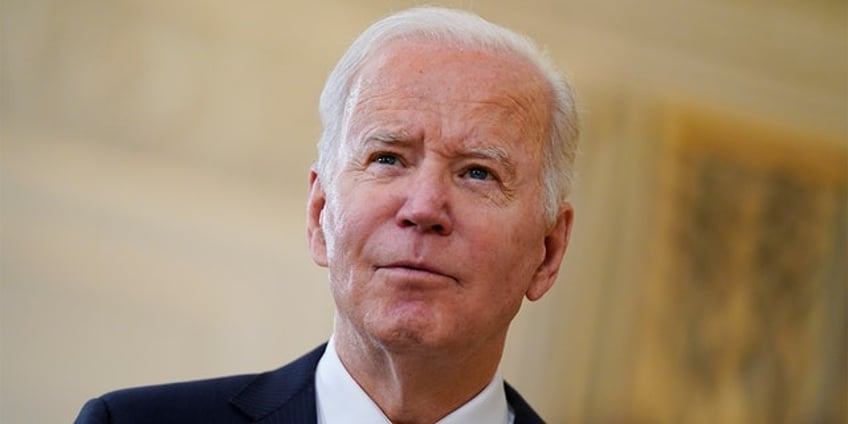

President Biden and Treasury Secretary Janet Yellen have negotiated a global minimum tax through the Organization for Economic Co-Operation and Development (OECD). (AP Photo/Evan Vucci)

In short, Biden and Yellen were failures in their tax negotiations. Now Republicans in Congress must clean up their mess.

BIDEN'S GLOBAL TAX SURRENDER HURTS US BUSINESSES, WORKERS, ECONOMY. HERE'S HOW

At a time when the United States is actively vying to stay competitive in a rapidly evolving global economy, allowing American businesses to be subjected to mandatory foreign taxes that would pay for woke, green policies in other countries are irrational and absurd.

"Globalists" will tell you this is better for the American economy. They are wrong.

The Founding Fathers purposely entrusted Congress with developing our country’s tax code. We will not cede that authority to unelected global bureaucrats, as President Biden wants to do.

As our debt crisis is looming, the United States should be focused on putting money back into our economy, instead of funding other countries’ pet projects. I can guarantee that as long as Republicans have the majority, we will never approve of Biden’s terrible deal.

With the failure of the current negotiations with the OECD, the United States’ economic standing was drastically weakened. China is laughing at our weak leadership for subjecting our own people to global socialism. While the Biden administration continues virtue signaling through misguided policy making, America falls further behind our adversaries.

Until last year, the United States was the only country in the world with a global minimum tax. Here at home, U.S. corporations already face a 21% tax rate. Congress has a long history of using the tax code to incentivize certain behavior from businesses and individuals.

We cannot give up our right to use the tax code to promote our own interests. If we force businesses to pay taxes to other countries, America’s economy will shrink while other countries’ will grow.

All 25 Republicans of the Ways and Means Committee sponsored the Defending American Jobs and Investment Act. This bill requires the Treasury Department to identify taxes enacted by foreign countries that attack U.S. businesses, like the Undertaxed Profits Rule (UTPR).

The UTPR’s goal is to force countries to enact the OECD plan for global socialism and collect more tax dollars from American businesses. The OECD is actively working against American interests, even while the United States funds 20% of its yearly budget. Republicans in Congress have promised to end all funding for the OECD if it continues along this dangerous path.

Treasury Secretary Janet Yellen listens as President Biden speaks to reporters before the start of a Cabinet meeting at the White House on March 3, 2022. (Anna Moneymaker/Getty Images)

Why does the Biden administration insist on increasing taxes for the American people?

In a previous Ways and Means Committee hearing, I warned that any country that has implemented the UTPR will suffer the consequences. As history as shown, American’s don’t take kindly to taxes by foreign countries. We will continue to fight against the OECD’s socialist policies that take money illegally from American taxpayers.

Illegal taxation from countries that claim to be our closest allies violates numerous treaties and international norms. Unnecessary taxation is theft. The Ways and Means Committee will implement a needed check on the Biden administration to stop them from taking more tax dollars and giving them to foreign countries. I will continue to fight for the America First agenda.

CLICK HERE TO READ MORE BY REP. CAROL MILLER

Republican Carol Miller represents West Virginia's Third Congressional District in the U.S. House of Representatives.