By Michael Every of Rabobank

A funny thing happened on the way to the rate cut

Pre-US CPI data yesterday, a friend bemoaned how monomaniacal markets are about “RATE CUTS!”, ignoring all else in their fixation on when the Fed, which doesn’t know what economy looks like now or ahead, will finally lower the official cost of borrowing, which has already plunged in the real economy, and with this FOMC act maybe not have anything to do with underlying inflation drivers anyway.

“Wouldn’t it be funny,” they said, “If CPI came in hot to mess up the narrative?”

“Well,” I replied, “Headline inflation won’t, but we might get something higher in core.”

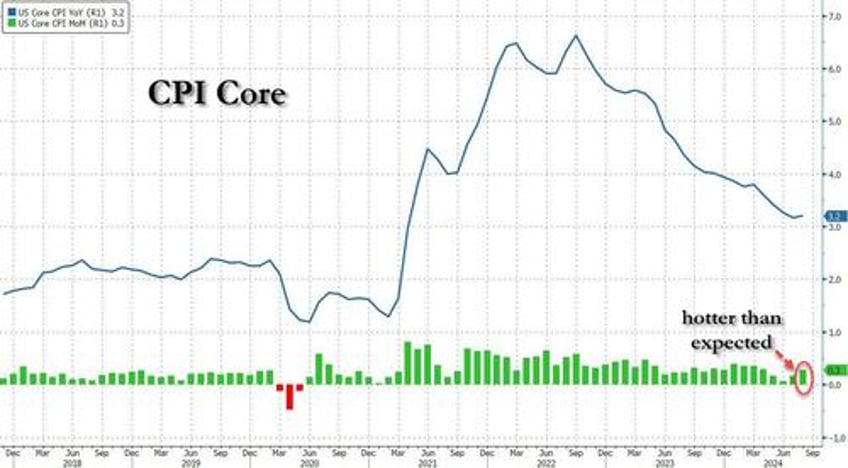

Many a truth is spoken in jest. And the odd lucky forecast. Because headline CPI was 0.2% m-o-m as expected and 2.5% y-o-y, down from 2.9%, but core CPI was a tick higher at 0.3% m-o-m and stayed at 3.2% y-o-y. Moreover, shelter inflation started to move higher again after a long decline. So, already high core inflation edging up, and headline inflation flattered by deep goods deflation due to China flooding the world with cheap goods, prompting tariffs, and threatening inflationary trade wars to come. Clearly, time to cut rates then! (ZH: something we first wrote about a month ago in "Powell Vows To Cut Rates With Stocks, Home Prices, Rents And Food At All Time Highs"). True, there’s a case for “RATE CUTS!” on the back of the ongoing commodity slump. However, what we are seeing there implies China is collapsing (which it isn’t), or the world is (is it?), or there’s more unwinding of Yen carry trades into commodities that can’t last forever. (As BOJ chatter today pushed JPY up again.)

Our Fed watcher Philip Marey has had a punchline with a punch for months: the Fed will cut 25bp, not 50bp, in September; but because of “stag”, like weak payrolls, not low “flation”. The latest CPI report not only makes that clear, but the potential risks of the Fed getting this all wrong and looking like clowns in 2025. (The ECB are going to cut 25bp today too: see here for more.)

A funny thing happened on the way to the election

In yesterday’s coverage of the US election ‘debate’ I noted Harris had won – albeit in a Pyrrhic sense given nobody, including the moderators, walked away with their reputations enhanced. Since then, the market has further priced out ‘Trump trades’. However, we’ve also seen a further set of pre-debate polls showing a tied race or slim Harris lead (with Democrat over-weighting), and one with a strong Trump lead. More importantly, we’ve seen very mixed feedback on what crucial undecided voters in swing states thought of the debacle.

Underlining NOT ALL VOTERS THINK LIKE MEDIA, POLITICAL, OR MARKETS COMMENTATORS, some data show Harris did best with undecideds, some a 50-50 split, and others a real lean towards Trump. Indeed, on the economy and the border, Trump polled significantly better: we shall have to see if voters put the cost of what they eat or “eating cats and dogs” first.

#New winning chance Model - Nate Silver

— Political Polls (@PpollingNumbers) September 11, 2024

🔴 Trump 62%

🔵 Harris 38% pic.twitter.com/g2NE0eJepP

Republican Vice-Presidential nominee Vance made a point markets should note on CNN when it took the ‘eating pets’ angle for another walk: the media (and markets) showed zero interest in the travails of Springfield, Ohio --whose population leapt by a third via a White House-led influx of Haitian immigrants-- until the “cats and dogs” (and ducks and geese) meme started spreading, which it then used to dismiss the underlying issues rather than address them. Haven’t we seen this before? And what was the punchline then?

A funny thing happened on the way to NATO

Meanwhile, Germany underlined why neither its comedy nor its diplomacy is funny, but its ‘geostrategy’ sadly is. After mocking Trump in public in the past when he warned them about relying on Russian gas and being NATO skinflints, and being proved humiliatingly wrong, a different German government seeing deindustrialisation, its auto industry being eaten by China – as it lobbies to NOT put more tariffs on Chinese EVs(!), and rising populism; and which is still a NATO skinflint that thinks roads and bridges are weapons, won’t fund Ukraine, and just shot down the only thing it’s capable of – Draghi’s reform plan to save Europe from “slow agony”, just allowed its foreign office to tweet the following in reply to Trump name-checking the country’s energy policies on Tuesday night:

“Like it or not: Germany’s energy system is fully operational, with more than 50% renewables. And we are shutting down – not building – coal & nuclear plants. Coal will be off the grid by 2038 at the latest. PS: We also don’t eat cats and dogs. #Debate2024”

A comedian might reply that Germany is shutting down lots of things. Lots more than they think might be off the grid by 2038 at the latest. PS: If Trump wins, Germany will be eating crow.

A funny thing happened on the way to the BRICS

BRICS-member Brazil won’t recognise the results of the presidential election in BRICS-applicant Venezuela. BRICS-member Egypt just sent 10,000 troops to Somalia as BRICS-member Ethiopia backs breakaway Somaliland. Now, Newsweek reports that despite the ostensible efforts of BRICS-member China to achieve rapprochement with BRICS-member India, Chinese troops have moved dozens of miles into Indian territory which China claims on their common border. Should we be surprised that at the same time, India is reportedly considering 30% tariffs on Chinese steel?

A funny thing happened on the way to state capitalism

Bloomberg says China’s investment bankers, “after being forced to take big pay cuts and adhere to other belt-tightening measures under President Xi Jinping’s years-long common prosperity campaign are now in the crosshairs of the nation’s top graft buster.” Reportedly, three top investment bankers from different securities firms have been detained by Chinese authorities since August, one of whom had fled the country but was arrested abroad and repatriated. State-backed brokerages have since asked staff to hand in their passports and seek permission for all business and personal travel plans, which now requires them to be accompanied. They also need approval to resign. This is, “raising questions about the future of China’s $1.7 trillion brokerage industry and domestic capital markets activity.”

At the same time, China is producing more and more cheaper and cheaper manufactured goods to flood global markets with. This is an economic model.

It’s just not one the Western “RATE CUTS!” crowd in the brokerage industry and domestic capital markets, who were also the “CHINA STOCKS!” crowd, gets. Nor do they get that at some point their own economies need to produce more and more cheaper and cheaper goods.

Or else it will be raining “cats and dogs” everywhere, politically.

A funny thing happened on the way to the end of the Daily

I leave you today/this week with the following personal news: I’m thinking of a new career where I estimate crowd sizes at different outdoor political events.

I wonder how many people are in that field.