Boeing’s commercial jets struggle, but its military machines thrive, all fueled by endless fiat money...

Not-so-mysteriously, none of the problems now associated with Boeing passenger planes seem to be affecting the weapons of annihilation they produce for the Military-Industrial Complex’s borderless global war machine, which is fueled by infinite fiat money.

Myriad problems with Boeing passenger jets have put the company into the news just about every day for months, but the company makes much more than just planes for commercial passenger airlines. Boeing is also a major aerospace contractor that produces fighter jets, attack helicopters, predator drones, missiles, and even the president’s airplane, Air Force One.

To be fair, Boeing’s record as of late beyond commercial jets is far from perfect — its Starliner, a crewed craft designed to bring astronauts to the ISS, was plagued with issues on the way to the space station that are now being investigated by its astronauts. And Boeing’s main rival in the space industry, SpaceX, has had its own problems with similar craft.

But when was the last time you heard about an Apache helicopter breaking down on its way to deliver a payload of highly-combustible “democracy” to a country unfortunate enough to be on the ever-expanding list of nation-states roped into unnecessary wars waged by the US or one of its global proxies?

Somehow, the systemic quality control issues at Boeing appear much more likely to get a handful of hapless air travelers injured than to cause problems with a military operation that has the “righteous” cause of protecting the petrodollar hegemon. The printing of fiat money fuels both phenomena in different ways.

Boeing’s corner-cutting and quality control issues are just one symptom of living in a fiat money system. As the dollar is debased, the incentive and ability to create solid, long-lasting products is degraded in kind. Manufacturing costs rocket upward as supplies, materials, logistics, storage, maintenance, insurance, wage demands, and every other production factor all increase, leading to a degradation in quality across the process as the irresistible temptation intensifies to prioritize minimizing costs over producing reliable, well-made, quality goods such as safe airplanes.

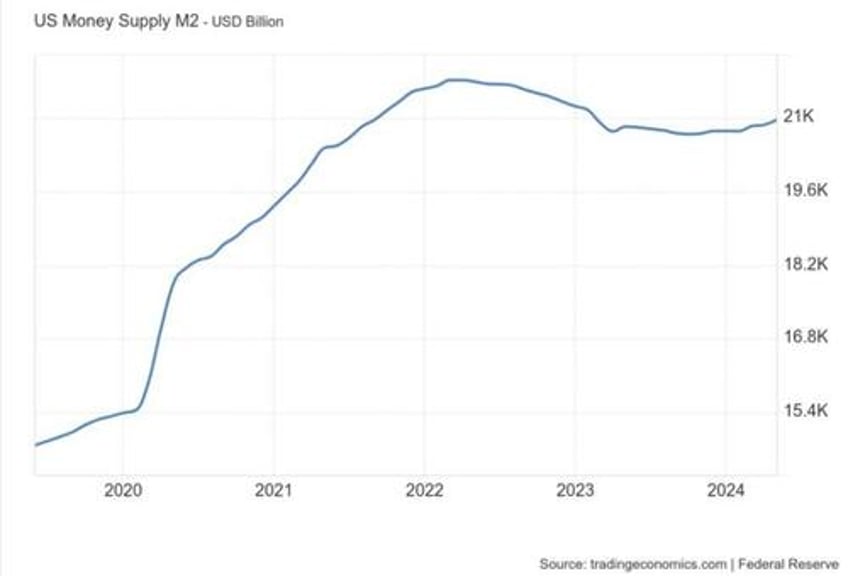

US M2 Money Supply (Billions)

When individuals and corporations realize that the money is worth less than it was a year ago, and in a year will be worth even less still, these cost-cutting measures become standardized matters of policy. Inflation expectations incentivize speed of production and cost-cutting over high-quality projects that take more time and money to make, but that will last much longer.

When central bankers turn on the printer and degrade the value of each dollar in circulation, they essentially steal not just money, but time, as any ability to meaningfully save for the future is diminished and short-term profits and speculation are rewarded over quality. The lifetime of hours you spend at work — time that could be spent with your family, on building a business, on creating great art, and on being a producer of lasting and valuable things — is shrunken so that bankers, politicians, and war profiteers can become richer.

Inflation is the most insidious and destructive tax. pic.twitter.com/L8rDxOxAMR

— Fight With Memes (@fightwithmemes) July 15, 2024

And it happens regardless of “which side” is in office. This is how fiat money contributes to the degradation in the quality of goods, such as airplanes, and sends the long hours that we spend working to earn that money — whether you work at Boeing or somewhere else — into a slow-motion black hole torn open by the thievery of money printing. When bankers can create infinite amounts of the currency out of thin air, it means that long-term projects, entrepreneurship, and literally everything else that requires a lower time preference are disincentivized in favor of spending, speculating, and cutting corners anywhere possible.

But when it comes to maintaining the Welfare-Warfare state, the ability to print infinite money is essential. Without it, the war machine consistently supported by both Democrats and Republicans would cease to exist. Dollars would be limited, there would be a practical cap on spending that would impose fiscal discipline because the currency would be pegged to something — like gold — of intrinsic value and real scarcity. That means that all of Boeing’s fighter jets, drones, military helicopters, and ballistic missiles would have to be financed through direct taxation, which Americans would never accept.

It also means that Boeing would be far more incentivized to produce passenger jets that don’t fall apart on the runway. But unlike a direct tax, stealing value (and time) by printing money takes longer to notice as it slowly drives the dollar’s value down toward zero. In a system with loose money, inflation goes up and down at different rates during different periods, but if you zoom out, you can always rely on costs going up.

Until it passes the event horizon of hyperinflationary collapse, the debasement doesn’t happen all at once. The US dollar uses its unique world reserve currency status, enforced by the threat of violence, to delay this process and export dollar inflation to other countries. But this is how the proverbial frog is boiled. When it gets bad enough that common Americans do finally start to notice, presidents and other politicians blame “price gouging” and “corporate greed.” This would be a more honest assessment if the accusations of greed were turned inward:

Onto the bankers who enjoy the privilege of being first in line at the money printer, onto shamelessly corrupt Federal Reserve officials who take advantage of knowing exactly which economic levers are about to be pulled, onto the senators who make millions with suspiciously-serendipitous stock trades and pass bills written by lobbyists at the same corporations that funded their campaigns, and onto the presidents who encourage the Fed to print, print, and print some more so that the economy can be made to appear robust during their term in office.

Until central banking is fundamentally changed (or the Fed abolished entirely) with a hard money standard, expect more of the same. Until, of course, the dollar is finally printed into oblivion and a monetary reset forces the empire’s hand. When that day comes, it will be disastrous, and the regime will try to blame everyone and everything except itself as it presents an even more centralized, bigger government and bigger banking “solution.”

But it will also be an opportunity to replace the current system with something better. However, it will be up to the people to look past the propaganda to recognize the issue, and demand hard money — lest we surrender another hundred-plus precious years of stolen time to the bankers and their political cronies.