President Trump is billions of dollars richer after shareholders in Digital World Acquisition Corp (DWAC) on Friday approved a merger with Trump's media startup, Truth Social.

The long-delayed merger adds roughly $3.5 billion to Trump's net worth - however the former president won't be able to sell any shares for at least six months unless the board waives it (or they can back a loan), raising questions over whether he'll be able to leverage it to secure a $464 million bond in his New York civil fraud case - which his lawyers say is "impossible" to secure due to a lack of cash on hand.

If Trump can't secure the giant sum by Monday, he risks the seizure of assets - which New York has already begun positioning itself to do.

Earlier this week, DWAC sued to force its former CEO, Patrick Orlando, to vote his 14.77% shareholding in favor of the merger, despite an ongoing dispute over compensation, Axios and FT report. Orlando was on the shareholder vote call.

"The professional relationship between Mr Orlando and Digital World became strained and has continued to deteriorate such that there is no assurance that Mr Orlando as a current member of our board or as a controlling affiliate of the sponsor will be co-operative," DWAC warned in a filing last month.

Following the merger, DWAC will effectively cease to exist, and will be replaced by TMTG - which will be listed on the Nasdaq. Its board of directors will include Donald Trump Jr. as well as several former members of the Trump White House, the report continues. Former Rep. Devin Nunes (R-CA) will serve as TMTG's CEO.

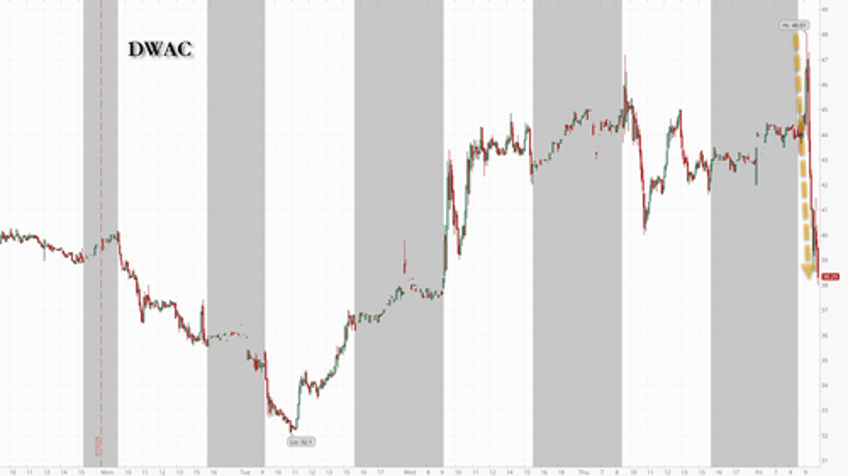

Meanwhile, and perhaps in anticipation of Trump selling to satisfy the bond, DWAC shares have plummeted on the news to the tune of 8% in early trading.

Beyond Trump's massive payout from the deal, three hedge funds also stand to make huge profits - Anson Funds, Mangrove Capital Partners and All Blue Capital, which participated in a $50mm convertible debt offering earlier this year after other funds had walked away. They're sitting on over $400 million in gains as of Thursday's closing price.

"The return will be amazing," said one person involved in the financing, per FT. "Trump’s advisers have been keeping him on the sidelines . . . they want to get this vote clear with no issues with the government. Then, on Tuesday when it starts trading, it is game on for Trump."