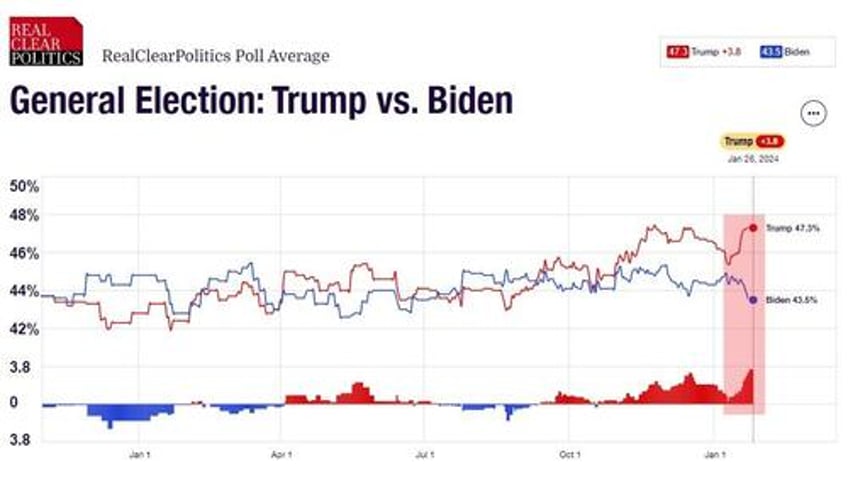

Former President Trump is currently polling better than President Biden with regard to winning the election this year by the most at any time in the last two presidential cycles.

As Daily Caller reports, Trump is ahead of Biden by 3.8 points in the RealClearPolitics (RCP) average, which is his largest lead this cycle against the president.

The lead is also far above Trump’s record for the last two cycles, where he never led Biden in the RCP average and was only ahead of Hillary Clinton during two separate periods in 2016.

In crucial battleground states like Georgia, Arizona, Michigan, Nevada and North Carolina, Trump is ahead of Biden by several points in the RCP averages.

The two are tied in Wisconsin, and Biden is narrowly leading in Pennsylvania by 0.6 points.

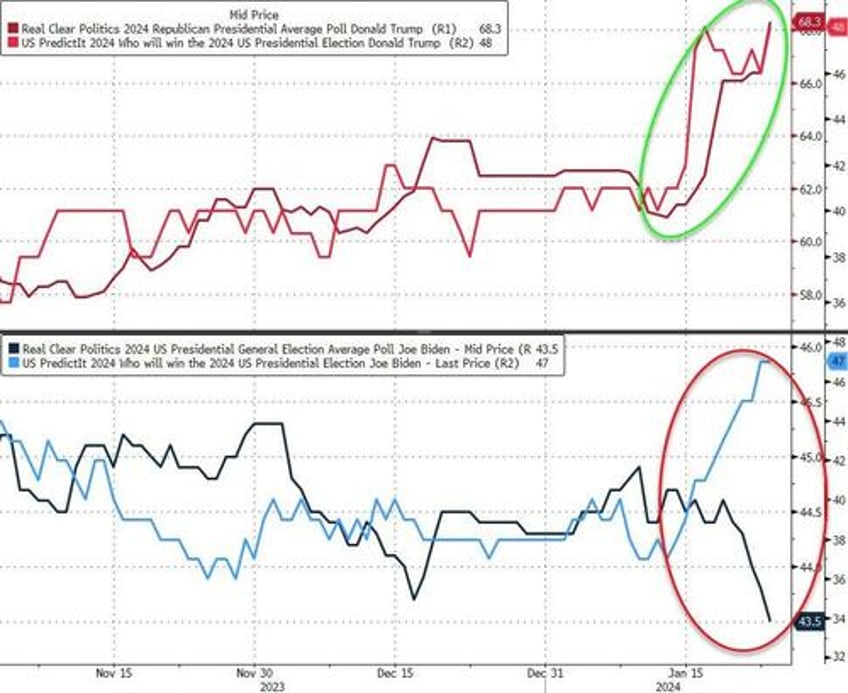

And by all accounts, it is clear that former President Trump will be the Republican Party nominee as polls in South Carolina (the next competitive primary since Haley is not competing for delegates in Nevada), show Trump leading Nikki Haley 52% to 21.8%.

All that background is to say that one could unarguably claim that former President Trump is the favorite (née strong favorite) right now to win the US general election in November.

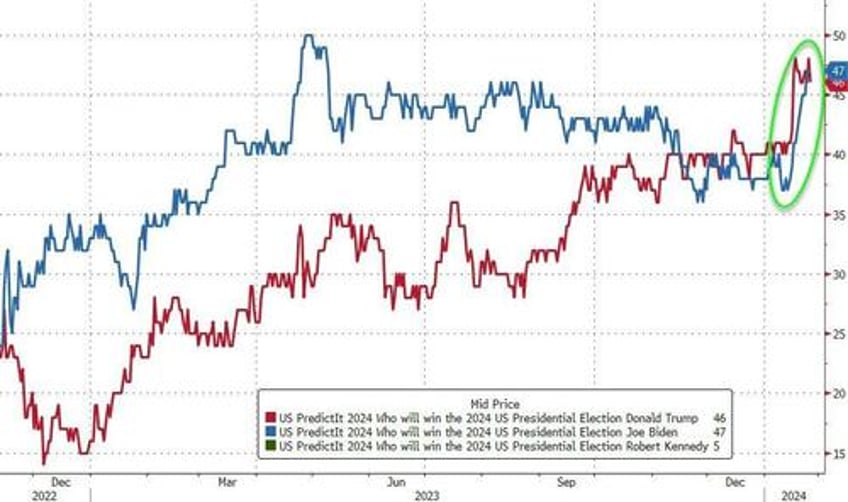

So, you may be surprised to learn that President Biden is actually leading former President Trump when it comes to the money-line.

According to PredictIt markets, President Biden is leading former President Trump 47% to 46% (RFK Jr is trading at around a 5% chance), after a somewhat stunning surge in President Biden's odds in the last week...

That's interesting.

What would have caused a sizable enough flow of betting money in President Biden's favor in the last week? When at the same time his actual polling data is collapsing?

President Biden's odds suddenly went vertical in the last 10 days from around 37% to 47%...

One of those things is not like the other!

Now, the idea of a prediction market is that participants, wagering real money on their forecasts, have an incentive to predict correctly, and that the collective intelligence of the speculators will deliver useful information about the world.

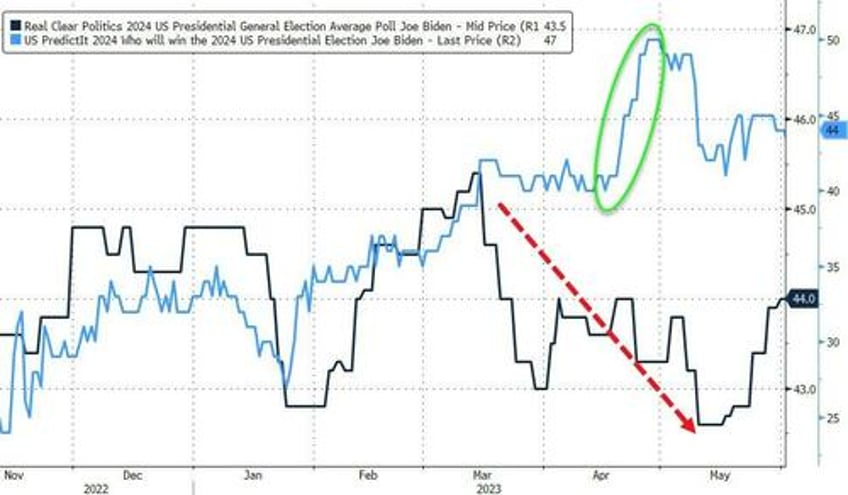

But, while we are well aware that 'a lack of correlation is not causation', would it be beyond the credible that - given Biden's crashing poll numbers - a Biden booster (or two), who have more than a monetary incentive to act, decided to bid his likelihood of winning up in the hopes of some reflexive circle of favorability?

It's not the first time that his odds have suddenly soared as his polling numbers plunged - it happened in April, but was quickly offered back down to reality...

We already know that the CFTC tried to shutter PredictIt back in 2022 (but CFTC was opaque in its reasons for shuttering the firm but many argued it was perhaps because the prediction markets could be manipulated with relatively small dollar amounts).

On August 4, 2022, the CFTC announced that Victoria University has not operated PredictIt in compliance with the terms of the no-action letter and as a result the no-action letter had been withdrawn.

The CFTC stated that all related and remaining listed contracts and positions on PredictIt should be closed out and/or liquidated no later than 11:59 p.m. (EDT) on February 15, 2023.

In September 2022, PredictIt and Aristotle International filed suit against the CFTC in the U.S. District Court for the Western District of Texas to block the action.

However, on January 26, 2023, the Fifth Circuit granted a temporary injunction allowing PredictIt to continue operating while the court considered further term relief for the organization

Of course, we are completely in favor of the free-market, First Amendment rights of PredictIt and the other prediction markets to continue operating and being successful, offering punters from around the world the chance to exercise their free will to gamble their hard-earned cash on the outcome of a rigged game.

Perhaps, just perhaps, by our bringing attention to this 'dark money' manipulation in the odds (in favor of Biden), we can provide information to speculators that can gain from pushing back against these apparent outlier moves in the market.

Would anyone be surprised if this was actually occurring?